Is An Earnings Recession Coming?

Image Source: Unsplash

The Q3 earnings reports showed once again that companies have largely been able to defy the doom-and-gloom predictions.

We are not suggesting that the earnings picture is great, but rather that it has proved to be a lot more stable and resilient than many had been willing to give it credit.

Actual Q3 results came in better than expected, with earnings growth turning positive for the first time after three consecutive quarters of declines. There wasn’t much growth to write home about, but that is hardly surprising, given where we are in the economic cycle.

The economy’s resilience in the face of the Fed’s extraordinary tightening has been a pleasant surprise. At this time last year, hardly any economist was projecting that the U.S. economy would generate the type of growth momentum that we saw in the recent upwardly revised GDP growth numbers for 2023 Q3. That said, it makes sense for growth to moderate going forward to reflect the cumulative Fed tightening and the higher-for-longer interest rates outlook.

All of this has direct earnings implications as estimates for the coming periods get trimmed.

To get a sense of what is currently expected, take a look at the chart below. It shows the earnings and revenue growth rates achieved in the preceding four quarters and current earnings and revenue growth expectations for the S&P 500 index for 2023 Q4 and the following three quarters.

Image Source: Zacks Investment Research

As you can see, 2023 Q4 earnings are expected to be down -0.2% on +2.4% higher revenues. This follows the modestly positive earnings growth reading we saw in the preceding period (2023 Q3) and a period of declining earnings in the three quarters before that.

Take another look at this chart before we go back to the ‘earnings recession’ question we raised at the top of this note.

This chart, which accurately represents current bottom-up consensus earnings expectations aggregated to the index level, does not see an earnings recession over the next three quarters. If anything, revenue growth is trending up over this period.

What we do see in the above chart is the three quarters of negative earnings growth from Q4 of 2022 to Q2 of 2023. Recessions are typically seen as two periods of declining growth.

Looking at it this way, the earnings recession issue is the rear-view mirror at this stage, not something on the horizon.

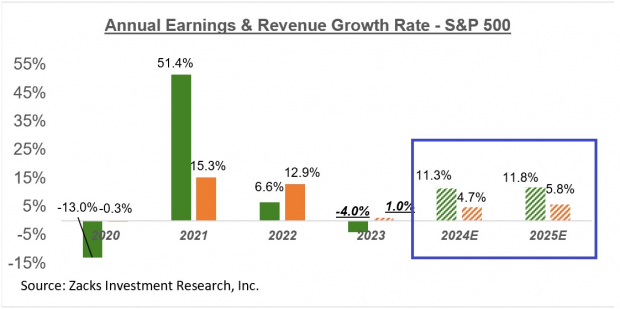

The chart below shows the earnings picture on an annual basis.

Image Source: Zacks Investment Research

It isn’t just the next three quarters where the long-feared recession is missing in action, but actually over the next two years, as you can see above.

The earnings recession proponents have been telling us for more than a year that earnings estimates were out-of-sync with the underlying economic reality and needed to be cut in a big way.

We did see a period of significant negative estimate revisions that started in April 2022 and lasted for about a year. During that period, estimates in the aggregate declined by about -15% from peak to trough, with the magnitude of negative revisions to several sectors exceeding -20%. These included Construction, Consumer Discretionary, Technology, and Retail.

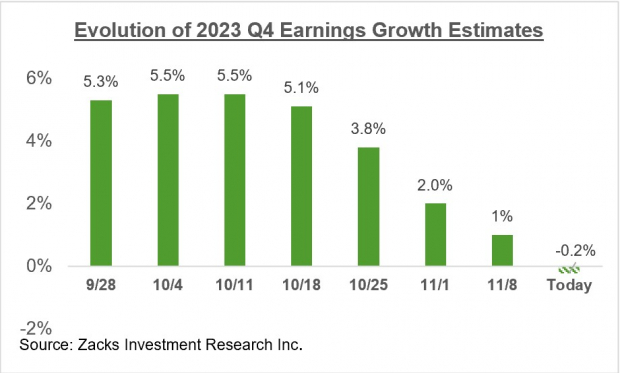

Estimates started stabilizing in April 2023 and actually increased for several major sectors, including the Tech sector. This favorable revisions trend remained in place until October 2023, when estimates started moving lower again.

The chart below shows how earnings growth expectations for the current quarter have evolved since the quarter got underway.

Image Source: Zacks Investment Research

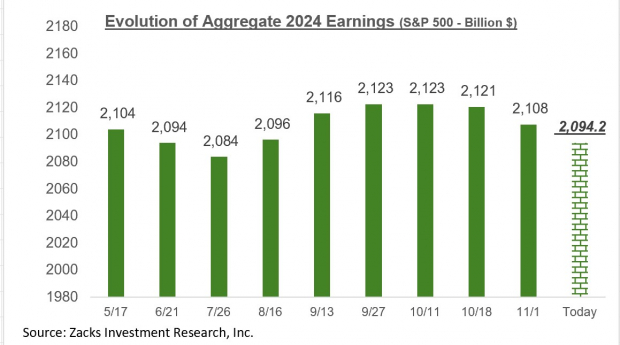

Estimates for full year 2024 have also been coming down. The chart below shows how the aggregate bottom-up earnings total for 2024 has evolved lately.

Image Source: Zacks Investment Research

The concerning aspect of this negative revisions trend is that it reverses a period of stabilizing and even improving estimate revisions.

The relatively sound explanation for this trend is that management teams are trying to anchor expectations to beat them easily. The problematic explanation would be that this is finally the beginning of the negative earnings revisions trend that the market bears had been warning us of.

My money is on the former explanation, but you can bet that we will be watching this trend very closely.

More By This Author:

Looking Ahead To Q4 Earnings

Top Analyst Reports For Amazon, Deere & Citigroup

Has The Profit Cycle Bottomed?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more