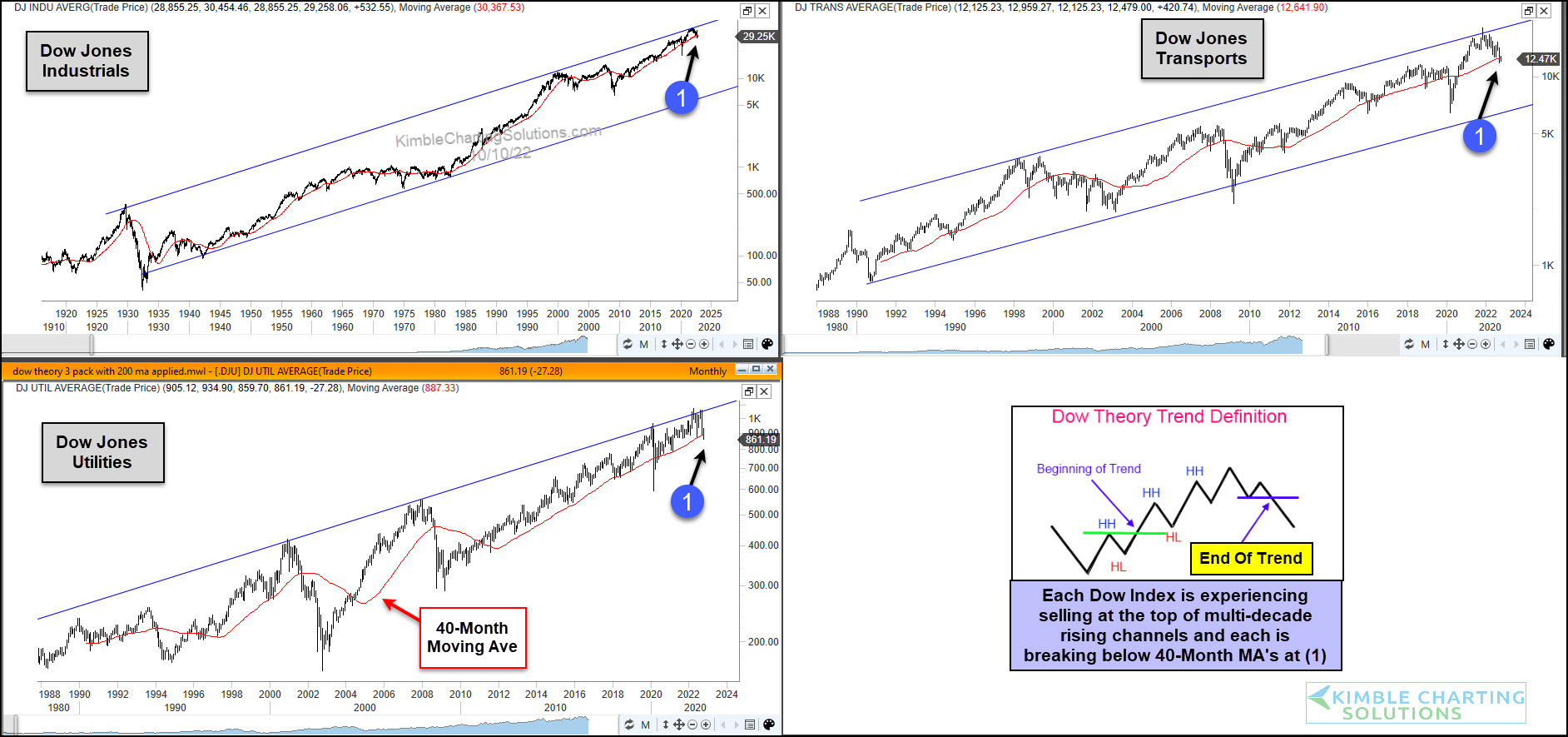

Is Dow Theory Saying Game Over For Stock Market?

Investors are really struggling to make sense of bearish, yet wide-ranging, economic data and varying analyst opinions.

Call it a sign of the times.

It’s been a very difficult past 30 months for literally everyone. And this has greatly affected stocks this year. 2022 has been a rough year by all investment return measures. And it could get worse.

That’s right, it could get worse. Today’s chart 3-pack highlights 3 Dow indices that are decisively bearish… and attempting to trigger a Dow Theory sell signal.

As you can see, the Dow Industrials, Dow Transports, and Dow Utilities peaked at the top of their respective price channels and are now trading below their 40-month moving averages at each point (1).

A breakdown of the Dow Jones Industrials and Transports triggers a “Dow Theory” sell signal. And with Dow Utilities also struggling, it seems like an important time for investors to remain vigilant.

(Click on image to enlarge)

More By This Author:

Semiconductors Break Of Triple Support Sends Global Bearish Message

Major Stock Market Indices Try To Form Double Bottoms

Did The 10-Year Bond Yield Peak At Key Fibonacci Level?

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.