IPOs 2021: CLEAR Looks Beyond The Aviation Sector

The global Biometrics-as-a-Service (BaaS) market is expected to grow at 20% CAGR from $1.5 billion in 2020 to $3.7 billion by 2025, driven by increasing use cases for data-security initiatives by governments and rising demand for robust fraud detection and prevention systems. CLEAR (NYSE: YOU), a provider of biometrics screening for security services, recently went public.

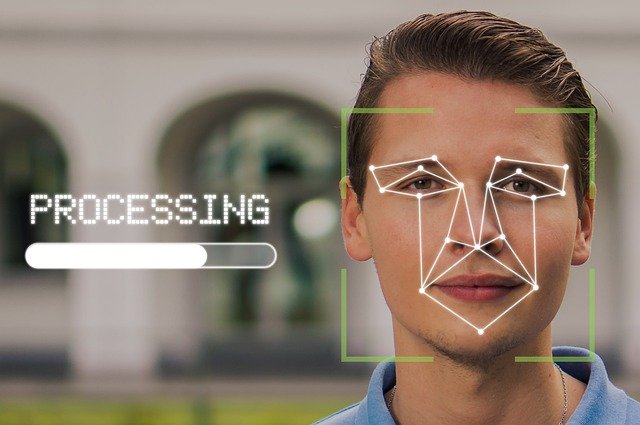

Photo Credit: Tumisu from Pixabay

CLEAR’s Offerings

Founded in 2010 by Caryn Seidman-Becker and Ken Cornick, New York-based CLEAR was launched to create a seamless travel experience while enhancing homeland security. After the 9/11 attacks, there was a need within the aviation industry to deliver safer and easier experiences. The field of biometrics was leveraged to help deliver this requirement by building an unbreakable link between individuals and their identities. CLEAR’s secure identity platform was created to use biometrics to automate the identity verification process through CLEAR lanes in airports. The result was a safer, easier, and more predictable travel experience.

Since its founding, CLEAR had envisioned that its solutions could be used in industries other than aviation. In the last decade, it has found a wide range of consumer applications that are subject to similar secular trends. CLEAR has built an extensive physical footprint through a nationwide network of airports, stadiums, and businesses that deliver similar experiences. It uses biometrics to build a connected world that is made smarter and more secure by linking the identity with other certified documents such as health care identification, driver’s licenses, and passports.

As of May this year, its network of partners and use cases extended to 38 airports covering 106 checkpoints, 26 sports and entertainment partners, and 67 Health Pass-enabled partners and events covering 110 unique locations throughout the country. Additionally, its solutions have been deployed in a growing number of offices, restaurants, theatres, casinos, and theme parks. Its information security program has a Federal Information Security Modernization Act (FISMA) High Rating that has been certified by the US Department of Homeland Security. The certification gives it a clear edge against competition from other vendors in the space.

CLEAR’s member base includes paying members and platform members. Paying members to subscribe to its CLEAR Plus consumer aviation subscription service, which provides access to dedicated entry lanes in airport security checkpoints across the nation as well as its broader network. Platform members include members who enrolled through its mobile app and were formerly paying CLEAR Plus members. Platform members can use CLEAR anywhere in its network outside of the CLEAR Plus service. These services include CLEAR Pass for US Customs and Border Protection (CBP) Mobile Passport Control (international arrivals), Health Pass (which includes validation of COVID testing results and digitization of vaccine status), and Home to Gate (end-to-end frictionless travel journeys). Later this year, CLEAR will offer a CLEAR/TSA PreCheck bundled subscription and will provide the ability to renew TSA PreCheck memberships on its website and complete new enrollments in-airport through its ambassador network.

With the onslaught of the pandemic, US airline passenger volumes dropped 60% in 2020. CLEAR responded by taking stronger control over its marketing spending and operating expenses and focused on the development of a COVID-focused app, Health Pass. Health Pass tracks users’ Covid-19 test results, vaccination status, and answers to a real-time health survey to make it easier for people to access the venues and locations they want to visit with their COVID status. But as COVID regulations begin to lift, CLEAR is hopeful that aviation, travel, hospitality, live events, and sports will grow, and that will continue to drive its base memberships.

Last quarter, CLEAR announced a partnership with Microsoft that will allow its members to verify and share digital credentials with Microsoft enabled partners. It also announced a partnership with Six Flags that will allow guests to use the CLEAR app and its digital vaccine card for proof of vaccination and entry at Six Flag Magic Mountain.

CLEAR’s Financials

CLEAR may have started with a focus on the aviation sector, but it wants to become a big part of people’s daily habits. It wants to create frictionless experiences for when people visit their office or even a movie theatre. That will take some time to achieve. For now, CLEAR has a portfolio of 5.6 million total cumulative enrollments for its $179 a year subscription service. It reported revenues of $230.8 million in 2020, up 20% from $192.3 million in 2019. Net loss narrowed from $54.2 million in 2019 to $9.3 million in 2020.

For the third quarter, revenues grew 20% to $67.6 million. Net loss was $32.8 million, or $0.23 per share.

CLEAR went public in June this year when it listed at $31 and raised $409 million at a valuation of $4.5 billion. Before going public, it had raised $135 million in six rounds of funding from investors including LionTree, Liberty Media, Revolution Growth, 32 Equity, General Atlantic, Enlightened Hospitality Investments, Partnership Fund for New York City, and Durable Capital Partners. The most recent round was held in February 2021 for $100 million. It is currently trading at $33.88 with a market capitalization of $4.9 billion.

Disclosure: All investors should make their own assessments based on their own research, informed interpretations and risk appetite. This article expresses my own opinions based on my own ...

more