Insiders Are Buying These 3 Tech Stocks

Investors closely monitor insider buys.

It’s easy to understand why; if an insider buys, it can deliver a positive message to shareholders, indicating that they’re confident in the long-term picture of the business.

But who are insiders?

An insider is defined by Section 16 of the Security Exchange Act as an officer, director, 10% stockholder, or anyone who possesses information because of their relationship with the company.

Many strict rules apply to insiders.

Insiders can’t trade based on material nonpublic information, they must pre-clear all trades, and all transactions of the company’s stock must occur during the Window Period.

In addition, insiders have a more extended holding period than most, a critical aspect that investors should be aware of.

Three tech companies – Iridium Communications, Amphenol, and MKS Instruments – have all seen recent insider activity. For those interested in trading like the insiders, let’s take a closer look at each.

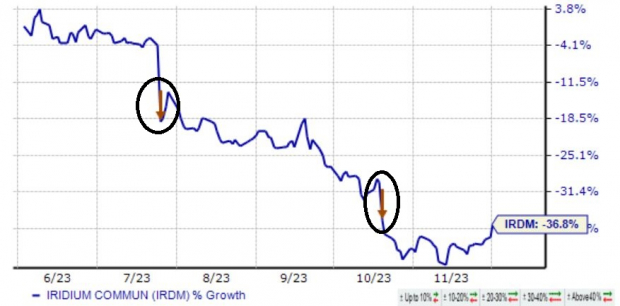

Iridium Communications

Iridium Communications provides mobile voice and data communications services via satellite. The CEO recently acquired a whopping 28k shares at a total transaction value of roughly $1 million.

Back-to-back releases of worse-than-expected quarterly results have weighed on shares, as we can see illustrated below. Still, since finding a bottom in mid-November, shares have added nearly 11%, perhaps reflecting a meaningful change in trend.

(Click on image to enlarge)

Image Source: Zacks Investment Research

IRDM shares provide tech exposure paired with a passive income stream, currently yielding a respectable 1.4% annually.

Amphenol

Amphenol designs, manufactures, and markets electrical, electronic, and fiber optic connectors, interconnect systems, antennas, sensors, sensor-based products, and coaxial and high-speed specialty cable.

In early November, a director purchased roughly 11.8k shares at a total transaction value of roughly $1 million.

The company’s shares saw notable buying pressure following its latest quarterly release, with Amphenol exceeding the Zacks Consensus EPS Estimate by more than 5% and posting a 4% sales surprise. The company also implemented a 5% boost to its quarterly dividend, undoubtedly pleasing investors.

(Click on image to enlarge)

Image Source: Zacks Investment Research

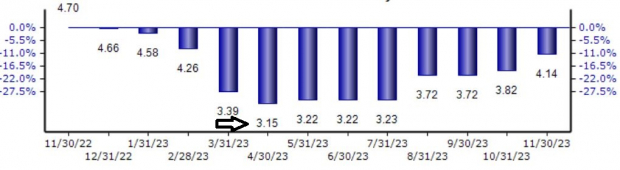

MKS Instruments

MKS Instruments is a global provider of instruments, subsystems, and process control solutions that measure, monitor, deliver, analyze, power, and control critical parameters of advanced manufacturing processes.

An insider recently made a splash, acquiring 2.5k shares at a total transaction value just above $170k.

Like APH, the market was impressed with MKS Instruments’ latest release, with shares moving well higher post-earnings. The company delivered a sizable 46% beat relative to the Zacks Consensus EPS Estimate and posted revenue a hair below expectations.

Analysts have become bullish on the company’s current fiscal year outlook, with the $4.14 Zacks Consensus EPS Estimate well above the $3.15 per share expected in late April.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, as they can provide a high level of confidence. After all, if an insider didn’t believe in the company’s future pathway, why would they buy?

And all three stocks above – Iridium Communications (IRDM) , Amphenol (APH) , and MKS Instruments (MKSI) – have seen recent insider activity.

More By This Author:

Time to Buy These Affordable Tech Stocks for More UpsideBest & Worst ETFs Of November

Bull Of The Day: CommVault Systems - Friday, December 1

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more