Investing In Times Of Uncertainty

The markets are experiencing extreme volatility at the moment – a variety of factors can affect the price of stock market investments; in recent months, global economic conditions, rising goods and services costs; and international politics have all affected prices. Investors always ask whether now is a good time to invest or if they should remain invested in the face of economic and geopolitical events.

Market volatility is inevitable; markets will always rise and fall. It is useful for investors to put any short-term market volatility into historical context.

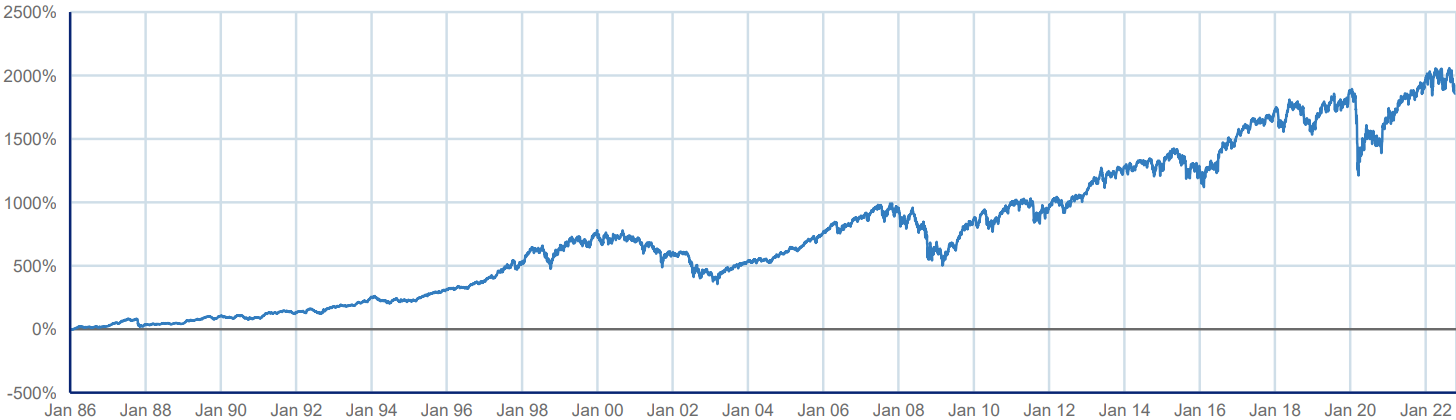

This chart below of the FTSE 100 since January 1986 shows a series of significant events over the past 36 years, notably: 1987 Black Monday, 1990-1991 Gulf War, 1995 Barings Collapse, 1997-1999 Asian Financial Crisis, 2000-2003 Dotcom Bust, 2007-2008 Global Financial Crash, 2015-2016 Oil Price Crash, 2016 Brexit Referendum, 2020 Covid-19.

The index still has a long-term growth trend despite market shocks and rebounds.

Chart: FTSE 100 January 1986 to 26th October 2022 (with income reinvestment), source Trustnet/FE fundinfo

The bigger picture

As investors, we are getting used to a variety of political, financial, and economic factors, and we are learning to look beyond the ‘noise’ to focus on what really matters. The key to managing risk and approaching investments is portfolio diversity. Instead of focusing too intently on short-term events and market fluctuations, it is important to consider longer-term timeframes.

Adopting the longer-term view

Investing requires discipline and the ability to hold your nerve when markets fall. Long-term investors know that jumping in and out of the stock market, panicking when prices fall, and selling investments at the bottom of the market are the worst investment strategies.

Diversifying your portfolio

To achieve your long-term investment goals, you must balance risk and reward. Diversification is intended to provide the potential to improve returns by choosing assets according to your risk level, objectives, and time horizon.

Risk level

You must decide how much risk is appropriate for you as an investor. While strategies designed to reduce risk will be incorporated into the process of building a portfolio, it cannot be eliminated altogether.

The right strategy

In order to position your portfolio in line with your objectives, attitude to risk, and to develop a well-defined investment plan, tailored to your objectives and risk profile, you can seek regulated financial advice.

More By This Author:

Disclaimer: This information is based on our current understanding and is subject to change without notice. The accuracy and completeness of the information cannot be guaranteed. It does not provide ...

more

Thanks for the share.