Insider Buys: 3 CEOs Buying Shares

Image Source: Unsplash

Investors closely monitor insider buys, as they can give hints surrounding the long-term picture.

But it’s critical to note that insiders have a longer holding period than most, and many strict rules apply to their transactions.

Recently, CEOs of several companies – Fifth Third Bancorp (FITB - Free Report), Fidelity National Information Services (FIS - Free Report), and CSX (CSX - Free Report) – have made splashes, acquiring shares. Let’s take a closer look at the transactions for those interested in trading like the insiders.

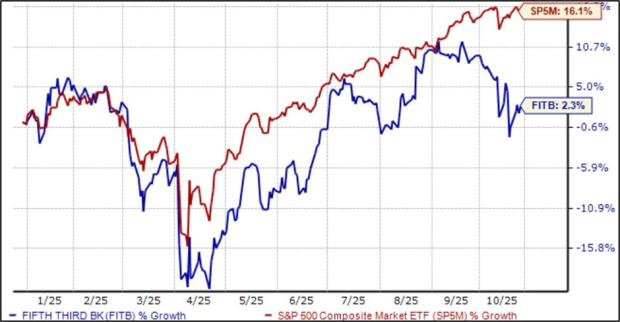

Fifth Third Bancorp

CEO Evan Bayh recently scooped up 3k FITB shares at a total transaction cost of just under $125k. Shares have underperformed YTD so far, gaining 2.3% compared to the S&P 500’s 16% gain.

Image Source: Zacks Investment Research

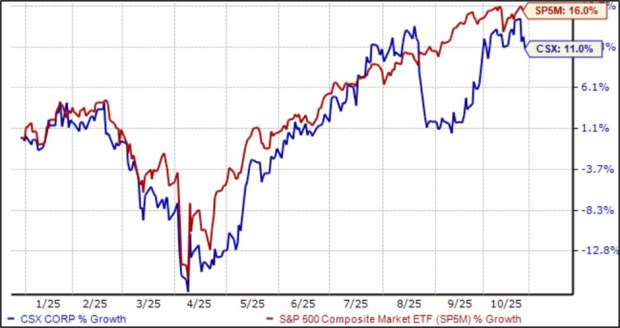

CSX

The CEO of CSX recently made a big splash, acquiring 55k shares at a total transaction value of roughly $2 million. Like FITB, shares have underperformed relative to the S&P 500 in 2025, gaining 11%.

Image Source: Zacks Investment Research

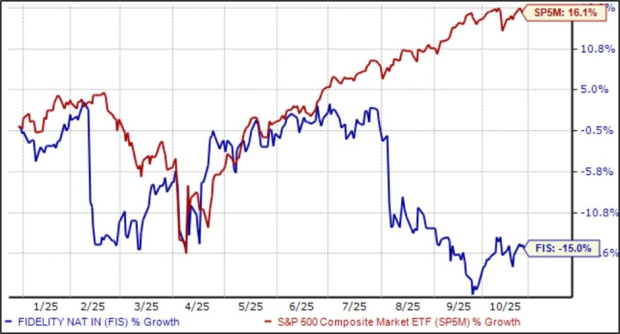

Fidelity National Information Services

The CEO of FIS recently bought roughly 900 shares at a total transaction cost of just above $60k. Shares have largely struggled in 2025, down 15% and widely underperforming.

Image Source: Zacks Investment Research

Bottom Line

Many investors closely monitor insider buys, seeking insights into the longer-term picture. The transactions shouldn’t be relied on for near-term performance, as insiders’ holding periods are longer than most, and many strict rules apply.

Rather, investors can see insider buys as an overall net positive concerning the longer-term outlook.

All large-cap stocks above – Fifth Third Bancorp, Fidelity National Information Services, and CSX – have seen their respective CEOs make purchases over the last month.

More By This Author:

This 3 Stocks Portfolio Provides Monthly IncomeCan Tesla Shares Charge Higher Post-Earnings?

Netflix Earnings Loom: Are You Still Watching?