Is Berkshire Hathaway's Stock Overvalued Or Undervalued?

Berkshire Hathaway Inc. (NYSE: BRK-A) (NYSE: BRK-B) shares have outpaced the S&P 500 in 2021, generating a year-to-date total return of 19.5%.

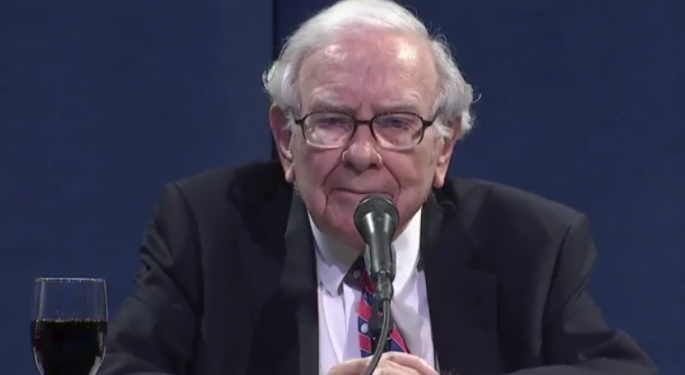

Warren Buffett's Berkshire Hathaway is still putting up solid growth numbers, but with a $730 billion market cap, some investors are wondering if there’s any value left in Berkshire stock.

Earnings: A price-to-earnings ratio (PE) is one of the most basic fundamental metrics for gauging a stock’s value. The lower the PE, the higher the value. For comparison, the S&P 500’s PE is currently at about 33.9, more than double its long-term average of 15.9.

Berkshire’s PE is currently 6.1, less than a fifth of the S&P 500 average as a whole. Berkshire's PE ratio is down 55.9% over the past five years, suggesting the stock is currently priced at the low end of its historical valuation range.

Growth: Looking ahead to the next four quarters, the S&P 500’s forward PE ratio looks much more reasonable at just 20.7. Berkshire’s forward earnings multiple of 21.4 is roughly in line with the S&P 500 as a whole, making Berkshire stock look fairly valued.

Berkshire’s forward PE ratio is about 50% higher than its consumer cyclical sector peers, which are currently averaging a 14 forward earnings multiple.

Yet when it comes to evaluating a stock, earnings aren't everything.

The growth rate is also critical for companies that are rapidly building their bottom lines. The price-to-earnings-to-growth ratio (PEG) is a good way to incorporate growth rates into the evaluation process. The S&P 500’s overall PEG is currently about 1; Berkshire’s PEG is 8, suggesting Berkshire is currently overvalued based on sales alone.

Price-to-sales ratio is another important valuation metric, particularly for unprofitable companies and growth stocks. The S&P 500’s PS ratio is currently 3.1, nearly twice its long-term average of 1.62. Berkshire’s PS ratio is 2.4, a significant discount to the S&P.

Finally, Wall Street analysts see at least some value in Berkshire stock over the next 12 months. The average analyst price target among the three analysts covering Berkshire is $329, suggesting about 19.8% upside from current levels.

The Verdict: At its current price, Berkshire stock appears to be slightly undervalued based on a sampling of common fundamental valuation metrics.

Disclosure: © 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.