Iren Limited: An AI, Crypto And Cloud Computing Stock

Image: Bigstock

Every so often, I come across a stock in my research that checks nearly every box I look for: innovation, growth, strong fundamentals, and technical momentum. Iren Limited (IREN - Free Report) is one of those rare finds. The company sits at the intersection of three of the most exciting technology trends, artificial intelligence, cryptocurrency, and cloud computing, while also boasting a top Zacks Rank, a reasonable valuation, and strong price momentum.

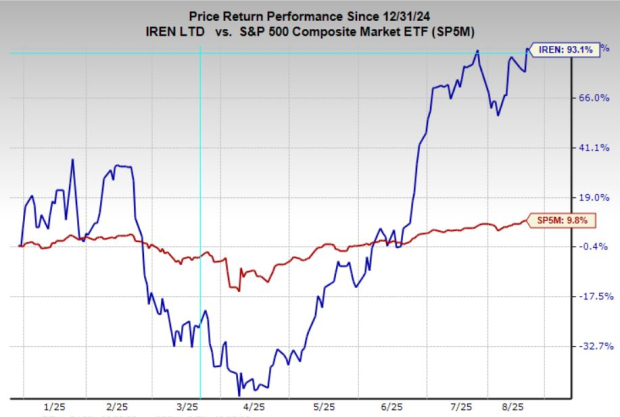

While 2025 has been volatile for the stock, Iren Limited has proven resilient, climbing an impressive 93% year-to-date. The recent price action suggests a period of healthy consolidation, setting the stage for a potential breakout to new highs.

Iren Limited operates next-generation, vertically integrated data centers built for AI, crypto mining, and high-performance cloud workloads entirely powered by renewable energy. Founded in 2018 and headquartered in Sydney, Iren operates large-scale, grid-connected facilities across North America, delivering scalable, energy efficient compute infrastructure in the rapidly growing AI and blockchain space.

While stocks like Nvidia (NVDA - Free Report) and Vertiv (VRT - Free Report) are well known ways to invest in the AI space, these companies are mammoths compared to Iren. For investors looking to play the trend in a considerably smaller market cap than Nvidia and Vertiv, Iren Limited may be worth considering.

Image Source: Zacks Investment Research

Shares of Iren Limited Appear Fundamentally Robust

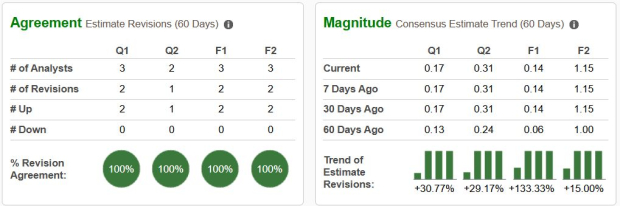

Iren Limited has a lot going for it from a fundamental perspective. Over the past two months, analysts have made substantial upward revisions to the company’s earnings forecasts. Current quarter estimates have been raised by 31%, while FY25 projections have surged 134%, earning the stock a Zacks Rank #2 (Buy) rating.

Revenue growth expectations are equally impressive. Sales are projected to soar 173% this year to roughly $515 million, and then climb another 86% next year to approach $960 million. This pace of expansion underscores the company’s ability to capitalize on its positioning in AI, crypto, and cloud computing.

Even with such explosive growth on the horizon, Iren Limited stock trades at a forward earnings multiple of just 16.6x, a valuation that may look very attractive given its momentum, earnings revisions, and sector tailwinds.

Image Source: Zacks Investment Research

Iren Limited Stock Poised to Break Out

The recent technical setup for Iren Limited stock looks extremely compelling. After a powerful rally off its April lows, climbing more than 250%, the stock has spent the past six weeks forming a large, orderly consolidation pattern. This kind of pause often serves as the launchpad for the next leg higher in a strong trend.

Recently, shares were seen hovering just beneath a key resistance level at around $19.15. The decisive move and close above that threshold seemingly confirmed a technical breakout, which may potentially trigger fresh momentum buying and fuel another major bull run. With the stock’s strong underlying trend and favorable fundamental backdrop, such a breakout could set the stage for significant upside in the weeks ahead.

Image Source: TradingView

Should Investors Buy Shares in Iren Limited?

In a market where giants like Nvidia and Vertiv dominate the AI and data center headlines, Iren Limited offers a smaller, faster-growing player with explosive upside potential. Its unique combination of renewable powered, high-performance compute infrastructure positions it to capture growth across AI, crypto, and cloud computing without the valuation premium of its larger peers.

With upward trending earnings revisions, massive projected revenue growth, a reasonable valuation, and a textbook technical setup signaling the potential of a breakout, Iren Limited is emerging as a high conviction idea for growth-oriented investors. The next leg higher could be substantial.

More By This Author:

Home Depot Vs. Lowe's: Which Is The Best Investment As Q2 Results Approach?Buy Dillard's Stock After Crushing Q2 EPS Expectations?

3 Funds To Buy On Solid Surge In Semiconductor Sales In Q2

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more