Is Renault A Value Bonanza?

Earnings Call Recap

On February 14, 2019, Renault published its earnings report for the fourth quarter of 2018. While some could feel disappointed that organic revenues alongside with EPS has declined plus dividends has not been raised , I’ve found myself rather satisfied with overall performance of the Renault Group, considering numerous headwinds the company was facing during last year (including arrest of its CEO, American embargo on Iran, introduction of WLTP and financial distress in core markets such as Turkey, Argentina, and Brazil). Below I will shortly summarise the key points from my article published a few weeks ago:

Renault managed to surprise many observers with rather stable results, in line with general three-point guidance (slide 17) declared on the previous earnings call. They have increased Group revenues by 2.5% (at constant rates), maintained operating margin above 6% (6.3% to be precise) and generated positive operational free cash flow (of over €600 million).

Nevertheless, the financial condition of French manufacturer has worsened during the last quarter, because there was little to no silver lining to key metrics. Group revenue increased at a constant rate, fair enough, but in nominal terms revenue dropped by 2.3% and organic growth was negative by whopping 5.7% (accordingly to my estimations, for further details please refer to the link here). Operating margin exceeded 6%, but automotive margins were around 4.3%, well below the desired level. If we talk about operating cash flow, it has decreased by over 300 million euro in comparison to the previous year.

Adding to the misery there was bad news coming from Nissan, a car manufacturer where Renault has a very significant stake of 43% of shares. In last year Nissan managed to contribute in the form of dividends only €1.5 billion, 1.2 billion euros less than in the previous year.

These beatings from all sides heavily affected Renault net income bringing it down to €3.4 billion, thus experiencing drop by 35%. It means that new earnings ratio dropped down to €12.24 per share, a significant fall from 2017's €19.23 p/share. As Thierry Bollore said during the Q&A session: “All-in-all, 2018 headwinds cost us about €3.6 billion in revenues and one point of operating profit margin”.

All this doom and gloom must be looked at from the perspective of very troubled half of the year. And if we take this into account, then we can say that Renault passed difficult stress test while keeping eyes on the long-term growth plan in rapidly changing and extremely demanding environment of the automotive industry. This is especially true because Renault managed to keep its cost leadership in the automotive industry by continuing introduction of Monozukuri, a set of Japanese manufacturing methods; and an increase of popularity of Dacia- an unquestionable value champion.

Regarding the future: Renault decided to increase the speed of introducing its new models. In second half of 2019 we shall expect to see in showrooms new Renault Arkana- which will try to create new market segment of affordable coupe SUV crossovers and electric SUV K-ZE (looking at the silhouette it is electrified Dacia Duster, so we shall expect true value explosion in EV segment), thus keeping an eye on maintaining its European leadership in EV.

Also, the Group remains focused on the mission of conquering Chinese market by acquiring local EV manufacturers, autonomous drive start-ups and charging platform solutions and services for EV. If we couple that with a strategic partnership with Google to provide infotainment and cooperation with Waymo, we can rest assured that the future of Renault shall be secured.

Valuation

Feeling satisfied (or not) about financials and long-term prospects, however, does not indicate if a company is a good material for investing. Therefore, I have decided to proceed with valuation to find out if Renault is a buy or not.

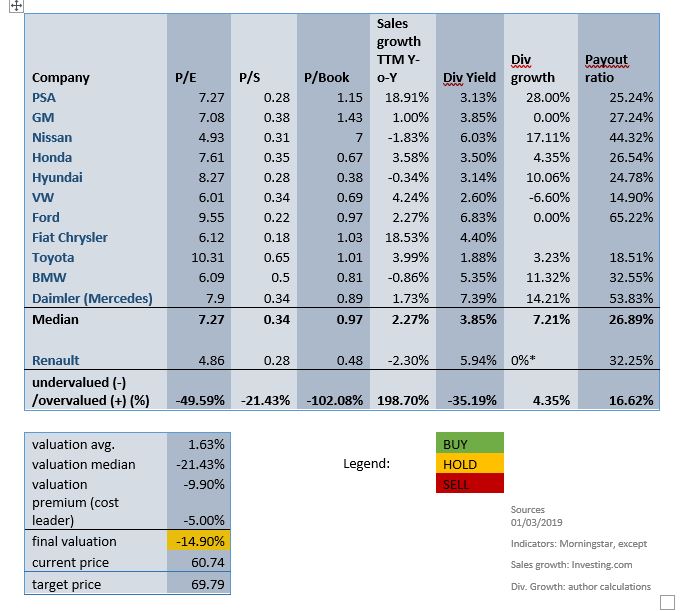

Comparing indicators to its peers, Renault seems to be slightly undervalued (table below).

Renault has the lowest P/E ratio across all competitors and below-average ratios for other indicators with an exception for Sales growth, dividend growth, and payout ratio. On the other hand, sales growth is sub-par in comparison to the peer group, having the worst numbers just in front of its alliance partner-Nissan. This normally should not bode well, especially that Renault shall continue experiencing declines in sales on TTM basis up until the end of second quarter of 2019 due to a big positive impact of WLTP introduction on second-quarter sales numbers in the previous year when many customers decided to buy a car before new protocol has been implemented. However, seeing recent impact of sales decline on Renault's Operating Margins, we shall rest assured that the bottom line will not be affected as much as one could expect. Nevertheless, it will negatively impact net income, shares price and most of its financial indicators. I believe that these headwinds are temporary and from third quarter onward Renault shall return to organic growth.

Looking at current dividend yield, French manufacturer is an attractive option for potential investors providing a yield of little under 6%, even when proposed amount of €3.55 per share is in line with the previous year (subject to approval on the annual meeting). Here it must be stressed to American investors, that European companies usually pay dividends in one installment. In the case of Renault, it is May. The payout ratio is on high side in comparison to its peers, reaching 32.5%. However, if we consider recent headwinds as one-off events, then we shall sleep well at night knowing that our dividends are secure. Additionally, during Question and Answers session Renault representative hinted that dividends might be increased in not so distant future due to improvements in Renault Finance’s balance sheet needed to meet European Central Bank requirements. Therefore, Renault's financial segment shall be in the position to contribute to dividends in the future, however exact figures were not declared.

Conclusions

In my investment style, I like to attribute a small premium to the price for a moat. Renault has one - it is cost leadership. While such moat usually does not provide opportunities to reap abnormal profits, it is a moat nevertheless, thus I am adding 5% discount to the valuation price.

Combining it with estimation of undervaluation equal to circa 10%, we end up with having Renault undervalued by 15% in comparison to its peers. For me, such small difference does not trigger "buy" button on my keyboard since as a value investor I am looking for bigger discounts to open position or add some more shares to current holdings.

Concluding, for now, Renault is a hold for current shareholders, and new investors shall wait until the financial update after second quarter, where Renault financials shall reach the inflection point and provide the best risk/benefit ratio.

The author is long Renault and has no plans to add/sell its holdings.

Nice, I'm bullish on Renault. $RNSDF