Investors Bullish On Treasuries - Most Since Summer Of 2016

Investors Bullish - Another Decline

The stock market fell for the 2nd straight day on Thursday. S&P 500 was down 0.21% and Nasdaq fell 0.16%. On the other hand, Russell 2000 rose 0.4% and VIX fell 2.57% to 14.42. Headlines blamed the decline on Powell’s hawkish stance. If a selloff of about 1% off the record high is all this hawkish stance did, investors should feel blessed.

Fed got a high bang for its buck when it turned dovish in late December because it was a moment of panic. Now that the market has calmed down and earnings season has been solid, the Fed not continuing with its dovish stance hasn’t caused stocks to crash.

Keep in mind, it’s not as if the Fed went back to its guidance of two hikes this year. It simply won’t change rates this year. As of Thursday evening, the Fed funds futures market showed there was a 48.6% chance of a rate cut by the end of the year.

The most common guess is for rates to stay where they are. There is a 91.7% chance rates are unchanged at the June 19th meeting. I’ve been saying all year that I don’t think the Fed will hike or cut rates. I stand by that forecast.

Investors Bullish - Daily Sector Breakdown

Best 2 sectors on Thursday were healthcare and the financials which increased 0.47% and 0.16%. Good news for healthcare stocks is Joe Biden has had some great national polls come out. He is seen as the establishment candidate who is closer to the center than Bernie Sanders. Specifically, Biden was above Sanders by 14, 24, and 26 points in the last 3 national polls. That means the odds of Medicare for All passing have diminished.

Financials like the Fed’s modestly hawkish tone. When the market thought there would be a cut, it made sense to go long the financials if you thought there wasn’t going to be one. There’s still some meat left on that trade, but it is dwindling as the market comes to grips with the idea of no cuts. There’s plenty of outperformance left to be had if you think the Fed will hike rates next year like I do.

Worst 2 sectors were energy and technology which fell 1.71% and 0.54%. Oil fell almost 3% on Thursday as it is about to have its 2nd straight week of declines.

Oil is falling because of record U.S. output. Last week production reached 12.3 million barrels per day which represents an increase of about 2 million barrels per day over the past 12 months. American exports of oil broke the 3 million barrels per day mark for the first time this year.

Investors Bullish - Everyone Is Bullish On Stocks & Bonds

CNN fear and greed index fell 3 points to 59 on Thursday. Somehow even though the market is about 1% off its record high, the index is close to neutral. Regardless of what that indicator says, the market is overbought and ripe for more of a pullback than 1%.

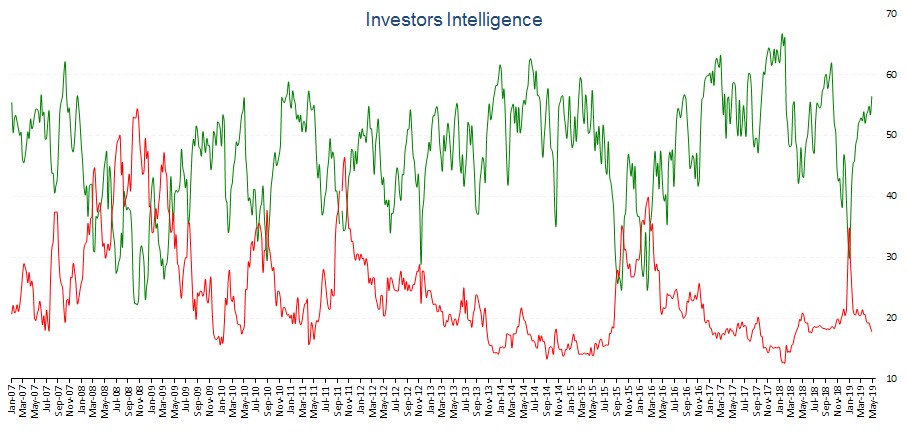

The chart below shows the Investors’ Intelligence poll. As you can see, 56.4% of investors are bullish and just 17.8% are bearish. 25.8% of investors expect a correction in stocks. This poll shows optimism, but not exuberance. I’m overriding this poll because of the market action.

(Click on image to enlarge)

bullishinvestors CHART

Investors aren’t just bullish on stocks. They are euphoric on treasuries. As you can see from the chart below, the JP Morgan all client net long treasury investor sentiment index is the highest since the summer of 2016 when the 10-year yield was below 1.5%. It makes sense to bet against treasuries here because the Fed won’t hike rates and the slowdown should end in the next few months.

(Click on image to enlarge)

On Thursday, the 10-year yield increased 4 basis points as it finally cleared the high end of the FOMC’s target range. That occurred while oil fell, implying investors expect higher real economic growth rather than higher inflation. The 2-year yield also increased 4 basis points which makes perfect sense because the market realizes the Fed probably won’t cut rates this year. I see this yield getting above the effective Fed funds rate, which is 2.45%, in the next few weeks.

Investors Bullish - Beyond Meat Explodes

Regarding Beyond Meat, it’s notable how this IPO soared 163%, making it the best performing IPO since 2008. That’s even after the firm priced its shares at the high end of its expected range. The maker of plant-based substitutes for meat now has a market cap of $3.77 billion even though the company loses money.

At least revenue growth was 170% in 2018 as sales hit $87.9 million. It makes sense there is euphoria in this name because of the trend towards people in developed markets eating less meat to be healthier. I’m eagerly awaiting the Uber IPO which will price next Thursday and start trading next Friday.

Investors Bullish - Consumer Confidence Improves

According to a February Gallup poll, 56% of respondents stated their current financial situation was either excellent or good. That’s the best reading ever, going back to the summer of 2001. People are in relatively good shape. April Conference Board consumer confidence reading agrees as the index went from 124.2 to 129.2, beating estimates for 127.1. This means real consumer spending might accelerate from its weak Q1 growth rate.

The present situation index increased 5.3 points to 168.3 and the expectations index increased 4.7 points to 103.

As you can see from the bottom chart below, the difference between expectations and the present increased to 65.3. Buying plans for durable goods and housing all fell sharply. Plans to buy vehicles fell 0.6% to 13.6%. Plans to buy major appliances fell 3.4% to 48.4%.

Finally, home buying plans fell 1.4% to 5%. That’s another negative signal for the housing market. It is in tune with the weak MBA purchase applications reports in April. The middle chart below shows 13.3% of respondents said jobs were hard to get. Finally, inflation expectations fell 0.1% to 4.5%. That’s low for this reading; this makes sense because PCE and CPI have fallen.

(Click on image to enlarge)

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more