INTC Stock Before Q3 Earnings Release: To Buy Or Not To Buy?

Image Source: Unsplash

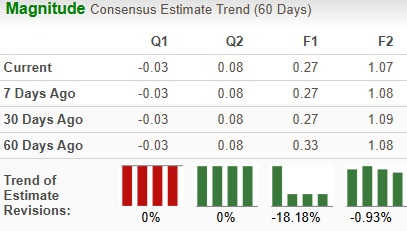

Intel Corporation (INTC - Free Report) is scheduled to report third-quarter 2024 earnings on Oct. 31. The Zacks Consensus Estimate for revenues and loss is pegged at $13.01 billion and 3 cents per share, respectively. Earnings estimates for INTC have declined from 33 cents per share to 27 cents for 2024 and from $1.08 per share to $1.07 for 2025 over the past 60 days.

INTC Estimate Trend

Image Source: Zacks Investment Research

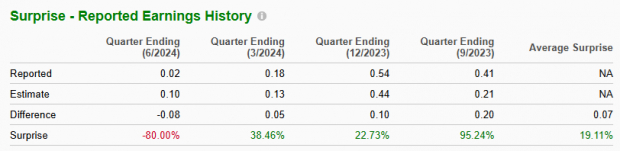

Earnings Surprise History

The leading semiconductor manufacturer delivered a four-quarter earnings surprise of 19.1%, on average, beating estimates thrice. In the last reported quarter, the company’s earnings surprise was negative 80%.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model does not predict an earnings beat for Intel for the third quarter. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. This is not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Intel currently has an ESP of 0.00% with a Zacks Rank #4 (Sell).

More By This Author:

American Airlines Surpasses Q3 Earnings And Revenue EstimatesIBM Tops Q3 Earnings Estimates

Coca-Cola Surpasses Q3 Earnings And Revenue Estimates

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more