Is Delta The Best Airline Stock To Buy After Its Strong Q3 Results?

Image Source: Unsplash

As it relates to the three largest airlines in the U.S., Delta (DAL - Free Report) is making its case as the best one to invest in after delivering strong Q3 results on Thursday morning.

To that point, Delta is now the largest domestic airline by revenue and the most profitable, ahead of United (UAL - Free Report) and American Airlines (AAL - Free Report).

And while United may deliver the higher EPS because of its lower share count, Delta’s valuation is neck and neck with a more affordable stock price as well.

Keeping this synopsis in mind, let’s see if it's time to buy Delta stock, which surged as much as +8% in today’s trading session.

Delta’s Strong Q3 Results

Posting Q3 sales of $16.67 billion, Delta’s top line expanded 6% from $15.67 billion in the prior year quarter and comfortably topped estimates of $15.79 billion. On the bottom line, Delta’s net income came in at $1.5 billion or $1.71 per share. This was a 14% spike from Q3 EPS of $1.50 a year ago and impressively exceeded expectations of $1.52.

Some of the pleasant growth drivers were a 9% increase in premium revenue, illustrating strong demand for Delta's higher-cabin classes. Additionally, corporate sales rose 8% YoY, showing a recovery in business travel and Delta's corporate travel program. SkyMiles, Delta’s core loyalty program, saw a 9% uptick in revenue.

Also reflecting stronger loyalty program engagement, Delta noted double-digit growth in co-branded credit card spending. Attributed to such, Delta earned $2 billion from its partnership with American Express (AXP - Free Report), a 12% increase from the comparative quarter. Notably, Delta’s operating margins improved to 11.2% from 9.4% in Q3 2024.

Delta’s Optimistic Guidance

Driven by strong holiday travel demand along with improving domestic and transatlantic unit revenue trends, Delta expects Q4 revenue to increase by 2%-4%. This came in above the Zacks Consensus of $15.33 billion or a decline of over 1%.

Delta projects Q4 EPS between $1.60-$1.90, coming in above expectations of $1.59. Full-year EPS is now expected near the top end of its prior range of $5.25-$6.25, with Zacks estimates currently at $5.67.

Full-year free cash flow targets were reaffirmed at $3.5-$4 billion, along with a margin outlook of 10.5%-12%.

DAL Performance & Valuation Comparison

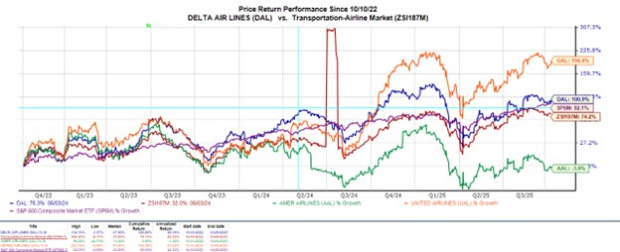

Year to date, Delta stock is still down roughly 1%, trailing United’s +4% with American Airlines’ stock down a grizzly 33%.

Stemming from tariff concerns, fears of weaker cross-border travel have weighed on all three major airline carriers as their stocks have underperformed the Zacks Transportation-Airline Market’s YTD gains of +5% and the S&P 500’s return of +15%.

Still, in the last three years, Delta’s gains of +100% have topped the broader market and most of its peers. During this period, American Airlines stock is down a very subpar 3% although United’s blazing price performance of nearly +200% has led the way.

Image Source: Zacks Investment Research

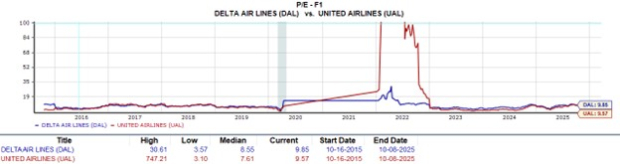

Considering their longer-term performances, DAL may stand out at closer to $60 a share and 9X forward earnings, as this is roughly on par with the industry average and United’s P/E valuation, but UAL trades at $100.

In contrast, American Airlines stock trades at a stretched forward P/E premium of 33X, although AAL still tends to lure investors with a cheaper stock price, which is around $11 at the moment.

Somewhat inherently, DAL, UAL, and AAL trade at less than 1X sales, on par with the industry average and well below the S&P 500’s 5X.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

The post-earnings rally in Delta stock looks warranted, but for now, DAL lands a Zacks Rank #3 (Hold) along with United and American Airlines. That said, it's easy to see how the smart money may start to favor Delta among the major airline stocks to invest in, given its valuation and position as the most profitable.

Delta’s diverse revenue streams should also be catching investors' attention, and it wouldn’t be surprising if a buy rating is on the way as earnings estimate revisions (EPS) are likely to trend higher in correlation with the company’s better-than-expected guidance.

More By This Author:

Keeping Track Of The Soaring "White House" Stocks: INTC, LAC, MP, TMQBuy The Surge In AMD Stock After Striking Partnership With OpenAI?

4 Agriculture Operations Stocks To Watch As Trade Uncertainties Weigh

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more