Intermediate-Term Forecast For Saturday, Nov. 21

We are 5 weeks into the decline phase of the intermediate-term cycle that began during the week ending September 25.

(Click on image to enlarge)

An extended decline phase that moves well below the last intermediate-term low at 3,209 would reconfirm the current bearish intermediate-term trend and favors additional losses. Alternatively, a quick rebound followed by an extended rally phase that moves up to meaningful new highs would signal the likely transition to a bullish intermediate-term trend.

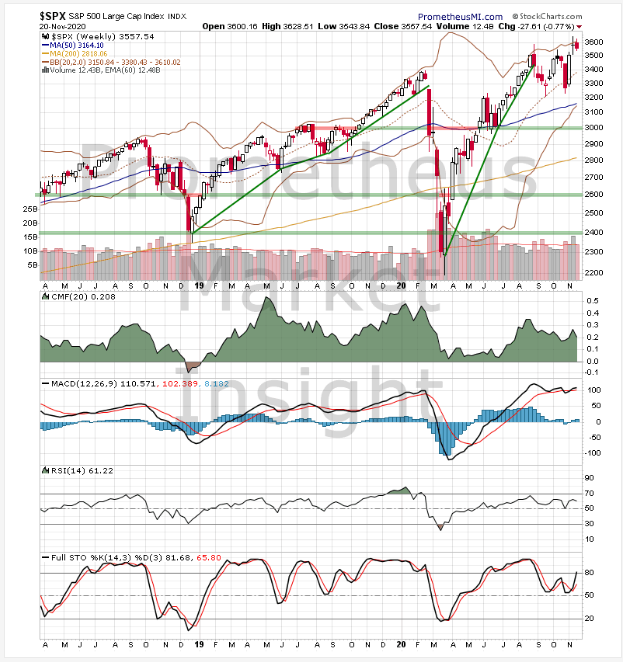

S&P 500 Index Weekly Chart Analyses

The following technical and cycle analyses provide intermediate-term forecasts for the S&P 500 index.

Technical Analysis

The index closed moderately lower this week, retreating from recent highs of the uptrend from March. Technical indicators are moderately bullish overall, favoring a continuation of the advance.

(Click on image to enlarge)

Cycle Analysis

We are 5 weeks into the decline phase of the cycle following the intermediate-term cycle low (ITCL) that occurred during the week ending September 25. An extended decline phase that moves well below the last ITCL at 3,209 would reconfirm the current bearish translation and favor additional losses. Alternatively, a quick rebound followed by an extended rally phase that moves up to meaningful new highs would signal the likely transition to a bullish intermediate-term trend. The window during which the next ITCL is likely to occur is from January 15 to March 19, with our best estimate being in the February 12 to March 12 range.

- Last ITCL: September 25, 2020

- Cycle Duration: 8 weeks

- Cycle Translation: Bearish

- Next ITCL Window: January 15 to March 19; best estimate in the February 12 to March 12 range.

- Setup Status: No active setups.

- Trigger Status: No pending triggers.

- Signal Status: No active signals.

- Stop Level: None active.

(Click on image to enlarge)

Intermediate-term Outlook

- Bullish Scenario: A weekly close above the recent long-term high at 3,600 would reconfirm the uptrend from March and forecast additional gains.

- Bearish Scenario: A reversal and weekly close below the recent short-term low at 3,270 would predict a return to the 50-week moving average at 3,164.

Both scenarios are equally likely.

Quite an interesting analysis and discussion of the cyclical nature of the market.