Invest Like Seth Klarman: Paypal Holdings Inc., Keryx Biopharmaceuticals, Micron Technology, Inc.

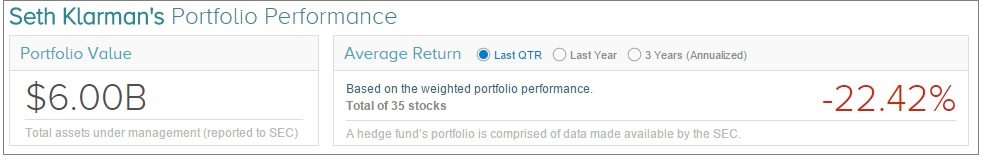

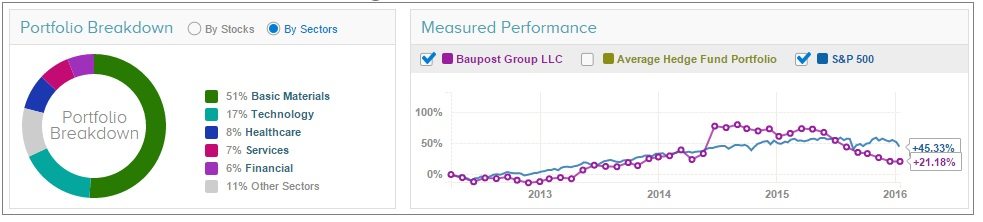

Many call Seth Klarman a modern day investing legend due to his expertise in value investing. However in the third quarter, Klarman’s hedge fund, Baupost Group, had a rough quarter, losing 22.42% of its value compared to the S&P 500 which lost about 7% in the same time period. Here are some of Klarman’s holdings that raise some eyebrows: Paypal Holdings Inc (Nasdaq: PYPL), Keryx Biopharmaceuticals (Nasdaq: KERX), and Micron Technology, Inc. (Nasdaq: MU).

Paypal Holdings Inc

Paypal, the online payment system, was established in the third quarter as a standalone company independent of eBay. Klarman did not waste any time adding the company to his holdings as it is now makes up more than 5% of his portfolio with his shares valued at $338 million.

The stock took off quickly, though ultimately fell more than 15% in the third quarter. However since the close of the third quarter, Paypal shares are up more than 4%. Most analysts are bullish on the new company due its loyal user base and strong name recognition; though many are giving it time to establish itself in the e-commerce market and prove itself in the face of competitors, such as Venmo.

Most analysts polled by TipRanks in the last 3 months have the same bullish sentiment on the stock as Klarman, with 14 recommending to Buy shares of Paypal. On the other hand, 2 analysts are bearish and 3 remain neutral. The average 12-month price target between these 19 analysts is $42.82, marking a 32% potential upside from current levels.

Keryx Biopharmaceuticals

Keryx, a small-cap biotechnology company that focuses on renal diseases, comprises more than 1.50% of Klarman’s holdings with nearly 26 million shares valued at over $90 million. The company has had a tough year due to Auryxia sales; the company’s lead product to control serum phosphorous levels in patients with chronic kidney disease (CKD) on dialysis. Analysts blamed disappointing Auryxia figures on challenges in rolling out the drug, but most agree the growing pains will stop once Keryx expands its sales force for the drug.

In the third quarter, Keryx announced a $125 million private placement of Convertible Senior Notes, a type of debt security, with the Baupost Group, due 2020. This move gave Keryx the right to appoint a director to Keryx’s Board; John Butler.

According to TipRanks, most hedge funds are bullish on this high-risk, volatile biotech stock as hedge fund holdings for the company increased by over 7 million shares in the third quarter.

Micron Technology, Inc.

Klarman significantly reduced his holdings in Micron in the third quarter, slashing his investments in the company by 94%. Now, Micron makes up a mere 0.25% of Baupost’s holdings with its shares valued at $15 million.

Micron, like the semiconductor sector in general, is struggling as the focus shifts from desktops to mobile and the Internet of Things area. Although Micron is reorienting itself with new technologies in this area, the company slipped more than 20% in the third quarter.

Micron has a negative hedge fund sentiment according to TipRanks since hedge funds collectively decreased holdings in the stock by nearly 50 million shares in the third quarter.

Note: All analyst photos and statistics in this article are measured over a three-month horizon. Links to analysts ...

more

Invest like Seth Klarman by shorting these stocks. It's the only way his investment is making money.