Is Pfizer The Best Mega Cap?

Summary

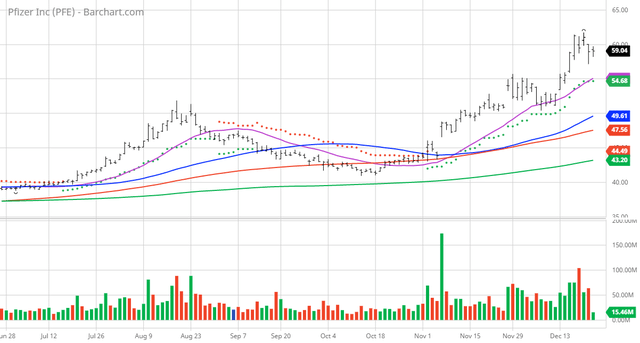

- 100% Barchart technical buy signal.

- 8 new highs and up 15.54%.

- 61.01% gain in the last year plus a 2.56% dividend.

The Barchart Chart of the Day belongs to the big pharma company Pfizer (NYSE: PFE). I found the stock buy using Barchart to sort the S&P 100 Index stocks first by the highest Weighted Alpha and Barchart technical buy signals then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 11/3 the stock gained 31.51%.

Pfizer Inc. discovers, develops, manufactures, markets, distributes, and sells biopharmaceutical products worldwide. It offers medicines and vaccines in various therapeutic areas, including cardiovascular metabolic and pain under the Eliquis, Chantix/Champix, and Premarin family brands; biologics, small molecules, immunotherapies, and biosimilars under the Ibrance, Xtandi, Sutent, Inlyta, Retacrit, Lorbrena, and Braftovi brands; and sterile injectable and anti-infective medicines under the Sulperazon, Medrol, Zithromax, Vfend, and Panzyga brands. The company also provides medicines and vaccines in various therapeutic areas, such as pneumococcal disease, meningococcal disease, tick-borne encephalitis, and COVID-19 under the Prevnar 13/Prevenar 13 (pediatric/adult), Nimenrix, FSME/IMMUN-TicoVac, Trumenba, and the Pfizer-BioNTech COVID-19 vaccine brands; biosimilars for chronic immune and inflammatory diseases under the Xeljanz, Enbrel, Inflectra, and Eucrisa/Staquis brands; and amyloidosis, hemophilia, and endocrine diseases under the Vyndaqel/Vyndamax, BeneFIX, and Genotropin brands. In addition, the company is involved in the contract manufacturing business. It serves wholesalers, retailers, hospitals, clinics, government agencies, pharmacies, and individual provider offices, as well as disease control and prevention centers. The company has collaboration agreements with Bristol-Myers Squibb Company; Astellas Pharma US, Inc.; Myovant Sciences Ltd.; Akcea Therapeutics, Inc; Merck KGaA; Valneva SE; BioNTech SE; Arvinas, Inc.; and Syapse, Inc. Pfizer Inc. was founded in 1849 and is headquartered in New York, New York.

Barchart technical indicators:

- 100% technical buy signals

- 72.71+ Weighted Alpha

- 61.01% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 8 new highs and up 15.54% in the last month

- Relative Strength Index 64.59%

- Technical support level at 57.39

- Recently traded at 59.03 with a 50 day moving average of 49.62

Fundamental factors:

- Market Cap $330 billion

- P/E 16.23

- Dividend yield 2.56%

- Revenue expected to grow 13.20% next year

- Earnings estimated to increase 26.90% next year and continue to compound at an annual rate of 100.59% for the next 5 years

- Wall Street analysts issued 7 strong buy, 1 buy, 15 hold and 1 under perform opinions on the stock

- The individual investor following the stock on Motley Fool voted 5,592 to 587 that the stock will beat the market with the more experienced investors voting 979 to 67 for the same result

- 326,720 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more

As long as Covid is here to stay, you can't go wrong with $PFE. Looks like we might need #Pfizer's shots forever. They are now giving out a 4th shot in Israel!