Is Nokia Going To Connect People Again?

Photo credit: Are Sjøberg

The plot

Rumor has it that Sony (SNE) is looking to sell the Xperia unit (original source: Reuters). Tomi Ahonen in his Communities Dominate Blog , argued that Nokia (NOK) could be one of the most suitable buyers for the Sony smartphone unit.

Tomi Ahonen estimated that the Xperia unit could be plausibly valued at 4.5 Billion, given the last deals in the Mobile phones industry (i.e. Motorola to Lenovo and Nokia to Microsoft (MSFT)). Additionally, he stated that the deal blocking Nokia from returning to the smartphone business will run out in the end of the year. Therefore, buying the Sony unit, running it until the end of the year and then rebrand it “Nokia” could be a good solution for Nokia.

Why Sony?

So if Nokia were to return to smartphone market place, why choose Sony Xperia unit as its entering door? First of all, Sony makes wonderful products since ever. Presently, it has serious difficulties in having profits, but this has more to do with marketing than anything else. Additionally, the Xperia unit has worldwide presence, with a portfolio 100% smartphones (no feature phones). It would be a great match for Nokia own heritage as a top mobile phone producer.

Does a return to origins makes sense for Nokia?

I believe that from a business perspective the answer is a clear yes! The Nokia brand is still worth a lot in the mobile space. Even if the Nokia-Microsoft years tarnished the brand, a significant number of consumers would be willingly happy to try phones made by an independent Nokia. A clear indication supporting this argument is the demand for the Nokia N1 tablet. The first Nokia experiment in consumer electronics since selling the mobile phones unit to Microsoft caught the attention of a significant number of consumers, even considering the fact that Nokia was never a top player in the tablet marketplace (source: xda-developers).

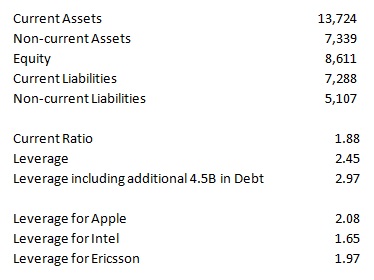

From a financial perspective things are not so clear. Nokia has a lot of liquidity with a current ratio around 1.88, almost doubling its current liabilities. However, the company already has a 2.5 leverage ratio. This means that if the company decided to raise, let’s say, 4.5 Billion in the debt market this would bring the leverage to 3. By comparison, we can see that other stable companies in the tech sector have lower leverage ratios.

Table 1 – Balance Sheet selected data and ratios for Nokia and Leverage ratio for Peers (2014)

Basically, this means that the perception that Nokia has lots of dough to spend is not entirely correct. The company does have a liquidity slack, but most likely it won’t be enough to a deal like buying Sony Xperia unit. One alternative could be a joint venture with Sony, which from the financial perspective would be much less demanding, but would be harder to implement.

What about alternatives?

If an acquisition or even a joint-venture with Sony fails to materialize, are there alternative moves for a Nokia comeback? The answer is a definitive yes. There are other low cost solutions. One possible low cost move would be the acquisition of Jolla. This company was founded by the development team behind the Nokia N9 that left Nokia when the previous management team showed little support for the homemade operating systems. On the same note, Jolla is most likely going through some rough times, it has even started financing campaigns for some its products on crowdfunding websites (it might be a cool thing to do, but it reveals that there are cash restrictions).

If Nokia went this way and bought a small producer like Jolla, it could easily leverage its old patents, some of the remaining engineering teams but most of all, it could start leveraging its valuable brand. Obviously, Nokia does not have the same level of human resources it once had but after years financing universities throughout Finland, there is a huge supply of specialized engineers salivating for an opportunity to bring back the old Nokia. In no time Nokia can have a full smartphone business unit ready to start shooting. Additionally, this solution is very interesting since it has lower costs and therefore lower financial risks.

Conclusion

Buying the Xperia unit seems a bit farfetched since Nokia does not seem to have the sufficient liquidity to buy and digest a EUR 4.5 billion acquisition. However, other scenarios are on the table and a possible comeback could materialize through a less demanding option in terms of capital.

With the end of the non-competing agreement with Microsoft, Investors should start contemplating the possibility of a Nokia comeback and its consequences for the company and the whole sector. The company still has lots of resources and competences (patents, people, contacts, experience) in the mobile space, but most of all it still has the Nokia brand.

Let us say that Nokia initiates a strategy aimed at achieving a 3% market share in the next couple of years. Assuming that this would represent around 40 million devices at an average selling price around EUR 150, we would be talking about an additional revenue stream of EUR 6,000 million. Assuming a profit margin around 5%, we could be talking about EUR 300 Million added to the bottom line.

Obviously, this scenario could be worse, especially if the company failed to achieve a profitable operation in smartphones. Nonetheless, Nokia was always capable of producing profitable smartphones before adopting the Windows Phone OS. We will have to wait to see if they are still capable of doing it.

A few ten thousand Foxconn'ed N1 tablets mean next to nothing. In any case, Nokia would have to re-emerge as Android brand, in a cesspool of competitiveness, spyware, malware and Google dependency. Also, all sophisticated Nokia design and engineering talent has left. I seriously doubt consumers will buy badge-engineered Sony devices, the Sony brand being severely tarnished as well. Nokia needs its cash to operate successfully in the network business, where competition with Ericsson and Alcatel-Lucent is fierce, while Huawei and ZTE are breathing down all three European vendors' necks.

I agree with you on the cash as you can see in the article. The cash they have is not enough for a serious acquisition. But the joint venture with Sony is a realistic possibility.

Yes, a big part of the mobile staff has left, but as I say in the article, Finland has produced lots of skilled people for the mobile sector. Additionally, many former engineers would be interested in coming back to Nokia if the company started a credible project.

Possibly, a comeback would be based on Android. I agree with you on that, but it doesn't mean that it would be bad. But I see your point there.

About the N1, there were Nokia Lumia phones that sold worse, so maybe the N1 isn't that meaningless.

Finally, as you say Chinese telecom vendors are squeezing margins in the sector, Nokia has to find growth opportunities in adjacent areas.

Thanks for your comment.