Is Capital One Stock Worth Owning Ahead Of Q4 Earnings?

Image: Bigstock

Key Takeaways

- Capital One is set to post Q4 results on Jan. 22, with revenues likely to rise 50% year-over-year on card strength and Discover impact.

- Capital One's NII is expected to rise more than 50% as loan demand and earning assets offset lower rates.

- Expenses are projected to climb from tech investments and the Discover acquisition, pressuring profits.

Capital One (COF - Free Report) is scheduled to announce fourth-quarter and 2025 results on Jan. 22, after the market close. Similar to the previous reported quarter, the company’s to-be-reported quarter’s performance is expected to have been driven by its solid credit card business, along with the acquisition of Discover Financial.

The Zacks Consensus Estimate for Capital One’s fourth-quarter revenues is pegged at $15.32 billion, which indicates year-over-year growth of 50.3%. The consensus estimate for full-year sales of $53.25 billion implies a rise of 36.2% from the previous year.

However, in the past seven days, the consensus estimate for earnings for the to-be-reported quarter has been revised 2.2% lower to $3.98. The estimate indicates a 28.8% improvement from the prior-year quarter’s actual reading. For 2025, the consensus estimate for earnings is $19.65, which indicates growth of 40.8%.

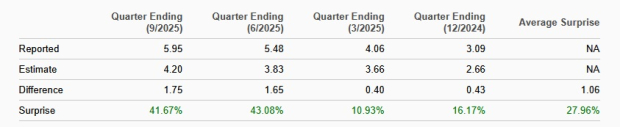

Estimate Revision Trend

Image Source: Zacks Investment Research

Capital One has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, with the average beat being 28%.

Earnings Surprise History

Image Source: Zacks Investment Research

Key Factors Likely to Influence Capital One’s Q4 Results

NII: In the to-be-reported quarter, the Federal Reserve lowered interest rates twice. This, along with the rate cut in September, is likely to have hurt Capital One’s net interest income (NII) to some extent. However, the overall lending scenario was robust in the fourth quarter. Per the Federal Reserve’s latest data, the demand for consumer loans was strong.

Moreover, the Zacks Consensus Estimate for total average earning assets for Capital One is pegged at $587.8 billion, implying a 27.6% rise from the prior-year quarter. Thus, despite declining rates, a solid lending scenario and stabilizing funding/deposit costs are expected to have aided NII.

Also, Capital One’s continued efforts to strengthen its card operations are expected to have provided support. The consensus estimate for fourth-quarter NII of $12.25 billion indicates 51.3% year-over-year growth.

Fee income: Supported by an overall rise in credit card usage and the Discover Financial buyout, Capital One’s interchange fees (constituting more than 60% of fee income) are likely to have increased in the quarter under review. The Zacks Consensus Estimate for interchange fees is $1.88 billion, suggesting a 49.2% year-over-year jump.

The consensus estimate for service charges and other customer-related fees of $866 million implies 56.3% growth from the prior-year quarter. The Zacks Consensus Estimate for other non-interest income is pegged at $313 million, indicating a 12.6% rise. Thus, the consensus estimate for total non-interest income of $3.03 billion indicates a jump of 44.6% from the prior-year quarter.

Expenses: Capital One has been witnessing a persistent rise in expenses over the past several quarters due to higher marketing costs and investment in technology upgrades. Further, the Discover Financial acquisition, along with inflation pressure, is expected to have resulted in an increase in operating expenses in the fourth quarter.

Asset Quality: Capital One is less likely to have set aside a huge amount of money for potential delinquent loans, as the interest rates have come down substantially from the highs of 5%-5.25%.

What Our Quantitative Model Unveils for Capital One

According to our quantitative model, the chances of Capital One beating the Zacks Consensus Estimate for earnings this time are high. This is because it has the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) rating or better. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

- Earnings ESP: The Earnings ESP for Capital One is +2.07%.

- Zacks Rank: The company currently carries a Zacks Rank #3 (Hold) rating.

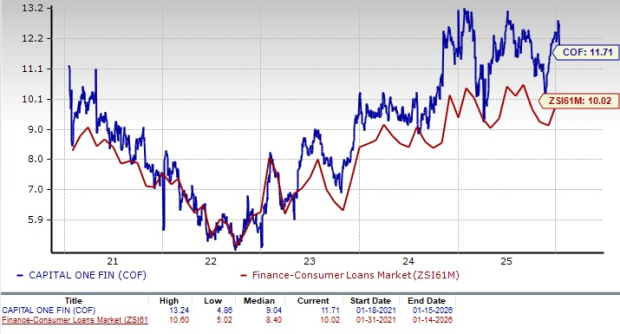

Capital One’s Price Performance & Valuation Analysis

In the fourth quarter, the stock rallied 13.5%, outperforming the Zacks Consumer Loans industry. Its peers, Wells Fargo (WFC - Free Report) and Citigroup (C - Free Report), gained 15.2% and 18.2%, respectively.

Q4 25 Price Performance

Image Source: Zacks Investment Research

Wells Fargo’s fourth-quarter 2025 adjusted earnings per share of $1.76 surpassed the Zacks Consensus Estimate of $1.66. In the prior-year quarter, the company reported earnings per share of $1.42. Its results benefited from an improvement in NII, higher non-interest income, and lower provisions.

Citigroup’s fourth-quarter 2025 adjusted net income per share of $1.81 increased 35.1% from the year-ago period. The metric also surpassed the Zacks Consensus Estimate by 9.7%. Results benefited from an increase in NII and lower provisions. Citigroup also registered a year-over-year increase in investment banking revenues, reflecting growth in Advisory and Equity Capital Markets.

Capital One shares appear expensive relative to the industry. The stock has been trading at a forward 12-month price/earnings (P/E) ratio of 11.71X. This is above the industry’s 10.02X, reflecting a stretched valuation.

Price-to-Earnings Forward 12-Months

Image Source: Zacks Investment Research

Evaluating Capital One Stock Ahead of Q4 Earnings

Capital One’s credit card business stands out as a core earnings engine, underpinned by its scale, data-driven underwriting, and strong brand presence in the U.S. consumer finance market.

The acquisition of Discover Financial in May 2025 (which reshaped the landscape of the credit card industry, creating a behemoth and unlocking substantial value for shareholders) has positioned Capital One to capture a larger share of card spending. Thus, given its solid credit card and online banking businesses, the company’s revenue prospects look encouraging.

Moreover, as one of the largest credit card issuers in the country, Capital One benefits from a diversified customer base that spans prime to subprime segments, allowing it to generate attractive yields while actively managing risks.

While near-term results may be influenced by provisioning trends and macro conditions, the long-term outlook for Capital One is supported by its disciplined risk management, strong consumer spending engagement, and potential margin expansion from scale and integration benefits.

However, given the company’s investments in technology and infrastructure, as well as its inorganic expansion efforts, overall expenses are expected to remain elevated in the near-term, hurting bottom-line growth. Thus, investors should not rush to buy the Capital One stock now. Yet, those who already own the stock in their portfolios should hold on to it for long-term gains.

More By This Author:

Iren Limited Or Hut 8: Which Bitcoin Infrastructure Stock Should You Bet On?Is Super Micro Still a Good Tech Stock to Own?

D-Wave Quantum, Rigetti, IonQ: Buy, Sell, Or Hold Ahead Of Q4 Earnings?

Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific securities ...

more