Intel: Layoffs Loom Large As Seasonal Weakness Approaches - Watch Post‑Earnings Risk

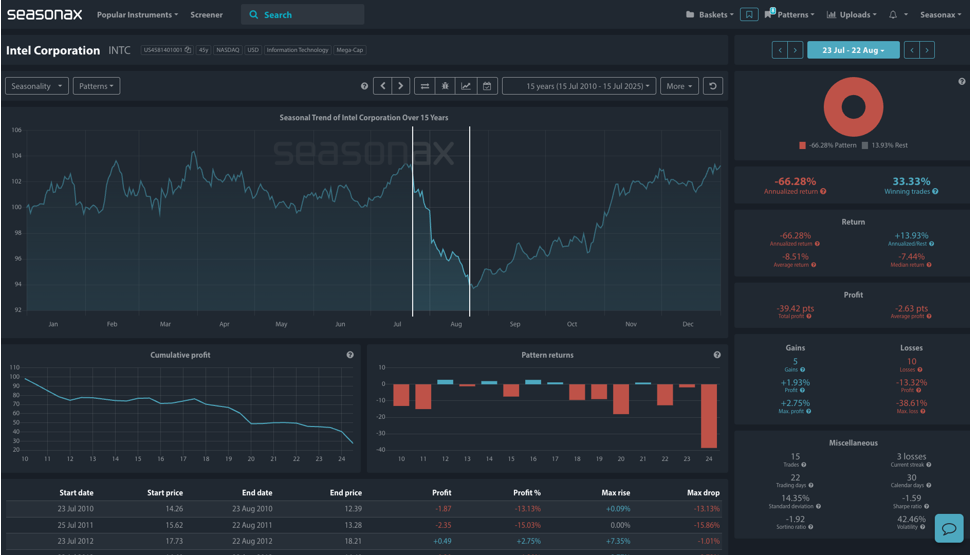

- Instrument: Intel (INTC)

- Timeframe: 23 July – 22 August (15 years)

- Average Pattern Move: –8.51%

- Winning Percentage: 33.33%

You may not realize it, but Intel shares tend to underperform sharply during late July into August. The chart below shows that over the last 15 years, INTC has produced an average return of –8.51% from 23 July to 22 August, with a win rate of just 33%. The annualized return for this window is a striking –66.28%, with a median loss of –7.44% — a seasonal headwind that should not be ignored ahead of Intel’s earnings due after the close on Wednesday, 24 July.

(Click on image to enlarge)

Why It Matters Now: Restructuring Headlines Meet Seasonal Gravity

Intel is undergoing a massive transformation:

- >500 layoffs in Oregon were disclosed this month on July 08, part of a sweeping plan to cut roughly 20% of staff under new CEO Lip-Bu Tan.

- The company has already reduced headcount at its California headquarters and is signalling more cuts across global operations.

- These moves are aimed at cost control and “removing organizational complexity,” but they also underscore ongoing challenges: Intel has lost ground in AI computer leadership to Nvidia.

While investors initially cheered the Oregon news (shares popped as much as 6.9%), history suggests caution into this seasonal window, which has seen 10 out of 15 losing years, with an average loss of –13.32% in those down cycles.

Technical Outlook

Two key trend lines are notable on the Intel chart below and breaks below them could signal momentum for technical sellers.

(Click on image to enlarge)

Earnings Catalysts

Intel’s report on July 24 will be the first real test of Tan’s turnaround strategy.

Markets will be listening for:

- Updates on headcount reduction and expected cost savings.

- Progress in catching up on advanced process nodes.

- Any signals on AI partnerships or foundry growth.

If guidance remains vague or cost‑cutting overshadows growth, seasonal sellers could step in quickly.

Trade Risks

- A stronger-than-expected margin outlook or positive AI roadmap could spark a relief rally.

Video Length: 00:02:03

More By This Author:

Silver: A Seasonal Pop Incoming As Hedge Fund Positioning Peaks?GBP/USD: CPI Miss Could Trigger Familiar Summer Slide

H2O America: Will Seasonal Strength Break The Downtrend?

Disclaimer: Past results and past seasonal patterns are no indication of future performance, in particular, future market trends. seasonax GmbH neither recommends nor approves of any particular ...

more