Inovio Pharmaceuticals: 2020 Is The Make Or Break Year

Inovio Pharmaceuticals’ (INO) stock, which has been gasping for air from 2017 to Jan 2020, received mouth-to-mouth resuscitation when news broke that it was in the reckoning developing a coronavirus cure, along with Johnson& Johnson (JNJ), Moderna (MRNA) and Novavax (NVAX).

The stock spurted 100% from $2.98 on Jan 6, 2020, to $5.91 on Jan 27, 2020. However, it developed vertigo at higher levels and crashed to $3.19 as of 10 Feb 2020.

(Click on image to enlarge)

Image Source: Investing.com

INO develops immunotherapies to fight cancer and infectious diseases. It has a unique platform is that utilizes DNA and next-generation antigen sequencing and delivery to activate the immune system

If it has got so much promise and is such a novel company, why is the stock not performing? Here’s my analysis:

Valuation Metrics

With a forward P/S ratio of 53.93 and a TTM P/B of 9.38, INO is obnoxiously overvalued even at its current price of $3.19.

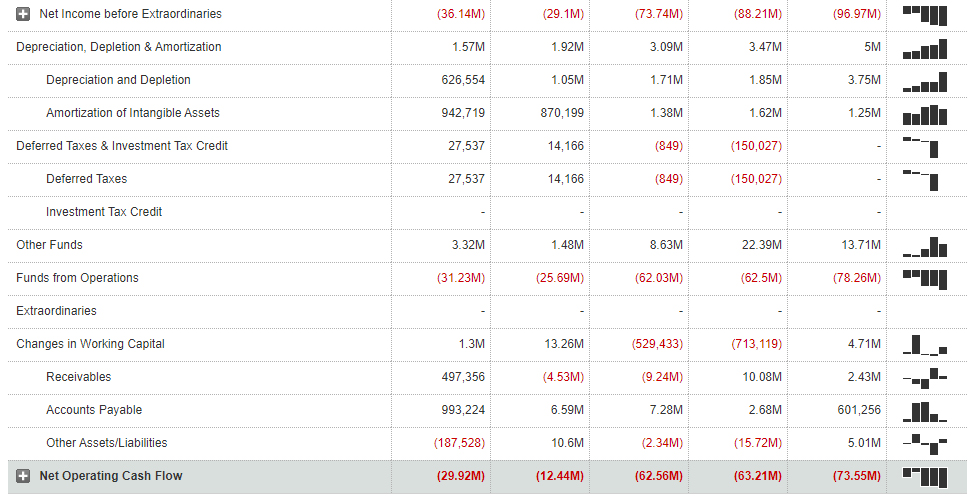

The operational cash flows are negative since 2014 and have been worsening over time:

(Click on image to enlarge)

Image Source: MarketWatch

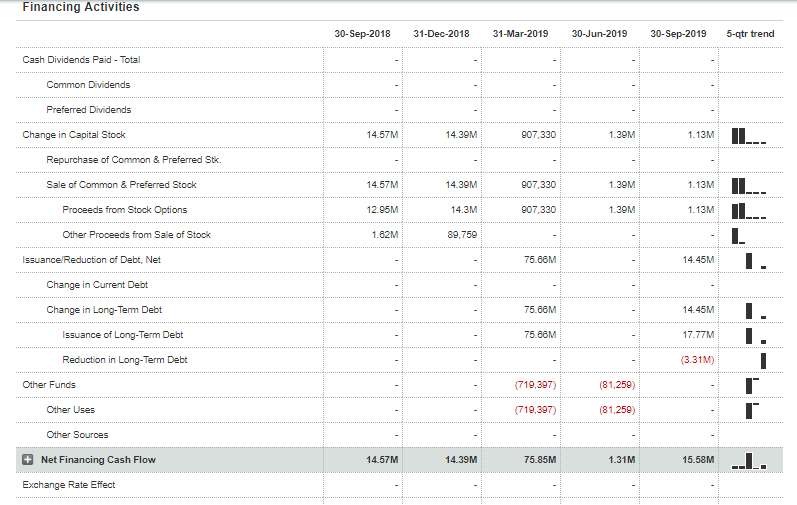

The situation in 2019 is no better. The company has been leaking cash quarter after quarter and has issued stock or borrowed to stay in the game.

(Click on image to enlarge)

Image Source: MarketWatch

To absorb a part of the losses, INO reduced a cost-cutting plan in July 2019 which included 28% staff reduction and closing down several R&D and clinical programs. This would help the company reduce 25% cash burn annually.

Management’s Expectations in 2020

Though INO’s main issue has been its overly long gestation period, the management has done some crystal ball gazing and has promised the following deliveries by late 2020:

1. GBM (Glioblastoma Multiforme) survival data at 12 and 18 months for its INO-5401, a T cell-activating immunotherapy encoding for three tumor-associated antigens. Glioblastoma is an extremely challenging disease, and most patients die of their brain cancer within 12-24 months of diagnosis. INO’s last trial in 2019 demonstrated that 75% of its patients became progression-free at six months.

2. Unveil successful clinical trials for its VGX-3100, which is DNA-based immunotherapy to treat cervical dysplasia caused by human papillomavirus (HPV).

3. VGX-3100 also will be in Phase 3 along in China (this market is being explored by Inovio and ApolloBio).

4. AstraZeneca (another collaboration), would by then report on efficacy results of MEDI0457 combined with their inhibitor.

5. The company said in its Q3 2019 earnings call that it was engaged with the FDA and was confident that it would be able to initiate a clinical trial of INO-3107 for HPV-related RRP (Recurrent Respiratory Papillomatosis) by the first half of 2020.

6. Finally, there’s the INO-4800 vaccine that has the potential to treat coronavirus (2019-nCoV). The Coalition for Epidemic Preparedness Innovations (CEPI) has awarded Inovio a $9 million grant that will enable the company to take the trial through Phase 1 human testing. On Jan 30, 2020, Beijing Advaccine Biotechnology started collaborated with Inovio to work on INO-4800 as a vaccine for coronavirus.

The Verdict

Sure enough, Inovio Pharmaceuticals has been burning cash and many patient investors have turned impatient because the company has to start cashing in on its research.

That said, 2020 promises to be a landmark year for INO. There’s a lot to look forward to including the successes promised by the management for GBM, HPV, the AstraZeneca collaboration and the coronavirus cure.

INO may be down in the dumps, and it may not be reacting to the recent developments – but what is exciting is that the management has promised some heavyweight deliverables by end-2020.

2020 can be a make or break year for the company and I would place INO in my tracklist while keeping up-to-speed with its coronavirus vaccine, and of course, the other developments that are expected by Nov 2020. If there is any positive news by then, INO will become a buy.

Disclosure: I have no position in the stocks discussed, and neither do I plan to buy/sell it in the next 72 hours. I researched and wrote this article. I am not being compensated for it (other ...

more

Good analysis on $INO.

Thanks, Danielle