Insider Watch: 3 CEOs Buying The Dip

Image Source: Pexels

Investors closely monitor insider buys, as they can give hints surrounding the long-term picture.

But it’s critical to note that insiders have a longer holding period than most, and many strict rules apply to their transactions.

Recently, CEOs of several companies – Church & Dwight (CHD - Free Report), Eli Lilly (LLY - Free Report), and Viatris (VTRS - Free Report) – have made splashes, acquiring shares. Let’s take a closer look at the transactions for those interested in trading like the insiders.

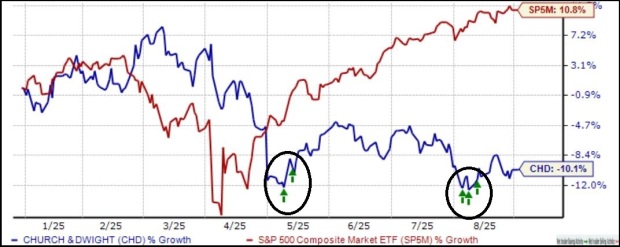

CHD CEO Buys $500K Worth

Church & Dwight develops, manufactures, and markets a broad range of household, personal care, and specialty products. The CEO dove in near mid-August, purchasing roughly 5.5k CHD shares at an overall transaction cost of just over $500k.

As shown below, shares have outperformed big in 2025 so far, losing roughly 10%. Still, insiders have been busy buying the dip, with the green arrows circled in the chart representing net insider buying activity.

Image Source: Zacks Investment Research

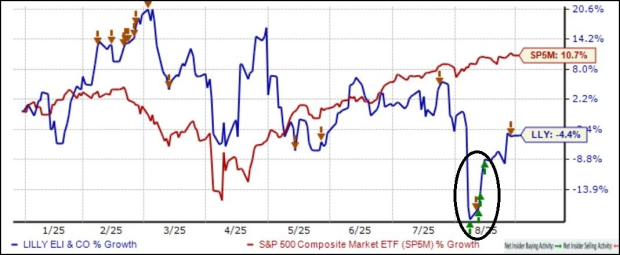

LLY CEO Buys Post-Earnings Weakness

LLY shares have faced pressure in 2025 so far, down 5% overall and widely underperforming relative to the S&P 500. But shares have shown nice life off the post-earnings lows so far, with insiders also buying after selling all throughout the year.

As we can see below, net insider buying activity has finally shown up after a 2025 that was primarily packed with selling.

Image Source: Zacks Investment Research

VTRS Insiders Buy On Momentum

Viatris, a global healthcare company, boasts an extensive product portfolio that comprises more than a thousand approved molecules across a wide range of key therapeutic areas. CEO Scott Smith made a sizable purchase, acquiring 22k VTRS shares at an overall transaction cost of roughly $220k.

Like those above, VTRS shares have lagged the S&P 500 considerably in 2025, down roughly 12%. But as shown again, insiders have been busy scooping up shares at discounted levels.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, seeking insights into the longer-term picture. The transactions shouldn’t be relied on for near-term performance, as insiders’ holding periods are longer than most, and many strict rules apply.

Rather, investors can see insider buys as an overall net positive concerning the longer-term outlook.

All large-cap stocks above – Church & Dwight, Eli Lilly, and Viatris – have seen their respective CEOs make purchases over the last month.

More By This Author:

Revisiting The Pandemic Stocks: SHOP, ZMAre IPOs Finally Back? CRCL, CRWV

Q2 Earnings: These 3 Tech Stocks Shattered Expectations

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more