Is MRVL The Best Nasdaq 100 Stock?

Summary

- 100% technical buy signals.

- 9 new highs and up 24.88% in the last month.

- 114.02% gain in the last year.

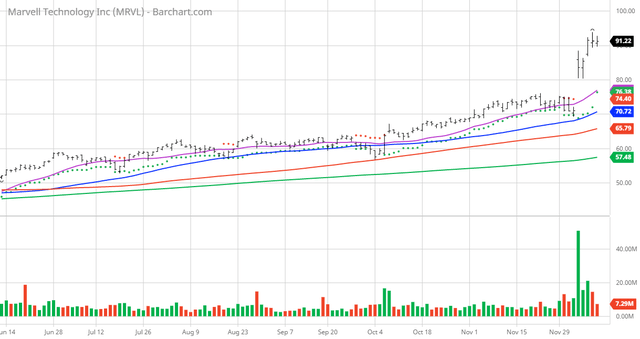

The Barchart Chart of the Day belongs to the technology company Marvel Technology (Nasdaq: MRVL). I found the stock by using Barchart to sort the Nasdaq 100 Index stocks first by the highest Weighted Alpha, then by Barchart technical buy signals, and lastly using the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 12/3 the stock gained 9.08%.

Marvell Technology, Inc., together with its subsidiaries, designs, develops and sells analog, mixed-signal, digital signal processing, and embedded and standalone integrated circuits. It offers a portfolio of Ethernet solutions, including controllers, network adapters, physical transceivers, and switches; single or multiple core processors; application-specific integrated circuits; and printer SoC products and application processors. The company also provides a range of storage products comprising storage controllers for hard disk drives (HDD) and solid-state drives that support various host system interfaces consisting of serial attached SCSI (SAS), serial advanced technology attachment (SATA), peripheral component interconnect express, non-volatile memory express (NVMe), and NVMe over fabrics; and fiber channel products, including host bus adapters, and controllers for server and storage system connectivity. It has operations in the United States, China, Malaysia, the Philippines, Thailand, Singapore, India, Israel, Japan, South Korea, Taiwan, and Vietnam. Marvell Technology, Inc. is headquartered in Wilmington, Delaware.

Barchart technical indicators:

- 100% technical buy signals

- 133.12+ Weighted Alpha

- 114.02% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 9 new highs and up 24.88% in the last month

- Relative Strength Index 78.16%

- Technical support level at 89.18

- Recently traded at 91.19 with a 50 day moving average of 70.72

Fundamental factors:

- Market Cap $77 Billion

- P/E 102.82

- Dividend yield .26%

- Revenue expected to grow 45.80% this year and another 32.60% next year

- Earnings estimated to increase 67.40% this year, an additional 39.60% next year and continue to compound at an annual rate of 43.50% for the next 5 years

- Wall Street analysts issued 19 strong buy, 7 buy, 3 hold and 1 under perform recommendation n the stock

- The individual investors following the stock on Motley Fool voted 1,424 to 80 for the stock to beat the market with the more experienced investors voting 280 to 7 for the same result

- 57,060 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more

Yes, it may very well be the best.