Internet Services Industry Is Hot: Buy Shopify, Alphabet, Uber

Image: Bigstock

Macro factors currently driving the economy, such as the relatively high interest rates, relatively strong labor markets, supply chain issues (though minimal right now and in pockets), and so forth have a varied impact on players in the extremely diverse Internet – Services industry, although a stronger economy is generally positive.

Additionally, since this is a capital-intensive industry with high fixed cost of operation and a fairly constant need to build infrastructure, a high interest rate just isn’t very positive for it. Therefore, the rate cuts this year make us incrementally positive about the Internet Services industry. Most companies are seeing estimate increases, with prices yet to catch up.

Our picks are Shopify (SHOP - Free Report), Alphabet (GOOGL - Free Report), and Uber (UBER - Free Report).

About the Industry

Internet - Services companies are primarily those that rely on huge software and hardware infrastructure (referred to as their "properties") to deliver various services to consumers. People can avail the services by accessing these properties with their personal connected devices from almost anywhere in the world.

Companies generally operate two models: an ad-based model and an ad-free model where the service is charged. Alphabet, Baidu, and Akamai are some of the larger players, while Crexendo, Upwork, Dropbox, Etsy, Shopify, Uber, Lyft, and Trivago are some of the emerging players. Very large players (mainly Alphabet) tend to skew averages.

Because of the diversity of services offered, it is difficult to identify industry-wide factors that could affect all players.

Factors Determining Industry Performance

It goes without saying that increased digitization of different aspects of daily life is a driver for the entire industry because digitization essentially transfers work online, which is where Internet service providers are required. To that extent, the pandemic had proved course-altering for the industry because of the huge volume of transactions that moved online. And people are not giving up all of these conveniences to go back to their old ways.

The expansion of the installed base of connected devices beyond PCs and smartphones to IoT, automotive and more is creating additional opportunities for targeting. Additionally, the ownership of multiple devices automatically drives people to use these services more as they increasingly automate routine chores.

Being a capital-intensive industry, there is the need to raise funds to build out costly infrastructure. Funds are also needed to maintain this infrastructure. Given the secular growth prospects, companies continued infrastructure investments through 2023 and this year, despite high interest rates.

With interest rates coming down this year, capex is likely to continue. Ex-Alphabet PP&E is soaring, though not as steadily as Alphabet, meaning that companies are investing heavily in their infrastructure.

Alphabet has an outsized impact on industry averages. Therefore, cost rationalization at the company, including a reduction in its workforce and office space, has had a positive effect on industry margins.

Acquisitions can also add to operating cost, which doesn’t appear to have been the case this year. Alphabet has been more acquisitive than the industry as seen from the intangibles balance and its margins have continued to soar, supporting industry margins.

Traffic/customer acquisition is one of the most important drivers of revenue, so companies invest in advertising or building communities that can draw more users to their online properties, to use the service more or spend more time on the platform, much like a store owner would try to keep a prospective buyer within the store.

Some large players, including those providing infrastructure services, grow by tying up with other such large players for access to their customers. Since the personal touch is absent in an online store, many rely on cookies and increasingly other technologies to track users, collect data on them, and profile them in order to better understand their needs.

Data is central to success in this industry, as it allows the players to build artificial intelligence (AI) models to improve the quality of services, create new technologies and services, and also to lower the cost of operation. Ad-based services are are subject to strict regulations. The EU’s GDPR and the CCPA (California Consumer Privacy Act), for example, require service providers to acquire explicit permission from users before collecting their data.

While not all businesses are built on the same scale or have the same customer reach, AI tools are increasingly helping organizations of every size. They are increasing operational efficiency and the scope for growth tremendously. Since larger companies and companies dealing directly with customers have direct access to customer data, there is a corresponding effect on the competitive dynamics as well.

The Zacks Industry Rank is Attractive

The Zacks Internet - Services industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank #65, which places it among the top 26% of 250 odd Zacks-classified industries. The group’s Zacks Industry Rank, which is basically the average rank of all the member stocks, indicates that there are several opportunities in the space.

Looking at the aggregate earnings estimate revisions over the past year, we see a bottom in December 2023, followed by one jump in April and another in November 2024. Overall, the industry’s earnings estimate for 2024 is up 19.0% from November 2023. The average earnings estimate for 2025 has increased 10.6% in the same period.

Historically, the top 50% of Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1. So the industry’s positioning in the top 50% of Zacks-ranked industries should be viewed positively.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock market performance and valuation picture.

The Industry Has Outperformed on Stock Market Performance

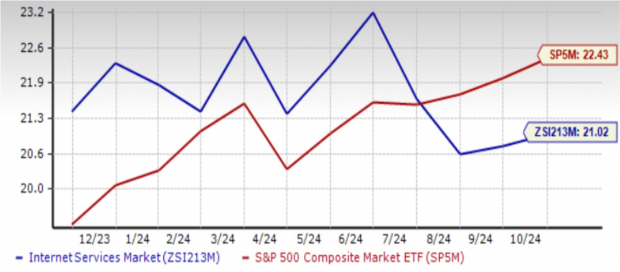

Over the past year, the industry has been far more stable than both the broader Technology sector and the S&P 500. Up to the beginning of 2024, the industry was trading more or less in line with the broader sector, as well as the S&P 500. Between this time and April, the broader sector plummeted while the Internet Services industry stayed on its growth trajectory.

Thereafter, until about August, it continued on the same path while the broader sector joined it, leaving the S&P 500 behind. Since the dip in August, it has recovered, leaving behind the other two. As a result, the industry’s net gain of 40.6% trumps the broader sector’s 33.3% gain and the S&P 500’s 35.5% gain.

One-Year Price Performance

Image Source: Zacks Investment Research

The Industry's Current Valuation: Attractive

On the basis of forward 12-month price-to-earnings (P/E) ratio, we see that the industry has recently been trading at a 21.02X multiple, which is a slight discount to its median value of 21.52X over the past year. It is also a discount to the S&P 500’s 22.43X and a greater discount to the sector’s 26.97X.

Over the past year, the industry has traded in the range of 20.62X to 23.22X, remaining at a premium to the S&P’s 19.32X to 22.43X throughout. The sector has traded in the 24.58X to 28.16X range.

Forward 12-Month Price-to-Earnings (P/E) Ratio

Image Source: Zacks Investment Research

3 Solid Bets

We are spoiled for choice because a growing number of players in the Internet Services industry are looking good at this point. The industry is highly diverse, and so there’s the possibility that some players could be doing exceedingly well, while others not so much. We currently have a Zacks #1 (Strong Buy) rating on Shopify, while Alphabet and Uber maintain Zacks #2 (Buy) ratings, as discussed further below.

Shopify Inc. (SHOP - Free Report)

Ottawa, Canada-based Shopify offers a platform facilitating a whole range of e-commerce operations across Canada, the U.S., the Middle East, Africa, the Asia Pacific, and Latin America. The platform enables merchants to display, market, and sell products using web and mobile storefronts, physical retail locations, pop-up shops, social media storefronts, native mobile apps, buy buttons, and marketplaces.

It also enables product sourcing, inventory management, order processing and fulfillment, customer acquisition and relationship building, access to finance, cash, payments and transaction management, and reporting. The company also offers analytics.

One of its primary assets is its database of merchant and customer interactions, which helps sellers analyze growth prospects and customer behavior. This is driving tremendous growth at the company, as it continues to take market share. Management said during the June conference call that "More and more merchants across the world are putting their trust in Shopify’s unified commerce operating system to fuel growth and simplify complex operations."

This was borne out by some impressive numbers: year-over-year growth in in revenue was 21%, with merchant solutions increasing 19%, subscription solutions increasing 27%, and monthly recurring revenue increasing 25%. Gross profit dollars grew 25% and free cash flow (FCF) increased by 243%. The outlook was also solid, with another double-digit revenue increase and solid FCF margin expected in the third quarter.

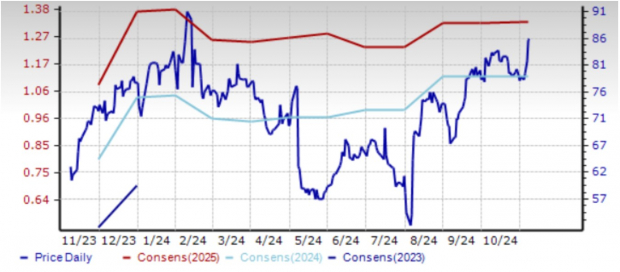

Estimates are relatively stable ahead of the third quarter earnings announcement next week. At recent levels, they represent 22.2% revenue growth and 51.4% earnings growth this year, followed by 19.6% revenue growth and 18.6% earnings growth in the next. The shares have appreciated 36.5% over the past year.

Price and Consensus: Shopify

Image Source: Zacks Investment Research

Alphabet Inc. (GOOGL - Free Report)

Mountain View, CA-based Alphabet is known for its flagship search engine, but in the last few years, the company has also branched into a number of other services that its loyal customer base has come to value. These primarily include cloud computing, video and music streaming, autonomous vehicles, and healthcare services. On a lower scale, it is also into smartwatches, laptops and tablets, and smart home products. All this is tied together by the treasure trove of data it continues to collect from its various products.

The company’s data is one of its greatest assets. At the last quarter’s earnings announcement, management said that the company’s "AI driven innovations across Search, YouTube, Cloud, our Pixel devices and more" were helping it make "AI more helpful for everyone." Alphabet has made significant progress on this front, and there’s "lots more to come."

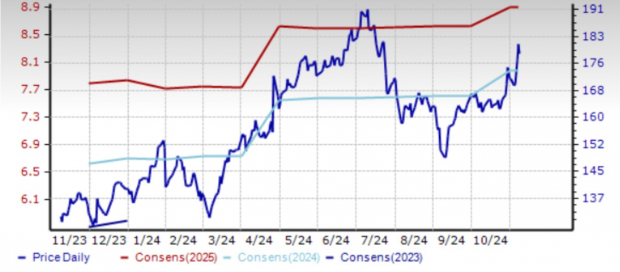

Despite its massive size, the company continues to grow its revenue at a double-digit rate. Earnings of $2.12 beat the Zacks Consensus Estimate by 15.9% on revenue that beat by 2.3%.

What’s more, analysts raised their estimates for the shares yet again: Altogether, the 2024 estimate increased 37 cents (4.8%) in the last 60 days, while the 2025 estimate went up 27 cents (3.1%). This amounts to earnings growth projections of 37.9% in 2024 and 11.4% in 2025. This will come from revenue growth projections of a respective 14.8% and 12.1% in the two-year period. The shares have appreciated 37.4% in the past year.

Price and Consensus: Alphabet

Image Source: Zacks Investment Research

Uber, Inc. (UBER - Free Report)

San Francisco, CA-based Uber Technologies provides ride-hailing, food delivery, and freight (leasing vehicles to third parties) services through its Mobility, Delivery, and Freight segments, respectively. The company operates across the Americas, Europe, Middle East, and Asia.

Each of its segments generated more than a billion dollars in revenue in the last quarter. Its ride-sharing and delivery platforms are growing in popularity, with monthly active platform consumers (MAPC) increasing 13% and MAPC trips increasing 17%.

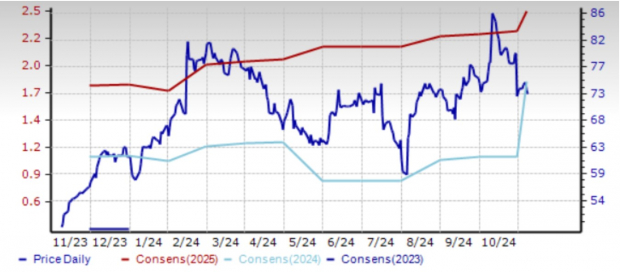

This is generating strong gross bookings, which grew 16% year-over-year, with Mobility growing 17% at constant currency (CC) and Delivery 16% at CC, as well as strong revenues, which grew 20%, with Mobility up 26% and Delivery 18%. As a result, the company posted a 192.7% earnings surprise and 1.7% sales surprise.

Analysts responded in kind, with the 2024 estimate jumping 75 cents (69.4%) since it reported in the past week. The 2025 estimate has raised 22 cents (9.6%) during the same period. Analysts are looking for 17.3% revenue growth and 110.3% earnings growth this year, followed by 16.4% revenue growth and 37.8% earnings growth in the next. The shares have risen 47.8% in the past year.

Price and Consensus: Uber

Image Source: Zacks Investment Research

More By This Author:

What Is The Right Approach For Chevron Stock Post Q3 Earnings?Nvidia Stock Dips While Market Gains: Key Facts

2 Intriguing Tech Stocks To Buy After Q3 Earnings: ANET, FTNT

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more