Is Food Inflation Here To Stay?

Investors are waiting for the CPI data a couple of days from now even as the big banks line up to report what looks like a rather soft quarter. Looking at the aggregate revenue and earnings trends for the S&P 500 in the last few quarters, you can’t miss the way earnings growth has trailed revenue growth this year with the gap continuing to widen as we moved through the year.

For the third quarter, in fact, earnings are expected to be up just 0.4% on 9% higher revenues. And if you take out the roaring energy sector, they are expected to be down -6.2%.

The huge increase in raw material prices, labor shortages and elevated fuel and transportation costs have obviously taken a toll on companies and impacted their profitability, even as relatively steady demand allowed them to pass on some of the higher cost to customers.

The most important factor supporting the consumer is the job market, which is still tight, despite availability coming down. For the most part, companies are still reluctant to let their people go when they might need to hire them back at a higher rate. Therefore consumers, while still impacted by inflation, are not going underwater. This in turn is supporting the continued escalation in food prices. Energy prices, the other major non-core factor in the CPI has been coming down in recent months after the release of strategic reserves.

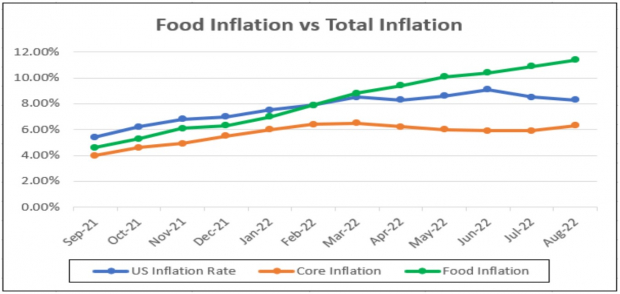

So there is a big question about food prices, and whether they may be expected to come down any time soon, given the Fed’s actions and the dire situation some lower-income groups are facing already.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Food price elevation is the result of many factors and a 1-2% increase in cost per year has been absorbed by consumers for years. But the last two years have seen extreme volatility in energy prices, which increase transportation costs for everyone, including food producers. And transporters have made the most of supply chain constraints to further drive up prices. Rising input costs and labor shortages (a secular trend exacerbated by the pandemic) also haven’t helped.

The war in Ukraine has also had a significant impact. While it has affected the whole world in different ways, the impact on agricultural production has been severe. For one thing, both countries, and especially Ukraine, produces nearly a third of the world’s wheat and this supply was cut off overnight. Sanctions against Russia also have a severe impact because Russia produces a third of the world’s fertilizers. With this supply cut off, agricultural production was destined to see cost escalation.

To make matters worse, America is seeing the effects of climate change.

The American Farm Bureau Federation (AFBF) says that 60% of the western, southwestern and central plains are experiencing severe drought conditions. The seventeen states included in this region from Northern Texas up to North Dakota and stretching in the west to California accounts for nearly half of the country’s agricultural production by value:

“This includes 74% of beef cattle, responsible (in total) for 18% of U.S. agricultural production by value; 50% of dairy production, responsible (in total) for 11% of U.S. agricultural production by value, over 80% of wheat production by value and over 70% of vegetable, fruit and tree nut production by value. Drought conditions, which have persisted well into 2022, put production of these commodities at risk, along with the stability of farms, ranches and local economies reliant on crops, livestock and downstream products and services for income.”

The AFBF conducted a survey between June 8 and July 20 this year that showed:

- 74% of farmers are seeing a reduction in harvest yields in 2022, up from 72% last year.

- 42% are planning to switch crops for growing season, up from 37% last year.

- 37% are tilling under crops. This is up from 24% last year.

- 33% are removing/destroying orchard trees and other multi-year crops (nearly double the 17% last year).

- 39% said that wildfires contributed to crop losses and cattle sell-offs in their area (there is no data from last year).

“Across the surveyed region, respondents expected average crop yields to be down 38% this year because of drought conditions, with the biggest drop expected in Texas (yields reported down 68%), followed by Oklahoma (down 60%) and New Mexico (down 54%).”

Livestock farming is not any easier:

- 66% are selling off portions of herd/flock, same as last year

- Insufficient forage requiring removing of animals 71%, down from 79% last year

- Increase in local feed costs (often expensive hay) linked to drought 90%, 87% last year

- Feed and forage coming from long distances away 72% (71% last year)

- Hauling water to livestock 60% (64% last year)

- Diminished access to public grazing lands 57% (no data from last year)

However, as a recent Forbes article points out, production numbers from the USDA indicate that volumes are not as bad as they could have been. Soybean production is actually up 2% from last year while wheat production is up 8%, supported by the strong prices resulting from the global shortage. Corn (around two-thirds used for cattle feed and ethanol) is a concern however and expected to be down 5%, which will also make it more expensive. The U.S. is cutting exports this year to support domestic needs.

With feed and water becoming harder to come by, both because of environmental factors and government restrictions to safeguard the environment, the outlook is not bright for meat and dairy producers.

Conclusion

The Fed’s actions will ultimately have a moderating effect on food price increases, likely next year. However, the above conditions point to long-term systemic issues that won’t be resolved quickly. Therefore, some modest inflation in food prices is likely to persist.

Considering these concerns, it may be a better idea to avoid food stocks for now. There certainly are better stocks to pick from, such as energy or transportation companies that are responsible for some of the price increases food producers are seeing. Therefore, stocks like NextEra Energy Partners (NEP) , CVR Energy (CVI) , Plains All American Pipeline (PAA) , Euroseas (ESEA) and Frontline (FRO) are great picks. Not only do they have solid growth prospects stretching into 2023 but they also offer attractive dividends that can support income generation.

More By This Author:

The Bank of New York Mellon Corporation Earnings Expected to Grow: What to Know Ahead of Next Week's ReleaseWall Street Waits For Q3 2022 Earnings To Kick Off

Sail Through Rough Waters With These 3 Low-Beta Stocks

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more