Insiders Are Buying These 5 Stocks

Image Source: Unsplash

Investors closely monitor insider buys. But who are ‘insiders’?

An insider is defined by Section 16 of the Security Exchange Act as an officer, director, 10% stockholder, or anyone who possesses information because of their relationship with the company.

Of course, many strict rules apply to insiders. Notably, they have a longer holding period than most, a critical aspect investors should know.

Several companies – Dominion Energy (D - Free Report) , Carvana (CVNA - Free Report) , Keurig Dr Pepper (KDP - Free Report) , American Homes 4 Rent (AMH - Free Report) , and Enphase Energy (ENPH - Free Report) – have all seen recent insider activity. Let’s take a closer look at the transactions for those interested in trading like the insiders.

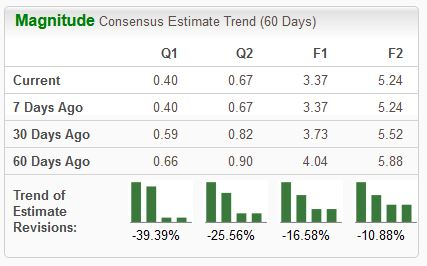

Enphase Energy

Enphase Energy is a global energy technology company that delivers energy management technology for the solar industry.

The CEO of Enphase Energy recently made a splash, acquiring 4000 shares at a total transaction value of roughly $480k. Analysts have taken a bearish stance on the stock, revising their earnings expectations lower over the last several months.

Image Source: Zacks Investment Research

Down 40% over the last year, the purchase reflects a confident stance among the CEO, scooping up shares at slashed levels.

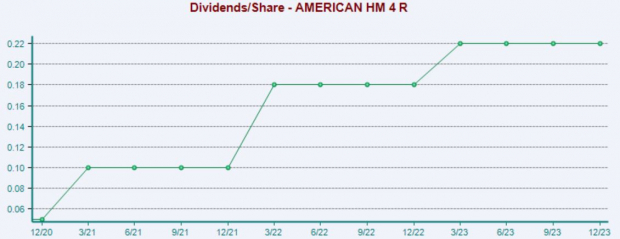

American Homes 4 Rent

American Homes 4 Rent is an internally managed real estate investment trust. A Director recently purchased roughly 1,000 shares, totaling $23.7k.

Investors stand to reap a passive income from AMH shares, currently yielding 2.4% annually. And dividend growth is robust, with the company carrying a 50% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

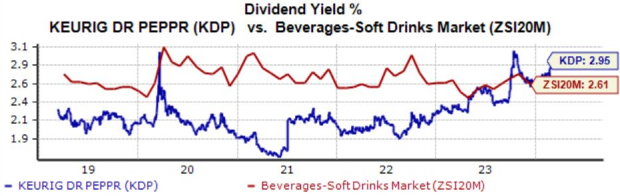

Keurig Dr Pepper

Keurig Dr Pepper is a beverage and coffee company in the United States and Canada. The CEO recently made a big purchase, acquiring 171k shares at a total cost of $5 million.

Like AMH, KDP shares reward investors nicely, paying out 2.9% annually. Dividend growth is also apparent, with the company carrying a 10% five-year annualized dividend growth rate.

The current yield is a few ticks higher than the average of those in the Zacks Beverages – Soft Drinks industry, as shown below.

Image Source: Zacks Investment Research

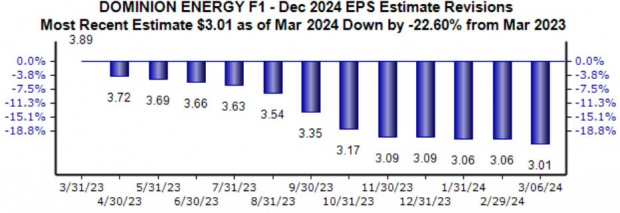

Dominion Energy

Dominion Energy and its subsidiaries produce and transport energy in the United States. Analysts have taken a bearish stance on the company’s outlook, with the current $3.01 Zacks Consensus EPS estimate down 22% over the last year and pushing the stock into an unfavorable Zacks Rank #4 (Sell).

Image Source: Zacks Investment Research

The CEO of Dominion recently bought 21.7k shares at a total cost of just under $1 million. The company’s near-term outlook is undoubtedly cloudy, and investors would likely be better off waiting for positive earnings estimate revisions to hit the tape.

Carvana

Carvana is a leading e-commerce platform for buying and selling used cars. A Director recently purchased 1.3k shares at a total cost of $100k.

Shares have been on a remarkable run over the last year, gaining nearly 800% in value and crushing its respective Zacks industry performance.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, as they can provide insight into the longer-term picture. After all, if an insider didn’t believe in the company’s future pathway, why would they buy?

All five stocks above – Dominion Energy, Carvana, Keurig Dr Pepper, American Homes 4 Rent, and Enphase Energy – have seen recent insider activity.

More By This Author:

3 Stocks To Buy For Post-Earnings Momentum3 Top-Ranked Stocks To Buy For Stability

These Highly Ranked Construction Sector Stocks Could March Higher This Month

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more