Investing In: Fiat Chrysler Auto, To (Potentially) Partner Up With Google

There is a deal in negotiations with Fiat (FCAU) and Google (GOOG, GOOGL), and it may not only have huge impact on Fiat’s stock price, but also the entire auto industry as a whole.

I love this investment opportunity because it feels like most investors are looking the other way regarding the auto industry as a whole, which has been flat for a while. Many people argue the auto market in the US has “peaked” and has no more room to grow, which is why the Google + Fiat Chrysler deal is timely. It’s this idea that tech will continuously be paving a new path for growth, in industries that seem to have no more growth to achieve, that is so interesting.

Google has developed the software and vehicle-control capabilities for driverless cars and tested it over 1.4 million miles. Fiat Chrysler can’t afford to develop its own autonomous cars and an internet company like Google wouldn’t want to spend billions on factories. So basically, it would be a win win for both.

If Fiat and Google come to a deal, it could mean that the Italian-American carmaker will let Google develop the brains of self-driving cars while the Fiat assembly plants supply the body. This would actually be the very first official partnership of a tech company and auto company, for the purpose of producing a self driving car. The reality of self driving cars are so much closer than we think.

Tech and auto is on the brink of massive development at this moment. There is so much value to be added from the collision of tech and auto, and I see it as a huge opportunity for us to invest in. Here is why Fiat to me, makes a good stock to invest in, aside from the potential Google + Fiat deal:

Cheap gas is driving sales of SUVs, which is leading to fat profits for General Motors (GM), Ford (F), and Fiat Chrysler Automobiles.

Credit is abundant, meaning that it isn’t difficult to finance a new or used car, or get a lease.

The average age of a car or truck on US roads is over 11 years, which I’m guessing could be leading to some pent-up-demand for those car owners who are ready to move on.

That’s a very general lay of the land for auto, but whats more is Fiat’s already strong first quarter for 2016.

Fiat Chrysler made $1.38 billion in North America, almost twice what it managed in Q1 2015.

The company has been heavily reducing debt, to the point where they will be “sitting on cash” in a few years, according to CEO Sergio Marchionne. A company sitting on cash is a healthy company. But they’re still not there yet…

Like everything, there are also cons to consider with this investment. Mainly the fact that Fiat is in debt about 6.5 billion euros (yikes), as well as a lack of free cash flow generation. Many analysts also feel like Fiat’s earnings per share aren’t as strong as they should be.

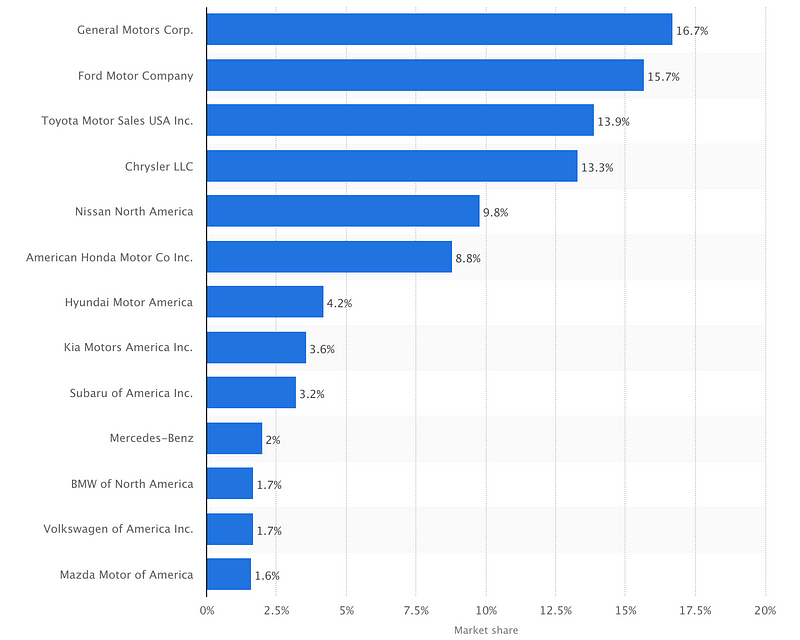

Here is the market share major car manufacturers in the US, as of March 2016:

*Image from http://www.statista.com/

Fiat Chrysler comes in at #4. The Google + Fiat partnership could put Fiat at the forefront (second only to Tesla) of the major developments we’ll hopefully see across the auto industry, branding it as a more cutting edge player.

Disclosure: None.

It will be interesting to see if whether a partnership between Google and Chrysler will be profitable for either company. Personally I am doubtful that more people will buy Chryslers just because of Google's involvement. I guess the bigger question here is what are Google's plans for Chrysler? Is this all to do with their plans to build self driving cars or is there more to this partnership?

Is Google not partnering with other car companies as well? I wonder why they selected $FCAU of all companies to work with.