Is 3 Quarters Of Negative Earnings Bad News?

“The estimated (year-over-year) earnings decline for Q3 2019 is -3.8%, which is below the 5-year average earnings growth rate of 7.3%. If -3.8% is the actual decline for the quarter, it will mark the first time the index has reported three straight quarters of year-over-year declines in earnings since Q4 2015 through Q2 2016. It will also mark the largest year-over-year decline in earnings reported by the index since Q1 2016 (-6.9%).” - Factset

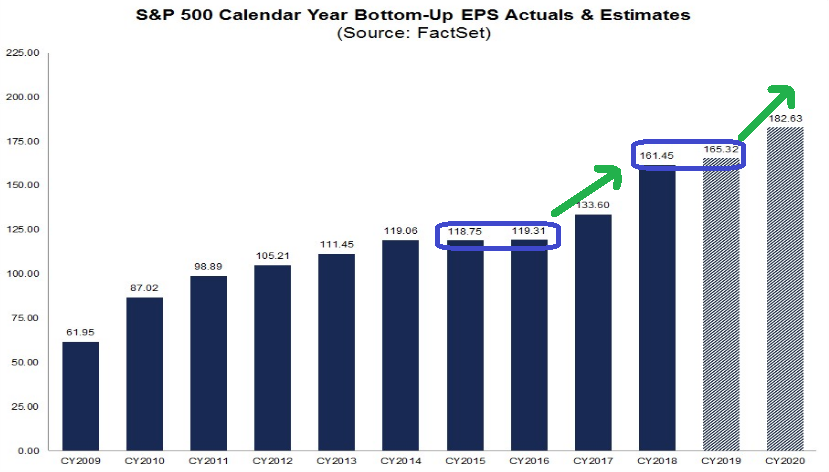

For the past couple of months we have drawn strong parallels with the 2015-2017 period side-by-side with the 2018-2020 period.The basic premise was that S&P 500 earnings (along with price) were sideways to flat for 2015-2016 period.Price began to take off in late Q3/early Q4 2016 in anticipation of the earnings jump in 2017 (despite having 3 quarters of negative earnings growth preceding it). Here is the article that explains the data:

Earnings did in fact meet positive expectations in 2017 jumping 11.97% from 2016-2017.From Q4 2016 lows, to Q1 2018 highs, price surged 36% (following 3 quarters of negative earnings growth in 2016).

For CY 2020, analysts are projecting earnings growth of 10.6% and revenue growth of 5.6%.

What is interesting when you ask the question of whether we will get a similar run (price) to what we saw in 2017 are the following 2 facts:

1. The average price appreciation following the 2/10 inversion of the yield curve to market peak (~18 months after inversion) is mid-30’s%.We inverted last month.

2. We have gone from a tightening environment in 2018-early 2019 when the market churned sideways, to an easing cycle which the discount rate has already come down 50bps.Just as it took 6 months to feel the economy slow after they stopped tightening, it will take a few months to feel the economy stabilize and heat up after initial loosening.

So is the 3 quarters of negative earnings bad news? It depends if you are looking in the rear view mirror to see what’s behind you, or through the windshield to see what’s ahead…

Disclaimer: Not investment advice. For educational purposes only: https://www.hedgefundtips.com/terms-of-use/

Interest rates were rising for mortgages. That could be a drag on your upbeat scenario.

Hi Gary. Thanks for your comment. I addressed this point (and the lagged effect of tightening/loosening) in the second to last paragraph. Hope that helps. T.J.

Great. We will see if it works out. Of course insurance companies cannot survive well with negative rates. Hopefully we are not headed there. One more point, we need to see how derivatives are impacting the repo market going forward.

Good points.