Investors Shift Time Horizon To More Distant Future

The S&P 500 (Index: SPX) didn't change much during the first full trading week of December 2023. The index closed the week at 4604.37, up 0.2% from where it closed out the previous week.

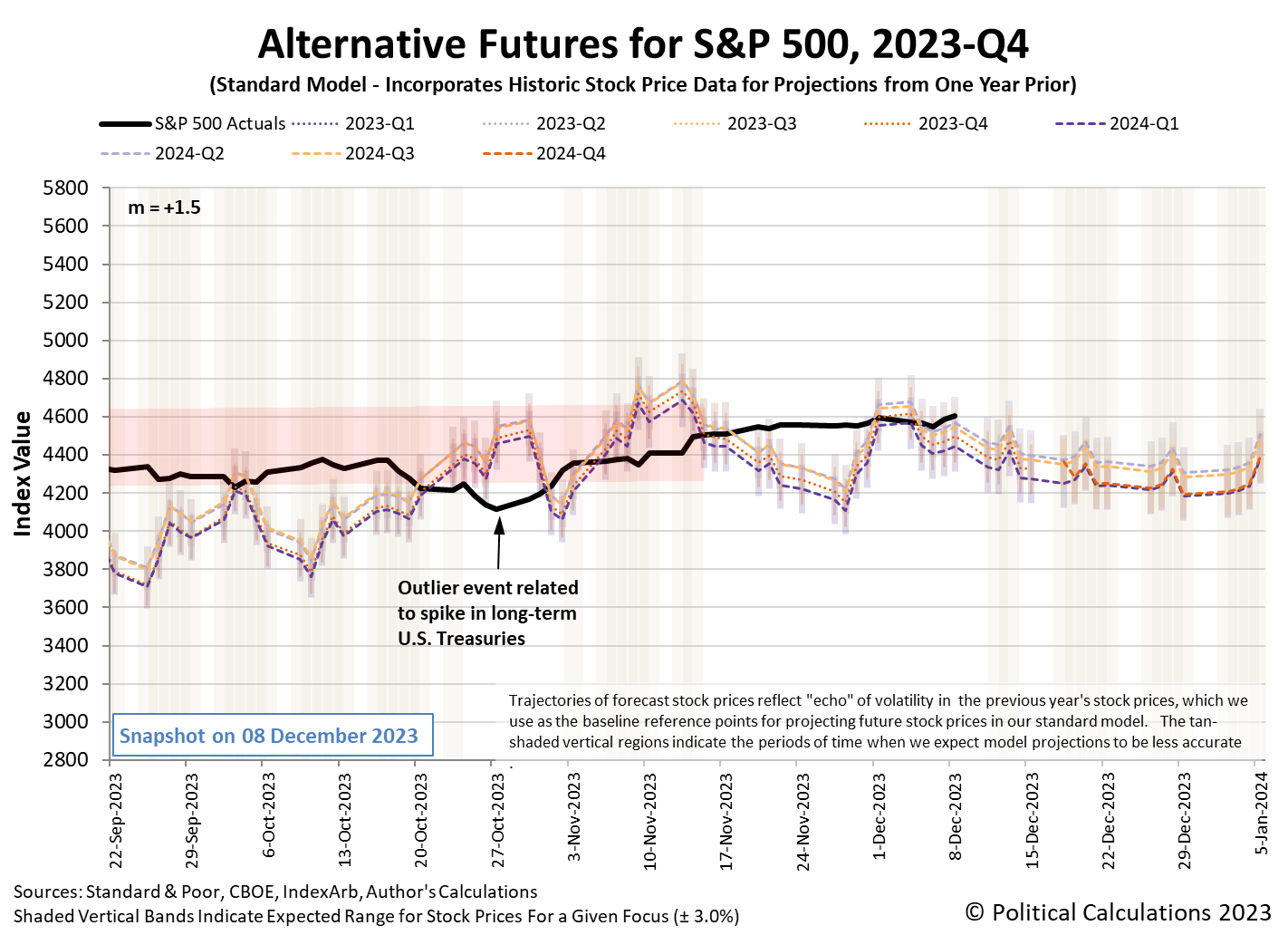

But the dividend futures-based model indicates investors pushed out their time horizon by a quarter toward the more distant future quarter of 2024-Q2. The change comes as positive economic news changed the expected timing of when the Federal Reserve will begin cutting interest rates in response to slowing economic conditions in 2024.

The CME Group's FedWatch Tool projects the Fed will hold the Federal Funds Rate steady in a target range of 5.25-5.50% through next April (2024-Q2), six weeks longer than it projected a week ago. Starting from 1 May (2024-Q2), investors expect deteriorating economic conditions will force the Fed to start a series of quarter point rate cuts at six-to-twelve-week intervals through the end of 2024.

The latest update for the alternative futures chart confirms the trajectory of the S&P 500 is consistent with 2024-Q4 as the new focal point for investors.

The Federal Reserve's Open Market Committee is having their final two-day meeting of 2023 this week. The announcments that come out of the meeting and the press conference that follows it on Wednesday, 13 December 2023 may well be the last major economic event of the year with market-moving potential in the U.S. The thing to watch out for is whether the Fed's minions will say anything that alters the expectations investors have for the timing of rate cuts in 2024.

With Fed officials in communication blackout mode this past week, there was little new information from that corner to influence investor expectations. On the plus side, there were fewer market moving news headlines for investors to absorb during the week that was.

Monday, 4 December 2023

- Signs and portents for the U.S. economy:

- Fed minions coming to terms that they're probably done with rate hikes:

- Bigger stimulus, bailouts, trouble developing in China:

- BOJ minions looking for reasons to keep never-ending stimulus alive:

- Bigger trouble developing in the Eurozone:

- Nasdaq, S&P, Dow end lower as Wall Steet takes a break after five weeks of gains

Tuesday, 5 December 2023

- Signs and portents for the U.S. economy:

- Bigger trouble developing in China despite some positive news:

- BOJ minions may have a bank problem to address:

- ECB minions forced to admit they won't hike rates anytime soon as bigger trouble develops in the Eurozone:

- Wall Street ends mixed after job openings hint at cooling economy

Wednesday, 6 December 2023

- Signs and portents for the U.S. economy:

- Fed minions expected to start rate cuts in or by mid-2024:

- Positive signs for China's economy:

- ECB minions expected to deliver rate cuts earlier in 2024:

- Nasdaq, S&P, Dow end in the red, dragged down by energy stocks as oil falls below $70

Thursday, 7 December 2023

- Signs and portents for the U.S. economy:

- Positive signs for China's economy:

- BOJ minions start actively promoting plan to end never-ending stimulus:

- Nasdaq ends sharply higher as Alphabet and AMD fuel AI surge

Friday, 8 December 2023

- Signs and portents for the U.S. economy:

- Fed minions expected to start delivering rate cuts in May 2024 after jobs report:

- Positive signs for China's economy:

- S&P posts six-week win streak after favorable labor market data; Dow, Nasdaq also rise

The Atlanta Fed's GDPNow tool's estimate of real GDP growth for the current quarter of 2023-Q4 held steady at +1.2% annualized growth for a second week. This is approximately the middle of the range anticipated by the so-called "Blue Chip Consensus", whose estimates run from a low of 0.7% to a high of 1.8%.

More By This Author:

Health Insurance Cost Trends Before And After The Affordable Care ActNew Home Affordability In October 2023 And The Months Ahead

Dividends By The Numbers In November 2023

Disclosure: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more