Insider Buys: 3 Small-Cap Stocks CEOs Are Buying

Image Source: Unsplash

Small-caps have been a strong trade over recent weeks, with the rate cut outlook providing strong tailwinds. Cheaper capital is a huge benefit for these smaller companies, explaining the rally.

And recently, CEOs of several small-cap companies – Star Equity Holdings (STRR - Free Report), Anterix (ATEX - Free Report), and Energy Vault (NRGV - Free Report) – have made splashes, acquiring shares. Let’s take a closer look at the transactions for those interested in trading like the insiders.

Star Equity Holdings

Star Equity Holdings is a diversified holding company. Its current structure consists of Building Solutions, Business Services, Energy Services and Investments. The CEO has recently made several purchases over the course of September, now holding roughly 660k STRR shares.

As shown below, shares have been strong over the past three months, gaining 35% and seeing a boost following last week’s Fed meeting.

Image Source: Zacks Investment Research

Anterix

Anterix operates as a wireless communications company that focuses on enabling private broadband connectivity for critical infrastructure and enterprise businesses. The CEO made a $100k purchase near mid-September, acquiring roughly 4.6k ATEX shares.

Shares have faced pressure over the last three months but have seen decent strength off 2025 lows, still underperforming relative to the S&P 500.

Image Source: Zacks Investment Research

Energy Vault

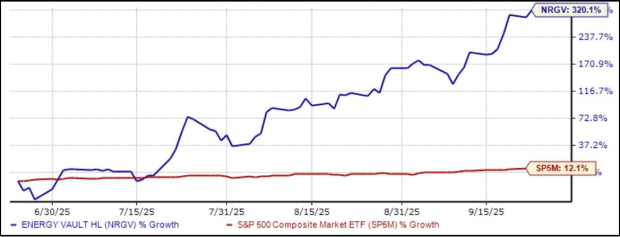

Energy Vault develops sustainable energy storage solutions designed to utility-scale energy storage for grid resiliency. The CEO recently made a big splash, picking up roughly 67.5k NRGV shares.

NRGV shares have been scorching hot over the past three months, more than tripling and crushing the S&P 500’s sizable 12% gain.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, looking to receive insights into the longer-term picture. The transactions should not be strictly relied on for near-term performance, as insiders’ holding periods are longer than most, and many strict rules apply.

Rather, investors can see insider buys as an overall net positive concerning the longer-term outlook.

All small-cap stocks above – Star Equity Holdings, Anterix, and Energy Vault – have seen recent CEO buying activity.

More By This Author:

What's Going On With NVIDIA And OpenAI?Why Earnings Season Is Critical

Football Season Could Massively Benefit This Stock