Investors May Look For AI Opportunities After Fed Dismissed Near-Term Rate Cut

Wall Street is coming off a poor session after the Fed’s meeting. The Dow Jones Industrial Average fell 317 points, or 0.8%, posting its worst day since December. The S&P 500 slid 1.6% in its worst day since September. The Nasdaq Composite lost 2.2%, its worst session since October.

Those losses come after Fed Chair Jerome Powell in his post-meeting conference discouraged investor hopes for a rate cut as soon as March, sending equities tumbling.

For most of January, investors in interest-rate futures markets have placed roughly 50% odds that the central bank would cut rates at its next meeting, March 19-20. But Powell volunteered on Wednesday that officials didn’t think a March cut was likely.

The market-based probability of a March cut fell to around 35%, according to CME Group. At their prior meeting in December, most officials anticipated they could cut rates three times this year if inflation continued to decline gradually to its 2% target and economic growth was steady but unspectacular.

The Fed doesn’t expect to lower rates until it has gained greater confidence that inflation is moving sustainably toward 2%, the statement said. Powell said Wednesday the Fed might be slower to cut rates or drag out the process if inflation proved to be more persistent. It could cut rates sooner and faster if the labor market weakened or there was “very, very persuasive lower inflation.

The Fed has held its benchmark federal funds rate steady at four consecutive policy meetings. Officials began raising rates from near zero in March 2022 and lifted them at the fastest pace in 40 years to combat inflation that also soared to a four-decade high.

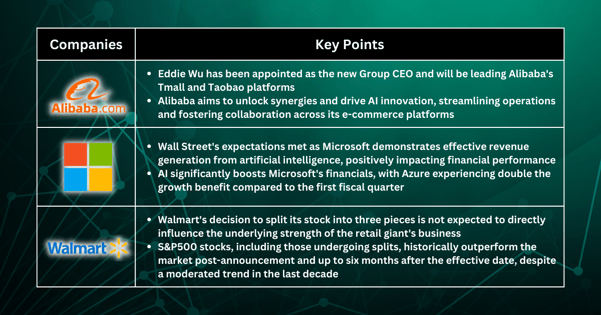

Alibaba: Unlock synergies and drive AI innovation (BABA)

Chinese e-commerce giant Alibaba has recently revealed significant organisational adjustments following the appointment of its new Group CEO, Eddie Wu. With Wu assuming leadership responsibilities for Alibaba's Tmall and Taobao platforms, the company aims to "unlock synergies and drive AI innovation.

This strategic move indicates a concerted effort to enhance collaboration between different divisions within the organisation, leveraging Wu's leadership to foster synergy and advance artificial intelligence initiatives. The realignment suggests a proactive approach towards streamlining operations and promoting innovation across Alibaba's prominent e-commerce platforms.

Microsoft: Ability to generate revenue from artificial intelligence (MSFT)

Microsoft appears to have successfully demonstrated its ability to generate revenue from artificial intelligence, meeting the expectations of Wall Street. Amidst the hype surrounding AI plans and attention-grabbing chatbots from tech giants, Microsoft's recent results suggest that AI is making a positive impact on its financial performance.

We can see that AI is really starting to impact numbers positively for MSFT, a six-point growth benefit to Azure is double compared to the first fiscal quarter. With more benefits from Copilots still to come plus a potential recovery, MSFT remains an exciting story.

Walmart: Split its stock into three pieces (WMT)

Walmart’s plan to split its stock into three pieces should do nothing for the underlying strength of the retail giant’s business, but history suggests the move might make shareholders richer anyway.

Stocks in S&P500 have historically outperformed the market immediately following the split announcement, as well as 6-months following the split effective date. Outperformance has moderated over the last decade but is still positive.

More By This Author:

Macro Condition Is Positive, But Some Tech Stocks Are Just Too Expensive

What To Watch For In Upcoming Fed Meeting

Fundamental Growth More Important Than Fed Policy Now?

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more