Interesting Equity Markets

The cumulative A/D line for the S&P 500 remains close to a new high. I continue to view the S&P breadth to be positive for U.S. equities.

(Click on image to enlarge)

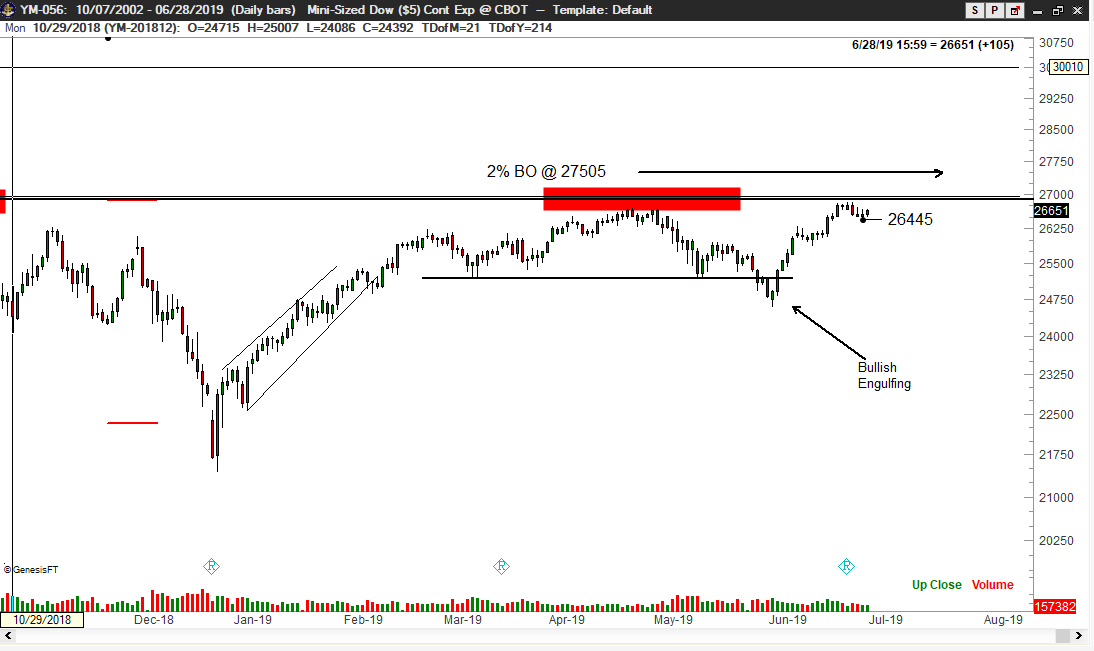

DJIA (CBOT)

The DJIA has been unable to make a new high for the past 18 months. This is also true for the S&P 500. My thinking is that a decisive new high by these two indexes confirmed by a new high in the S&P A/D is required to put the cyclic bull trend back on track. The Factor Tracking Account is long the micro Dow Index.

(Click on image to enlarge)

(Click on image to enlarge)

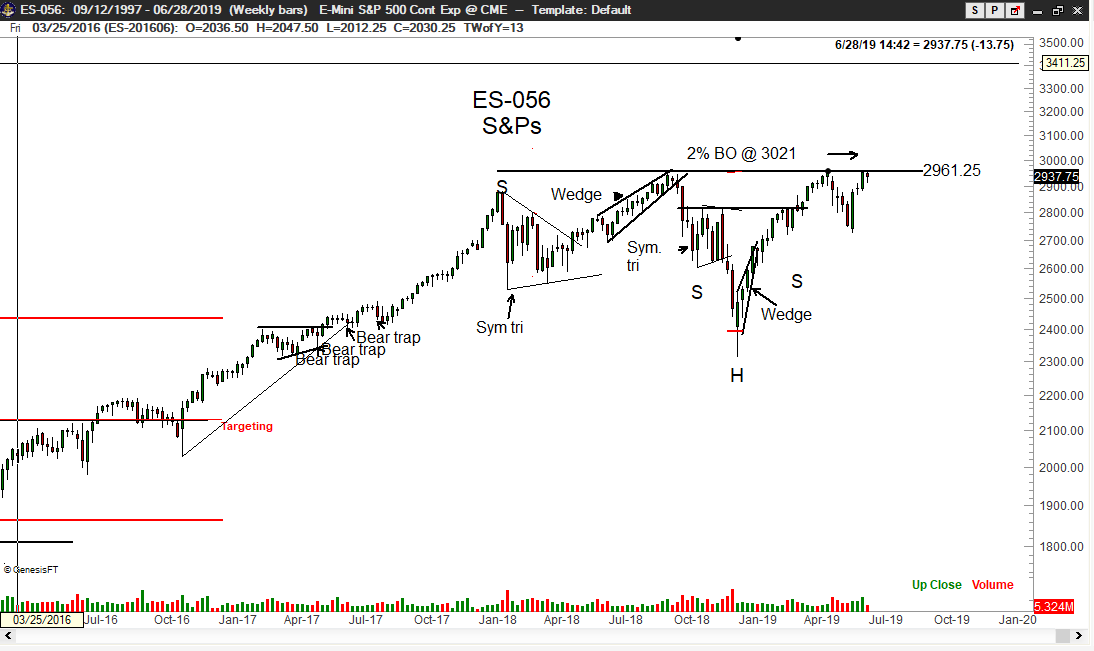

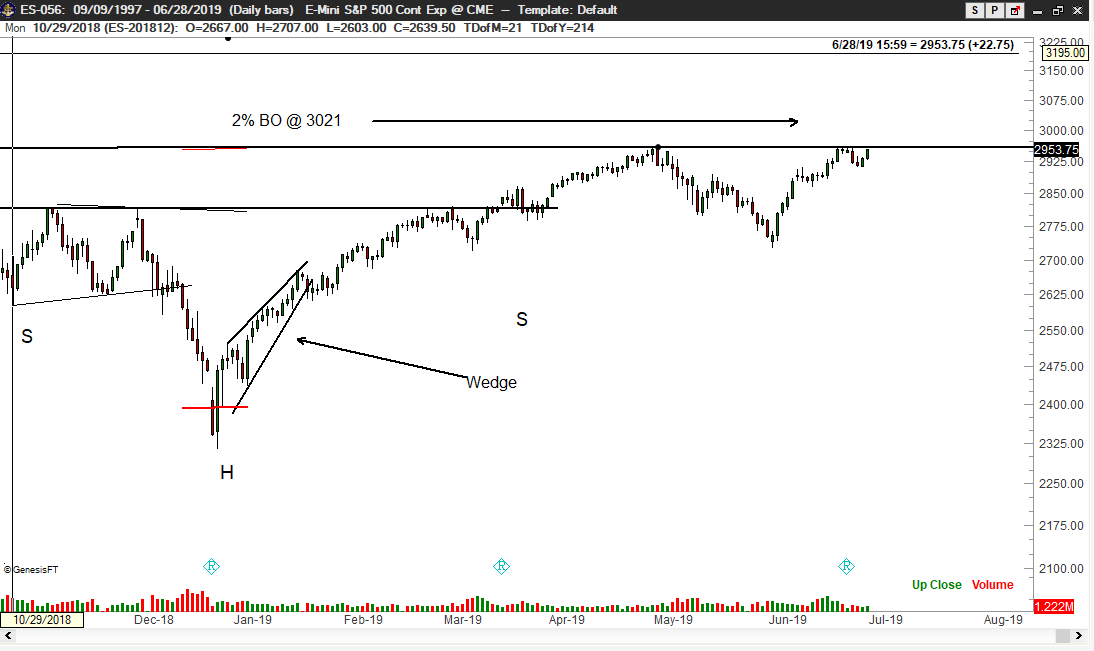

S&Ps (CME)

A decisive close above 3021 would be a breakout on the S&P chart. Such a close would establish a target of 3640. Factor is flat. I will buy S&Ps if it breaks out before Dow futures. I would not wait for 3021 before acting.

(Click on image to enlarge)

(Click on image to enlarge)

Factor Membership is now available, including a quarterly option. You could consider your membership in the Factor ...

more

Yes, this is a good sign.