Investing In “Crazy” Ideas

Invest in crazy ideas.

So say some of the best angel investors in the world.

AngelList‘s co-founder Naval Ravikant likes investing in “crazy” startup founders. Among his investments that were weird at the time are Uber and Twitter (TWTR).

This week, Mr. Ravikant made an epic, 2 1/2-hour-long appearance on Tim Ferriss’ podcast. They talked about this very thing, investing in crazy ideas.

Their discussion was fascinating, full of valuable nuggets on a range of topics: from angel investing advice to their favorite books to tips on living a more meaningful and happy life. I highly recommend listening to the podcast (it’s free).

“The best new companies look really strange,” Ravikant says. “Each great business looks weird, and there’s no such thing as a perfect deal.”

Later he adds, “You get paid for being right when everybody else is wrong.”

Naval goes so far as to say that sometimes great founders “are very hard to separate from delusional crazy people.”

Why?

Because their ideas seem a little out there. And because promising founders are often obsessed with their project. They don’t care that some people don’t get it. They believe in it. And that excitement can be contagious to investors who can also think differently.

Not-So-Crazy in Hindsight

In 2008, a startup called Airbnb was trying to raise money. Their offering valued the company at $1.5 million. In other words, for $15,000 you could have bought 1% of the company.

The startup’s concept must have seemed strange – and risky – at the time. They help property owners rent to strangers through an open marketplace.

Obviously, there are liability concerns. What happens if somebody trashes the house? What happens if someone gets murdered by a guest? These worries are what caused legendary investor Chris Sacca to pass on Airbnb.

Anyway… back in 2008, a friend introduced Airbnb founder Brian Chesky to seven prominent Silicon Valley venture capitalists.

Five of the VCs rejected Airbnb politely. Two didn’t respond. Chesky posted all five of the negative replies in a recent post on Medium.

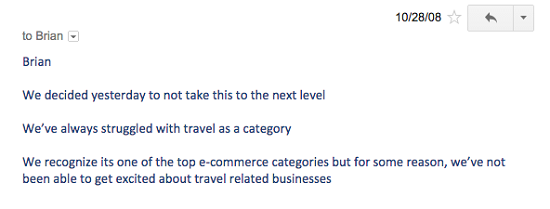

Here’s one rejection letter from a top VC firm:

Today a $15K investment at that stage would be worth about $20 million, ballpark. That’s based on Airbnb’s current $24 billion valuation (there’s guessing involved here).

According to Fortune, Airbnb is on track to do around $900 million in revenue this year. That’s up from $250 million in 2013.

CEO Brian Chesky ends his post with an encouraging message for startup founders.

Next time you have an idea and it gets rejected, I want you to think of these emails.

Crazy ≠ Stupid

Crazy does not mean stupid. It doesn’t mean you should invest in poorly thought-out ideas or unstable founders.

It simply means you should be open to ideas that at first might seem a little weird. Or hard to pull off. They’re often the investments that make the math of early-stage investing work.

In this sense, crazy means someone who is thinking different. As cliché as it sounds, it’s true.

The Next Great Crazy Idea?

This week more than 100 startups graduated from Y Combinator, the prestigious startup accelerator program. (Note: Airbnb graduated back in 2009.)

There are all sorts of startups that seem weird and different in this summer’s class. TechCrunch has summaries of all the companies in two parts, here and here.

A few ideas from this batch that stuck out as crazy in a good way to me:

- Flirtey – delivery by drone, anytime, anywhere

- Scope AR – virtual reality for industry

- Plate iQ – price optimization for restaurants.

What are your favorite Y Combinator Summer 2015 grads? Let us know in the comments.

Good investing,

Adam Sharp