Intermediate-Term Forecast For Friday, May 23

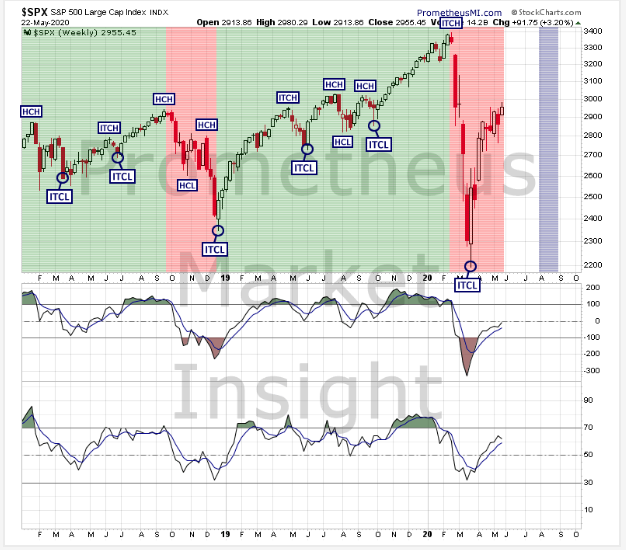

We are 9 weeks into the rally phase of the intermediate-term cycle that began in March.

(Click on image to enlarge)

The magnitude of the last decline phase signals the likely transition to a bearish intermediate-term trend and favors additional losses during the next decline phase.

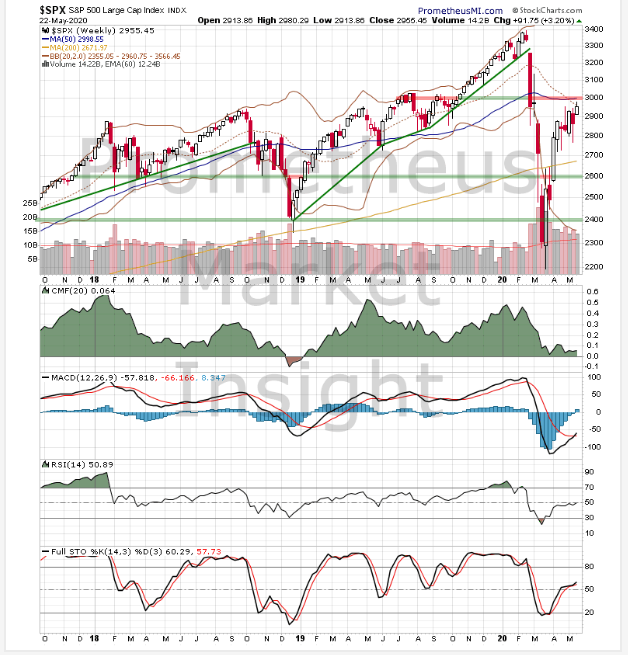

S&P 500 Index Weekly Chart Analyses

The following technical and cycle analyses provide intermediate-term forecasts for the S&P 500 index.

Technical Analysis

The index closed moderately higher this week, returning to recent short-term highs of the uptrend from March. Technical indicators are moderately bearish overall, favoring a return to previous lows of the downtrend from February.

(Click on image to enlarge)

Cycle Analysis

We are 9 weeks into the rally phase of the cycle following the intermediate-term cycle low (ITCL) that occurred during the week ending March 27. The magnitude of the last decline phase signals the likely transition to a bearish translation and favors additional weakness. The window during which the next ITCL is likely to occur is from July 10 to September 11, with our best estimate being in the August 7 to September 4 range.

- Last ITCL: March 27, 2019

- Cycle Duration: 9 weeks

- Cycle Translation: Bearish

- Next ITCL Window: July 10 to September 11; best estimate in the August 7 to September 4 range.

- Setup Status: No active setups.

- Trigger Status: No pending triggers.

- Signal Status: No active signals.

- Stop Level: None active.

(Click on image to enlarge)

Intermediate-term Outlook

- Bullish Scenario: A weekly close well above congestion resistance in the 3,000 area would reconfirm the uptrend from March and forecast additional gains.

- Bearish Scenario: A reversal and weekly close below the 200-week moving average at 2,672 would predict a return to the previous intermediate-term low at 2,290.

Both scenarios are equally likely.

We will identify the key developments moving forward as they occur in our daily market forecasts and signal notifications available to paid subscribers. Try ...

more

Many thanks. Well said. Erik.