Is Meta Platforms Stock A Smart Buy Before Q3 Earnings Report?

Image: Bigstock

Key Takeaways

- Meta Platforms expects Q3 2025 revenues between $47.5 billion and $50.5 billion, up about 21.8% year-over-year.

- Advertising revenues are estimated at $48.5 billion, fueled by strong AI-driven ad demand.

- Reality Labs' expected $5.58 billion loss could pressure margins despite Family of Apps growth.

Meta Platforms (META - Free Report) is set to report its third-quarter 2025 results on Oct. 29. The company expects total revenues between $47.5 billion and $50.5 billion for the third quarter of 2025.

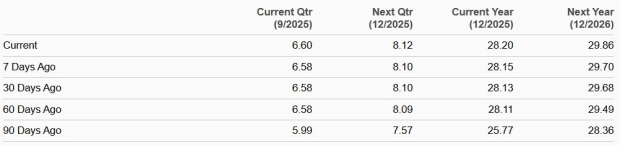

The Zacks Consensus Estimate for third-quarter revenues is pegged at $49.43 billion, indicating an increase of 21.8% from the year-ago quarter’s reported figure. The consensus mark for earnings stands at $6.60 per share, up a couple of cents over the past 30 days, suggesting growth of 9.5% from the figure reported in the year-ago quarter.

Consensus Estimate Trend

Image Source: Zacks Investment Research

Meta Platforms’ earnings beat the Zacks Consensus Estimate in all the trailing four quarters, with the average surprise being 20.47%.

Meta Platforms, Inc. Price and Consensus

Image Source: Zacks Investment Research | Meta Platforms, Inc. Quote

Let’s see how things have shaped up for the upcoming announcement.

Strong Advertising Growth to Aid Meta’s Q3 Results

Meta Platforms is riding on strong advertising revenue growth prospects. Meta Platforms’ advertising revenues are expected to benefit from strong spending by advertisers as they leverage its growing AI prowess despite macroeconomic uncertainties. The Zacks Consensus Estimate for third-quarter 2025 advertising revenues is pegged at $48.5 billion, suggesting 21.6% year-over-year growth.

Meta Platforms’ offerings — Facebook, WhatsApp, Instagram, Messenger, and Threads — currently reach more than three billion people daily. Their staggering reach and increasing ad impressions (up 11% year-over-year in the second quarter of 2025) make the company one of the most important players in the digital ad sales market, apart from Alphabet (GOOGL - Free Report) and Amazon (AMZN - Free Report).

According to eMarketer, global ad spending is expected to rise 7.4% to reach $1.17 trillion in 2025, with Alphabet, Meta Platforms, and Amazon accounting for roughly two-thirds of new ad spending.

Meta Platforms has been leveraging AI and machine learning to boost the potency of its social-media offerings, including WhatsApp, Instagram, Facebook, Messenger, and Threads. Meta Platforms is frequently introducing new features across its platforms to drive more conversation and user engagement. The company is using Meta AI (currently used by more than one billion people) to boost user experience.

However, rising expenses related to investments in developing more advanced models and AI services are expected to keep margins under pressure. The Zacks Consensus Estimate for Family of Apps’ operating income is pegged at $24.86 billion, indicating 14.1% year-over-year growth.

The Reality Labs business continues to burn cash, which doesn’t bode well for the company’s third-quarter results. The consensus mark for Reality Labs’ loss is pegged at $5.58 billion, wider than the year-ago quarter’s loss of $4.43 billion.

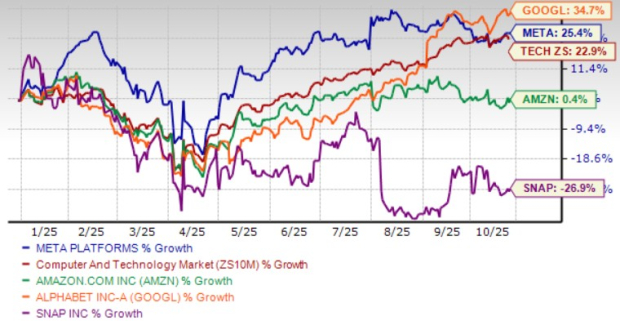

Meta Platforms Shares Outperform the Sector, Lag the Industry

Meta Platforms shares have jumped 25.3% year-to-date, outperforming the Zacks Computer & Technology sector’s appreciation of 22.9%. Shares have underperformed Alphabet but outperformed Amazon and Snap (SNAP - Free Report). Year-to-date, Alphabet and Amazon shares have climbed up 34.7% and 0.4%, respectively, while Snap shares have declined 26.9%.

Meta Platforms Stock Outperforms the Sector

Image Source: Zacks Investment Research

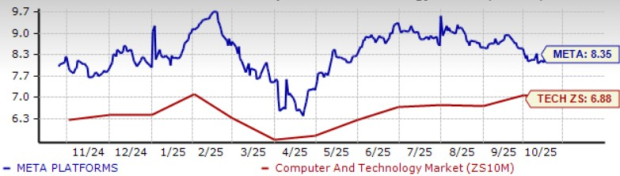

Meta Platforms’ recent valuation has been stretched, as suggested by the stock's Value Score of C.

In terms of the forward 12-month price/sales, Meta Platforms has been trading at around 8.35X, which is higher than the broader sector’s 6.88X, Snap’s 2.08X, Alphabet’s 8.31X, and Amazon’s 3.07X.

Meta Platforms Shares are Pricey

Image Source: Zacks Investment Research

Meta Platforms Leverages AI to Boost Growth

AI is heavily dependent on data, of which Meta Platforms has a trove, driven by its more than 3.48 billion daily users. The company's growing footprint among young adults, driven by improving recommendations, boosts its competitive prowess against the likes of Snap.

AI usage is making it a popular name among advertisers. Meta Platforms’ focus on improving advertisers’ return on ad spending is noteworthy. Andromeda, its proprietary machine learning system, improves the performance of the company’s advertising system by delivering more personalized advertisements to viewers. The deployment of Meta Platforms' deep neural network on the NVIDIA Grace Hopper Superchip has been a key catalyst.

Meta Platforms has also been focusing on improving security across its platforms, which improves user engagement. Meta Platforms has introduced features and new anti-scam tools in WhatsApp to combat scammers. For Facebook, the company launched passkeys on Facebook for mobile devices, which now allows users to verify their identity and log in to their account more securely compared with traditional passwords.

The introduction of Teen Accounts has been a key catalyst in boosting security on Instagram. Meta Platforms has expanded Teen Accounts to Facebook and Messenger platforms. The company recently announced that Instagram Teen Accounts will be guided by PG-13 movie ratings by default.

Conclusion

Meta Platforms' use of AI across its platforms bodes well for its user engagement. This, along with an improved recommendation tool, continues to help advertisers in ad targeting, thereby driving top-line growth. Meta Platforms is spending heavily on expanding AI infrastructure, which bodes well for future prospects. These positive factors justify a premium valuation.

Meta Platforms currently has a Zacks Rank #2 (Buy) rating, which implies that investors may want to start accumulating shares of the stock.

More By This Author:

Figma Drops 56% Since Going Public: Hold Or Fold The Stock?Year-End Rally Odds Increase: Stocks To Watch

5 Stocks To Add To Your Portfolio From The Prospering P&C Insurance Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more