Is OxiGene The Cheapest Biotech On The Nasdaq?

I recently initiated a long position in OxiGene (OXGN). In my view, this is a superb buying opportunity, because its market cap ($40 million) exactly equals net cash ($40 million), a feature I seldom see in biotech stocks, while its rich pipeline boasts highly promising drug candidates. If any of the multiple near-term catalysts pan out well, shares could deliver a 5X return this year. I think it’s more probable than not that the drug candidates will progress to the next phase, which should elevate the company value to whole new heights. Meanwhile, I don’t have to worry much about a sell-off because a) that just occurred, b) shares trade at cash level and c) dilution risk in the short-term is 0 because they just successfully conducted an offering with no discount (!).

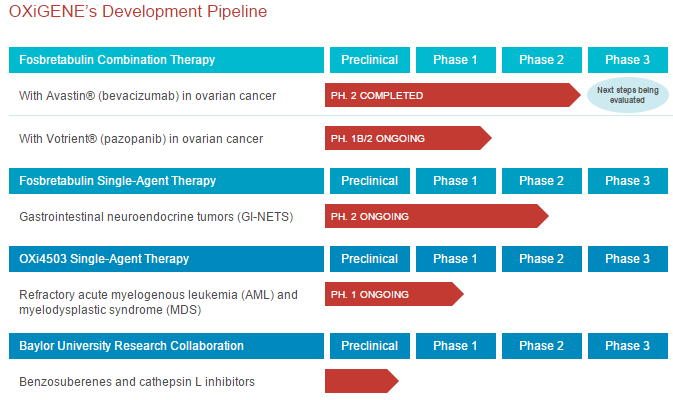

Pipeline overview

OxiGene is focused on developing innovative new therapies for cancer that address serious unmet needs. Its primary focus is developing anti-vascular drugs referred to as vascular disrupting agents (VDAs). The lead drug is called fosbretabulin, a potential treatment for ovarian and certain thyroid cancers. This drug candidate holds an Orphan Drug Designation already. VDAs are a new and highly differentiated class of anti-vascular drug that target existing tumor vasculature, leading to extensive tumor cell death. Here’s an overview of their website:

Its lead drug Fosbretabulin is about to enter Phase III

Late November, OxiGene wrapped up a successful Phase II study and presented positive results. There are a lot of numbers to digest, but it came down to this: recurrent ovarian cancer patients benefit from treatment with the combination of fosbretabulin and Avastin, and the benefit is particularly promising in the hardest-to-treat patients with platinum-resistant tumors. Based on the statistically significant end results regarding efficacy and safety, the principal investigator would like to see fosbretabulin advance into a larger phase III study. This is of course exactly what OxiGene is going after. The Phase III study should commence within a few months.

Near-term catalysts

Let’s see what near-term catalysts are lined up:

- The company is to receive FDA guidance in Q2 on the potential design and scope of the Phase III trial for fosbretabulin in ovarian cancer (this is a high-impact catalyst). Depending on what the FDA will say, OxiGene is able to start the Phase III trial.

- Also in Q2, enrollment in the ongoing Phase 2 study in GI-NETs should be completed.

- The company has plans to move their second clinical candidate, OXi4503, into a company-sponsored Phase 1/2 study in acute myeloid leukemia (AML), which will increase the number of clinical sites enrolling these subjects.

- I expect OXiGENE will receive an Orphan Drug Designation in the EU for OXi4503 regarding the treatment of Acute Myelogenous Leukemia (AML).

The company will also issue updates regarding the recruitment of patients for its other programs. Also, it would not surprise me if the company is to announce a partnership soon. Obviously, any of these catalysts panning out in a positive way could drive the share price much higher.

Financial condition

OxiGene currently has $40 million in net cash minus Q1 burn. [Market cap and cash figures shown here reflect the $10 million at-the-market offering OxiGene conducted last week.] Given their monthly $1 million burn, I estimate the company is good to go for a long time. It could be that they need to raise more capital in the future because expenses rise when a drug candidate enters the next phase, but short-term I definitely do not expect another raise. Overall, OxiGene is extremely well-financed.

Peer cancer stocks are valued much higher

OxiGene is with a $40 million market cap severely undervalued compared to many other peer biotech stocks. In the world of cancer stocks, the average valuation of Phase 2 companies is certainly >$100 million. Note that OxiGene successfully finalized a Phase 2 study already, so that warrants a higher valuation too.

Cancer stocks in Phase 2 and 3 in general carry valuations up to a billion dollar because the potential of an effective and safe drug against cancer is gigantic.

Major sell-off provides excellent entry point

In just a 2 week timespan, shares lost more than a quarter of its value. Why? The offering on the 20th of March was a factor, but the share price is now a good 20% lower than the offering price. I like buying stocks after a fierce sell-off. Panic selling are often provide great buying opportunities, because a good part of the selling is caused by actions that are not motivated by the underlying business. For example, stop-losses can be triggered, investors are hurt by sudden margin calls, or they simply freak out and start selling. Isn’t the catchphrase buy low, sell high? This time, the sell-off is so irrational, that shares are currently trading at net cash level!

Risks

OxiGene is a biotech stock, and it’s no secret that biotech stocks are risky by nature. I can’t tell when exactly or even if their drug candidates will eventually be granted market approval by the FDA. Delays could occur, or the FDA could put a program on hold for whatever reason. A phase III trial is costly too, so OxiGene may need to partner up, or raise more capital to be able to finance the development. Also, they in license the technology from Arizona State University and Baylor University, so these agreements need to be continued (no reason at the moment to assume otherwise). Lastly, there could be some resistance >$1.70 because of the ample supply of directly exercisable warrants priced at $1.71.

Conclusion

OxiGene’s share price has entered such undervalued levels that the market now puts 0 value on its entire drug pipeline. This doesn’t make any sense whatsoever. OxiGene actually boasts a rich pipeline worth in the millions, and with multiple near-term catalysts lined up, the current risk vs. reward appears to be extremely compelling. With good news, shares will absolutely skyrocket, and with unfavorable news, the downside is very slim because the company trades at net cash, making OxiGene a super attractive asymmetrical trade.

Summary points:

-OxiGene is the ideal buying opportunity in biotech: very limited downside risk vs huge upside potential.

-The downside is very limited because the stock now trades at net cash (!), with 3 years runway.

-The upside is huge given the rich pipeline and multiple near-term catalysts lined up.

-After positive Phase II end results on both safety and efficacy, OxiGene’s lead drug against ovarian cancer will probably advance to Phase III within months.

-Peer biotech stocks are valued much, much higher.

Disclosure: Long OXGN. Please do your due diligence before investing.

$OXGN looks very promising, thanks.

Excellent article, but "cheap" is a relative firm. Personally, I consider it to be fairly priced:

charts.stocktwits.com/.../original_34689474.jpg

I disagree, after reading the above this looks like a distinct opportunity.