IPO Preview: Coupa Software

Business summary

Coupa Software Incorporated (Pending:COUP) is a cloud-based technology company that offers a proprietary spending-control platform for businesses. The company's platform unifies business processes across all the ways employees spend money. It currently connects more than 460 companies worldwide with more than 2 million suppliers around the world. The platform provides tight controls by integrating data that would otherwise require organizations to purchase and use multiple applications.

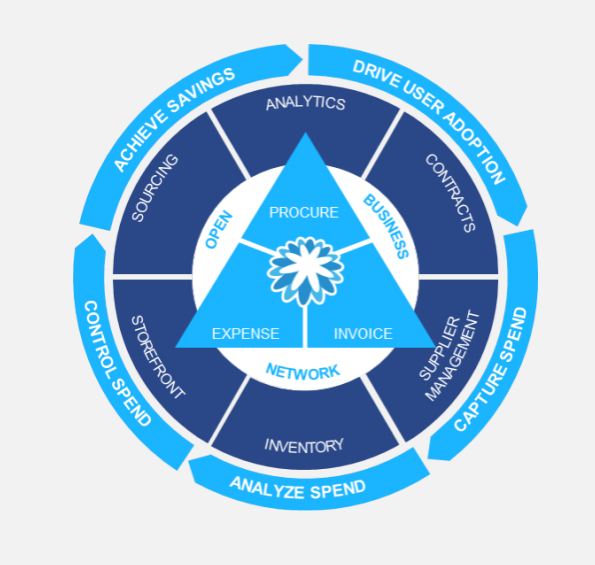

The company offers a variety of product and services, with its primary services including: procurement, invoicing and expense management. The company's platform also offers modules for sourcing, contract and supplier management, analytics, storefront and inventory management. Through the platform, suppliers are able to communicate electronically with buyers, reducing the need and expense of paper. The company is based in San Mateo, California.

(Company Website, coupa.com)

Executive management overview

Robert Bernshteyn has served as Chief Executive Officer and Chairman of the board since February 2009. From June 2004 to February 2009, Mr. Bernshteyn served in various positions, including VP and Global Product Marketing & Management of SuccessFactors Inc., a provider of cloud-based HCM solutions. Before that, he served as Director of Product Management at Siebel Systems, Inc. and Project Manager and Systems Integration Consultant of Accenture. He holds a B.S. in Information Systems from the State University of New York at Albany and an M.B.A. from Harvard Business School.

Todd Ford has served as Chief Financial Officer since May 2015. Previously, he served as Chief Financial Officer of MobileIron, Inc., a mobile IT platform company for enterprises, and co-Chief Executive Officer and Chief Operating Officer of Canara, Inc., a provider of power systems infrastructure and predictive services. Other roles included Managing Director of Broken Arrow Capital, a venture capital firm he founded, and President of Rackable Systems, Inc., a manufacturer of server and storage products for large-scale data center deployments. He holds a B.S. in Accounting from Santa Clara University.

Financial highlights and risks

The company generated of $83.7 million in 2016, a 64.8% increase from $50.8 million in revenue the previous year. In the last six months ended July 31, 2016, the company generated revenue of $60.3 million, almost double from $34.5 million in the same six-month period the previous year. Its 2015 net losses were $27.3 million, and its 2016 net losses were $46.2 million.

The company indicates that it intends to use the proceeds from its IPO to continue development of software as well as increase its financial flexibility. It anticipates it will receive net proceeds of $88.6 million (or $102.6 million if its underwriters fully exercise their over-allotment option).

Relative Valuation and Competitors

Assuming the IPO prices at the midpoint of its price range ($15) and underwriters exercise in full their option to purchase additional shares, Coupa's fully diluted market capitalization value would be approximately $726.24 million. Using last twelve-month sales of $109.5 million, Coupa's price/sales multiple is 6.63x.

Coupa Software competes directly with technology giants such as Oracle Corporation (Nasdaq:ORCL) through that company's acquisition of Ariba, Inc. and Concur Technologies, Inc. and SAP AG (NYSE:

). These companies provide a similar spending control platform as one small component of their many different businesses.

In terms of companies similar in size to Coupa, which also offer enterprise software solutions: Paycom Software, Inc. (NYSE:PAYC), a provider of cloud-based human capital management (Nasdaq:HCM) software, and Manhattan Associates, Inc. (NASDAQ:MANH), a developer and provider of supply chain commerce solutions, are close fits. Both are larger in size than Coupa and growing revenue at a slower rate. Compared to Coupa Software, both trade at a higher price to sales. Manhattan Associates, Inc. trades at 7.3x sales and Paycom Software, Inc. at 13.2x sales.

Conclusion: Buy

Coupa Software has shown tremendous revenue growth and competes in a fast growing market.

The success of the Nutanix IPO (Pending:NTNX) last week demonstrates there is a strong demand for technology IPO (Nutanix gained 131.3% in the first day of trading).

Assuming Coupa prices at the mid-point of its range, it will trade at a price/sales multiple below that of peers, giving it room to move upward.

We are hearing there is big demand and are excited about this upcoming IPO and recommend it as a buy to investors.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in COUP over the next 72 hours.

more

Thanks for this thorough analysis on $COUP. I've been curious about this #IPO.