Is Constellation Brands A One Trick Pony? What To Expect From Wednesday’s Report?

(Photo Credit: Glen)

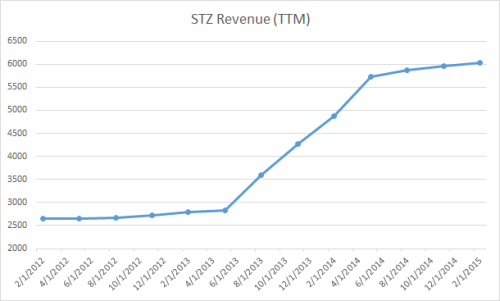

Constellation Brands (STZ) will reports its FQ1 ’16 results Wednesday morning and both Estimize and Wall Street are predicting a solid lift in EPS QoQ. Constellation Brands has performed extremely well year-to-date (YTD) posting a capital return of 18.68% compared to the broader S&P 500 index which has only risen 0.35%. The share price surge can be attributed to Constellation Brands’ surge in earnings over the past two years. Since FQ1 ’14, EPS has increased from $0.38 to the reported figure of $1.03 in FQ4 ’15, representing an astronomical increase of 172% in only 7 quarters.

Estimize are predicting the upcoming result to produce an EPS figure of $1.24 and a revenue number of $1.622B. This compares to Wall Street’s estimates of an EPS figure of $1.22 and a revenue projection of $1.615B.

Constellation Brands is a global producer, importer and marketer of alcoholic beverages including beer, wine, and spirits. The company sports a variety of premium brands and has been a direct beneficiary of high demand for imported products in the United States. Constellation Brands distributes household name brands such as Corona and Modelo. Modelo in particular has been a fantastic revenue generator for Constellation Brands and has contributed to the company’s rapid sales growth. Investors will want to see a continuation in sales growth from its Modelo brand and other contributing brands.

Constellation Brands is expected to further benefit from its imported beer brands as demand continues to grow. Imported beer volumes rose by a staggering 13.0% in the first quarter of 2015 year-on-year (YoY) in the United States. Circa 60% of the imported beer value came from Mexico, the homeland of Corona and Modelo. An increasing Hispanic population in the United States will likely translate to further growth in demand for these two products stimulating Constellation Brands sales and earnings.

Constellation Brands has continued to outperform consensus and as a result the stock has continued rise. The stock is currently trading near its all-time high. The report and guidance provided by management on Wednesday should be closely analyzed by investors as this report will likely be influential to the stock’s performance over the coming months.

Disclosure: There can be no assurance that the information we considered is accurate or complete, nor can there be any assurance that our assumptions are correct.

oh by the way, I like my Corona with a twist of lime! me gusta!

Dear Leigh, totally agree with you on STZ -it is the leader of the pack..BUD is cryint in its domestic suds nobody wants..DEO continues to unimpress as does Brown Forman..TAP is okay I guess. Haven't really looked at SAM- Anyway I am long STZ going into earnings..its number one on the IBD list and was recently blessed (or is cursed?) by Cramer..Great article as usual..cheers Carol