Is It Time To Buy The Dip In Coreweave Stock?

Image Source: Pexels

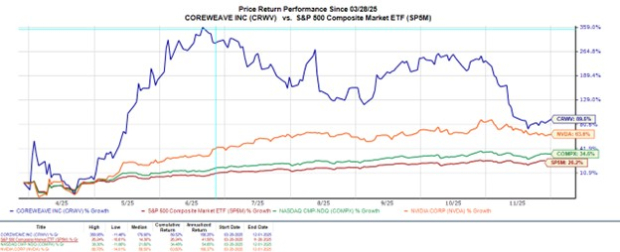

As an AI cloud provider that has been backed by investments from Nvidia (NVDA - Free Report), CoreWeave (CRWV - Free Report) stock is still up an impressive +90% since launching its IPO earlier in the year.

That said, CRWV has slid more than 50% from its high of $187 a share as investors have become concerned over CoreWeave’s slowing growth, heavy debt, and weaker-than-expected guidance.

Needless to say, this has drawn attention to the notion that the AI boom may be peaking, at least for CoreWeave.

Image Source: Zacks Investment Research

Why CoreWeave’s Guidance Has Investors Concerned

Despite comfortably exceeding its Q3 expectations in November and reporting record revenue growth, CoreWeave gave disappointing full-year guidance that has contributed to its recent stock decline. While CoreWeave’s Q3 sales of $1.34 billion more than doubled year over year, its growth rate is expected to decelerate, raising doubts about sustainability, especially since the company isn’t profitable yet.

Adding to profitability concerns, CoreWeave's operating margins have fallien below 4%. In regard to its decelerating growth rate, CoreWeave cut its fiscal 2025 revenue forecast to between $5.05-$5.15 billion, down from prior guidance of $5.35 billion due to delays in major customer contracts and data centre construction setbacks. However, CoreWeave has secured new deals with Meta Platforms (META - Free Report) and OpenAI, with the company insisting that its lowered forecast reflects timing issues rather than demand weakness.

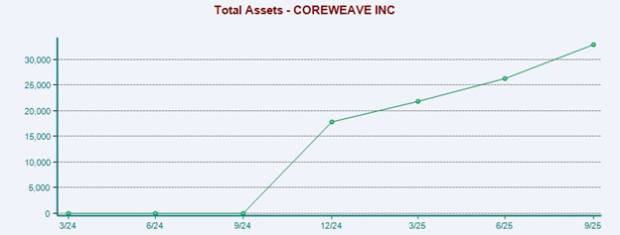

Monitoring CoreWeave’s Balance Sheet

What is also concerning investors is that CoreWeave carries significant debt, and rising interest expenses may make profitability harder to achieve. Still, CoreWeave is solvent, having $32.91 billion in total assets, although this is not advantageously above its total liabilities of $29 billion. It’s noteworthy that CoreWeave has seen a nice uptick in cash and equivalents since going public, which currently sits at around $2.53 billion.

Image Source: Zacks Investment Research

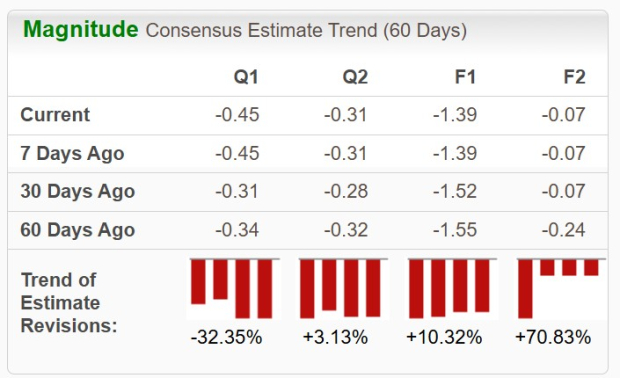

Tracking Coreweave’s EPS Revisions

Posting a smaller-than-expected adjusted loss of -$0.08 a share during Q3, CoreWeave’s full-year EPS is now expected at -$1.39 compared to estimates of -$1.52 a month ago. Optimistically, CoreWeave is expected to move closer to the profitability line next year. Plus, over the last 60 days, FY26 EPS revisions are up to -$0.07 from estimates of -$0.24.

Image Source: Zacks Investment Research

CoreWeave’s Reasonable P/S Ratio

Price-to-sales may be the best way to gauge CoreWeave’s fundamental value to investors at the moment, and CRWV does have a reasonable forward P/S ratio of 5X. Considering the price-to-sales premiums that high-growth tech stocks can command, CoreWeave’s P/S ratio is pleasantly beneath the benchmark S&P 500, with Nvidia, for example, at 22X and Meta Platforms at 8X.

Plus, based on Zacks' estimates, CoreWeave’s annual sales are projected to leap to $11.51 billion in FY26, and the company has a massive revenue backlog worth $56 billion.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Although CoreWeave is still growing rapidly, it's transitioning from explosive expansion to steadier, backlog-driven growth, which is less exciting for investors chasing AI hypergrowth stories.

Coreweave’s ability to manage debt, execute on its backlog, and stabilize margins will determine whether its recent setback is temporary or a sign of deeper structural challenges. It may be too soon to buy the dip, but CoreWeave’s position as an AI infrastructure developer could still be very lucrative with CRWV landing a Zacks Rank #3 (Hold).

More By This Author:

Rigetti Vs. D-Wave Quantum: Which Quantum Stock Is The Smarter Bet?Opendoor Vs. Compass: Which Real Estate Tech Stock Has The Edge?

3 State Street Mutual Funds Positioned For Strong Performance

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more