Intuit Ahead Of Earnings: Strong Buy Rating And A Tight Trend Channel

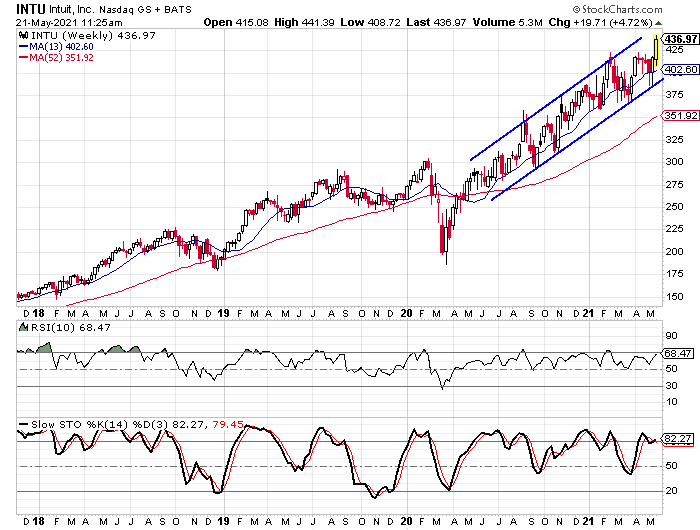

Financial software firm Intuit (INTU) is set to release earnings on May 25 and the company’s fundamentals and chart look pretty good right now. Over the past year, the stock has been trending higher and there is a tight trend channel that helps define the cycles within the overall upward trend.

The lows from last fall and from the last few months all connect nicely to form the lower rail of the channel. The parallel upper rail isn’t quite as clean, but it helps define the upside swings and where it can see some short-term profit-taking.

As you can see, the stock is getting close to the upper rail of the channel at this time and the weekly stochastic indicators are in overbought territory. The 10-week RSI isn’t quite hitting AN overbought reading just yet, but it is awfully close. The stochastic indicators have moved in to overbought territory and remained there on several occasions, but when the RSI has moved above 70, it has been a pretty good sign of a short-term downturn. It’s also worth noting that the RSI hasn’t been below 50 since April 2020.

Strong Profitability Measurements Highlight the Fundamental Picture

Intuit gets a “strong buy” rating from Tickeron’s Scorecard and a big part of that rating is due to its fundamentals. At this time the company gets positive marks in five out of six categories with the only one showing negative at this time being the SMR rating and I think that is a technical issue that I asked to be checked. The reason I asked the tech team to check the rating was that Intuit’s profitability measurements are really high. The return on equity is at 46.9% and the profit margin is at 35.1%.

(Click on image to enlarge)

The company has seen solid earnings and sales growth over the last three years, but it did have a little hiccup in the fiscal second quarter. Earnings have increased by an average of 14% per year in the last three years while sales have increased by 11%. In Q2 earnings declined by 41% and sales declined by 7%.

Third-quarter results are expected to show a return to growth rather than contraction. Analysts expect earnings to grow by 45% compared to Q3 2020 and revenue is expected to jump 46.9%.

Intuit gets strong ratings in the Profit vs. Risk Rating and Valuation Rating, and it gets above average marks in the Price Growth Rating, Outlook Rating, and its Seasonality Score.

The Short Interest Ratio has been Climbing

Turning our attention to the sentiment analysis, analysts are pretty bullish on Intuit, but that seems to be warranted. Short sellers are neutral based on the average short interest ratio, but the ratio has been trending higher in recent months.

There are currently 25 analysts following Intuit with 19 “buy” ratings, three hold ratings, and two “sell” ratings. This gives us a buy percentage of 79.2% and that is slightly higher than the average stock. The average buy percentage falls in the 65% to 75% range.

The short-interest ratio for Intuit is at 2.93 currently and that is right in line with the average stock’s ratio. One thing I did take note of with the ratio is that it has been trending higher. In December and January, all four readings were below 2.0 and on the low side. The current reading is the third-highest reading from the past year.

The overall reading is important when it comes to analyzing the short-interest ratio as it tells you how many days of average volume it will take for short sellers to cover should the stock rally. However, I also like to look at why the ratio is changing, is it because the short interest is increasing or is it due to a decline in the average daily trading volume? In this case, it is due more to a decline in volume.

The Outlook for Intuit

For the long term, it’s hard not to be bullish on Intuit. The fundamentals are strong, the trend is to the upside, and the sentiment isn’t overly optimistic. The second-quarter results appear to be an anomaly in terms of growth and analysts expect Q3 results to reverse back to strong growth.

The only thing that concerns me at this time is the 10-week RSI. With it being so close to the 70-level and seeing how the stock has experienced short-term declines when it does hit 70, I have to wonder if investors might be better served waiting a few weeks to enter a new position.

If you are a long-term investor and you already own the stock, I’m certainly not suggesting you sell it. But if you are looking to enter a new position on Intuit, you might get a better entry point in a few weeks. The lower rail is approximately 10% below the current trading level, but it is climbing. You might target the $400 level as an entry point after earnings.