IP: A Turnaround Play Too Attractive To Pass Up

Image Source: Pexels

This is a market of stocks, not simply a stock market. So, while pundits fret about a broad-based index like the S&P 500 (SPX) trading at a nosebleed forward P/E of 25.7, those willing to venture into individual equities have plenty of inexpensive names from which to choose. I like International Paper Co. (IP)

We understand that patience is critical to our success, and that we have not had even a 5% pullback since the April lows. But we think our future is bright as corporate profit reports have topped expectations in Q3 by a wider-than-usual margin, Asian tariff deals were just struck, the Federal Reserve is accommodative, M&A activity has picked up, and the economy has held up well.

International Paper Corp. (IP)

As for IP, it’s one of the largest packaging companies in the world. It also remains a leading containerboard and box producer in North America, with an estimated quarter of the market.

IP’s Q3 results marked a meaningful step forward in its transformation under CEO Andy Silvernail, as adjusted EBITDA rose 28% from the prior quarter and margins widened by roughly 300 basis points. Mr. Silvernail underscored steady execution of the 80/20 strategy. It streamlines the portfolio and operations, while channeling resources to the best opportunities for profitable growth (with a further $600 million of EBITDA benefits expected in 2026).

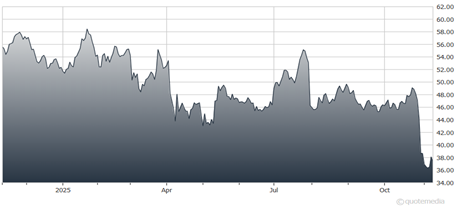

Unfortunately, softer demand, higher labor costs, and planned outages will weigh on Q4 results, while management also reined in projections through 2027, sending the stock skidding 20%-plus. Despite the headwinds, a focus on efficiency and disciplined capital allocation toward high-return projects such as the Riverdale lightweight containerboard conversion should lift profitability and the 2027 consensus EPS estimate is north of $3.

Recommended Action: Buy IP.

More By This Author:

Confidence: Near A Record Low As Job, Inflation Concerns SpikeARTY: An AI-Focused Fund For This AI-Driven Economy

PLTR: Burry's Big Downside Bet Smacks Palantir Shares