Iomab-B Makes Actinium Pharma A Rare And Exciting Investment Opportunity

On June 12th, Actinium Pharmaceuticals (ATNM) hosted a webinar that provided an update on the pivotal Phase 3 SIERRA trial. In SIERRA, Actinium is investigating Iomab-B as an induction and conditioning agent designed to enable elderly patients with relapsed or refractory acute myeloid leukemia (AML) to receive a bone marrow transplant (BMT). Iomab-B is the only induction and conditioning agent under clinical investigation. This is a truly differentiated approach that has excited some of the top BMT surgeons in the country.

The Case For Iomab-B

Dr. Rajneesh Nath is the Director of Bone Marrow Transplant and Acute Leukemia at Banner Health MD Anderson. Dr. Nath is a principal investigator in the SIERRA trial and participated in Actinium's webinar update. He provided an excellent background for investors on the challenges of treating elderly patients with AML. This is, unfortunately, a large segment of the affected population.

For example, the majority of patients diagnosed with AML are over the age of 55. In fact, the median age is 68 and that creates significant problems in treating these patients due to co-morbid conditions and interactions of concomitant or unrelated medications. As such, the 5-Year survival rate is abysmally low for this older population (see below). New treatment options that are safe and effective are desperately needed.

(Click on image to enlarge)

A bone marrow transplant (BMT) is the only curative option for patients with AML. However, in order to qualify for a BMT, the patient must be in complete remission (CR). Transplant surgeons are not going to perform an allogeneic bone marrow transplant on a patient with active disease. As such, not every AML patient is going to qualify for a BMT because complete remission rates for newly diagnosed AML patients are below 50%.

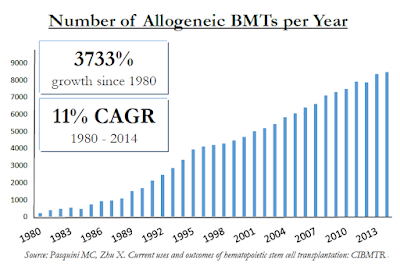

For example, in Celator's landmark Phase 3 trial investigating Vyxeos™, the CR+CRi rate was 47.7% for Vyxeos vs. only 33.3% for standard of care "7+3" chemotherapy. The majority of patients are not moving onto a BMT despite the fact that it can cure the disease. In fact, there are only roughly 9,000 allogeneic BMT's in the U.S. each year vs. roughly 21,000 new diagnosed cases of AML. And allogeneic BMT's are performed on a host of other patients, includes those with multiple myeloma (MM), myelodysplastic syndrome (MDS), non-Hodgkin's lymphoma (NHL), and acute lymphoblastic leukemia (ALL). These populations sum to over 150,000 individuals in the U.S. Unfortunately, despite allogeneic BMT's being one of the fastest growing hospital procedures, it falls far short of meeting the medical need.

(Click on image to enlarge)

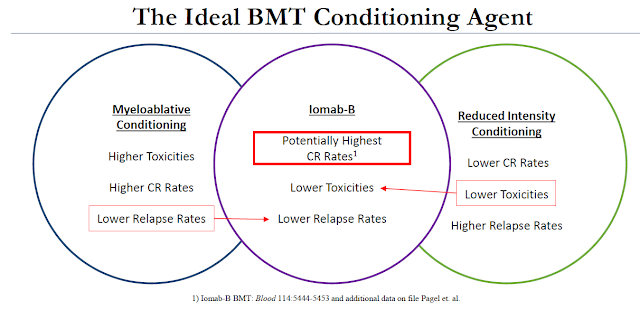

An important differentiator of Iomab-B is that it can be used in patients with active disease. Unlike standard conditioning agents or patients being readied for a BMT, Iomab-B can be used on refractory or relapsed AML patients. These are patients that are over the age of 55 that might not qualify for myeloablative conditioning due to the potential high toxicities and patients that have tried and failed (or relapsed after) reduced intensity conditioning (RIT) because of the low response rate.

(Click on image to enlarge)

This is where Iomab-B has the real potential to change the market because Iomab-B is an induction and conditioning agent at the same time. Induction is killing leukemic cells and conditioning is ablating bone marrow. This is traditionally done in sequential steps with different chemotherapeutic agents. By targeting CD45, a protein found on the surface normal bone marrow cells and up to 90% of leukemia cells, Iomab-B wipes out both leukemia and bone marrow in one single infusion through high-range, low-energy radiation. However, because CD45 is not expressed on any other cell types, Iomab-B has excellent systemic tolerability and can be used in elderly patients with co-morbidities and on unrelated medications.

(Click on image to enlarge)

Another important differentiator is the speed at which Iomab-B works. For example, the time to BMT for traditional salvage chemotherapy is a minimum of 28-42 days. As noted above, induction and conditioning are done in sequential steps. Toxicities are high and there is a significant risk of serious adverse events. Complete remission rates are low, ranging between 25-35%. However, with Iomab-B, the therapeutic dose is administered via a single infusion. Time to BMT is only 12 days and previous clinical studies suggest good safety and tolerability.

(Click on image to enlarge)

The result is significantly higher complete remission rates vs. salvage chemotherapy. In fact, results of the previous Phase 1/2 clinical study show 100% of patients on Iomab-B achieved complete remission (CR) and 100% went on to receive a BMT. More importantly, this resulted in an increase in overall survival for patients taking Iomab-B versus historical survival rates of patients treated with standard chemotherapy using data from Fred Hutchinson and MD Anderson (see below).

(Click on image to enlarge)

KOL's Taking Notice

In February 2017, Actinium attended the combined meeting of the Center for International Blood & Marrow Transplant Research (CIBMTR) and the American Society for Blood and Marrow Transplantation (ASBMT), commonly referred to as "BMT Tandem". It is important to note that several clinical investigators and key opinion leaders in the AML space are starting to talk about the potential for Iomab-B.

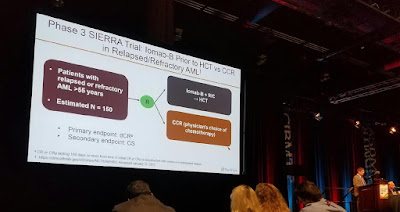

For example, Dr. Jeffrey Lancet, MD of the Moffitt Cancer Center presented results from Celator's Phase 3 trial with Vyxeos. Dr. Lancet was a principal investigator in that trial. The picture below shows Dr. Lancet discussing Iomab-B and the Phase 3 SIERRA trial being conducted by Actinium as a means to deliver a more effective antileukemic therapy to the bone marrow without inducing too much toxicity. Dr. Lancet noted that Iomab-B has the potential to bring in a new population of patients who traditionally would not be considered for a transplant because they have active disease.

Another prominent KOL that noted Iomab-B during their talk was Dr. Sergio Giralt, Chief of Adult Bone Marrow Transplant Service at Memorial Sloan Kettering Cancer Center (MSK). During this talk, Dr. Giralt spoke about a void in the market for elderly patients that are not candidates for standard transplant. He went on to highlight previous data from Iomab-B noting, "I think we would agree that for patients with active disease, these are very good results." The website OncLive posted an article after interviewing Dr. Giralt talking about the previous Iomab-B data.

Further evidence of high KOL support for Iomab-B can be found simply by looking at the centers participating in SIERRA. The BMT market in the U.S. is highly concentrated. There are roughly 150 BMT centers in the country and the top 30 centers perform 50% of all the AML BMT procedures. Actinium is targeting the top 15-20 sites for enrollment, with 11 sites currently active and recruiting patients as of today. In March 2017, Actinium announced that data from SIERRA would qualify for registration in the EU. In May, management received approval to open the first clinical site in Canada. These announcements are a testament of the excellent credibility of the program.

(Click on image to enlarge)

What's Next For Actinium

The slide below shows the expected timeline for further updates on the SIERRA trial. SIERRA is expected to enroll 150 patients with 1:1 randomization between Iomab-B and physician's choice standard of care. As noted above, target participation for SIERRA is 15-20 clinical sites. That means an additional 4-9 sites are expected to open patient recruitment in the next few months. A data monitoring committee (DMC) is monitoring results from the trial and will be providing an update back to Actinium once the first 25% of patients receive treatment. That is expected to take place during the second half of the year.

(Click on image to enlarge)

In February 2017, Actinium hired Steven Price in the position of Vice President, Clinical and Commercial Strategy. Steve will initially focus on pre-commercial efforts including strategic planning and product messaging for Iomab-B. Most recently, Steve was at Merck as Global Disease Lead, Hematology where he focused on Keytruda®, an anti-PD-1 immuno-oncology antibody. Steven's experience includes strategic planning and sales positions at ImClone, Enzon, and Immunex Corp.

Beyond continuing to enroll patients in SIERRA, it is important that management continues to increase awareness for the drug in the transplant and hematologist communities. This can be accomplished by continuing to publish data from previous clinical trials and presenting new pharmacoeconomic data that will facilitate reimbursement with Medicare and private payors once the drug is approved.

Equally crucial is ensuring manufacturing and delivery of product during the clinical trial to help Actinium build and establish relationships with hospitals that might use Iomab-B once approved. These are large medical centers that not only treat leukemia patients but also do allogeneic bone marrow transplants and have nuclear medicine capability. Importantly, because these sites are experienced with radiopharma and Iomab-B is prepared on site, I'm not expecting Actinium to be hampered by the nightmare procedures that plagues Bexxar® and Zevlin® over a decade ago.

A Large Market Opportunity

The U.S. FDA and EU EMA have already granted Actinium Orphan Drug designation to Iomab-B. The market opportunity with Iomab-B is significant. According to the American Cancer Society, there will be an estimated 21,380 new cases of AML in the U.S. in 2017. Another 27,500 new cases arise in Europe each year. The U.S. NCI estimated 73% of newly diagnosed AML patients are over the age of 55 and there are no currently approved treatment options for these elderly patients with relapsed or refractory disease. It's an estimated patient population of approximately 15,000 individuals, the majority of who cannot tolerate standard conditioning regimens that allow them to progress to a BMT.

By offering a more effective and more tolerable solution to these elderly relapsed or refractory AML patients, Actinium is sitting on a sizable market opportunity with Iomab-B. Standard conditioning regimens cost between $50,000 and $200,000. They can also take as long as 28 to 42 days. At $75,000 for a course of treatment (my guess) over only 12 days for Iomab-B, this is a $1.15 billion peak market opportunity. And, given that Actinium will target only a few dozen BMT centers with a focused sales force, it's an opportunity the company can easily tackle alone. That puts forth the potential for a high margin, high profitability commercial business once Iomab-B is approved in 2020.

I think this makes Actinium tremendously undervalued. For example, with 30% penetration, Iomab-B is a $350 million product. I've conducted two separate valuation approaches to valuing Iomab-B and both peg the fair value of the product around $300 million. That's 4x the current value of the company today and we still have yet to incorporate Actimab-A (Phase 2 for AML) and Actimab-M (Phase 1 for MM).

(Click on image to enlarge)

Conclusion

BMT is one of the fastest growing hospital procedures according to AHRQ; US Dept. of HHS. Iomab-B offers a better solution - cheaper, faster, safer, and more effective - than the current standard of care. It also targets a significantly larger patient population because the drug acts as both an induction and conditioning agent, potentially allowing those with active disease to progress to an allogeneic transplant. KOL interest in the drug is high and the company has partnered with some of the leading BMT centers in the U.S. to enroll patients in SIERRA. This is likely why the EMA agreed to accept the data for regulatory filings in Europe.

We are likely to see an interim safety update from the data monitoring committee (DMC) once the first 25% of patients in SIERRA receive treatment. I expect this to occur in the next few months. Two more safety updates at 50% and 75% completion are expected to follow months later, with the top-line data from SIERRA likely during the first half of 2019. I think this will be a major transformative event for Actinium Pharmaceuticals and shareholders.

Disclaimer: BioNap is NOT an Investment Advisor. We are an investor intelligence and strategic advisory firm. Most of the companies mentioned on this blog are party to a services ...

more