Infrastructure Bill Beneficiaries Index Has Finally Taken Off: Up 30% YTD

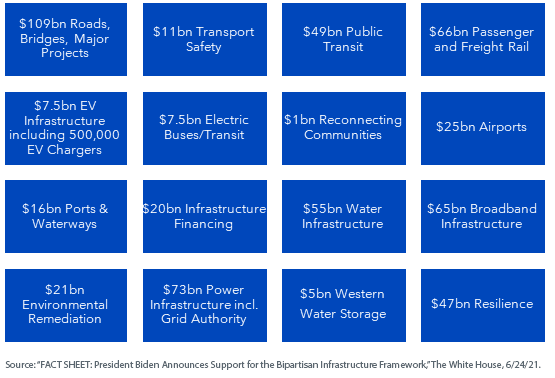

For almost two decades the U.S. has been underinvesting in infrastructure but that under-allocation is about to change with the passage in November 2021, of the Infrastructure Investment and Jobs Act (IIJA) into law. It has authorized the spending of $1.2 trillion (see below) with $550 billion of new spending over the next 5 years.

The munKNEE Infrastructure Bill Beneficiaries Index continues to forge ahead and is now up 30.6% YTD (as of February 28th). Below is the performance of the 12 constituents in the Index YTD, in descending order:

- United Rentals (URI): UP 31.8% YTD

- As the provider of specialty equipment specifically designed for underground work and fluid treatment URI should benefit from business generated by the infrastructure bill.

- Nucor (NUE): UP 27.0% YTD

- As the largest domestic steelmaker in North America, the pent-up demand from automakers and other industrial buyers should benefit NUE considerably going forward.

- ChargePoint Holdings (CHPT): UP 19.2% YTD

- The planned building of 250,00 customized charging stations should be a major benefit to CHPT.

- The USPS announced on February 28th that:

- it intended to acquire a 75 percent electric fleet of Next Generation Delivery Vehicles (NGDV) over the next 5 years with acquisitions of NGDV after 2026 being 100% electric,

- it plans to begin building out its charging infrastructure across a minimum of 75 locations within the next 12 months, and thereafter to continue the infrastructure build out in the succeeding years at many additional facilities as a part of our delivery vehicle electrification strategy,

- it’s total investment in vehicles is expected to reach $9.6 billion, including $3 billion from Inflation Reduction Act (IRA) funds.

- Eaton Corp. (ETN): UP 11.5% YTD

- As a major supplier of electrical components and systems the integration of wind and solar farms into the national grid should benefit ETN considerably.

- Brookfield Infrastructure Corporation (BIPC): UP 11.1% YTD

- With operations spanning utilities, transportation, energy, and even data infrastructure, BIPC should benefit enormously from business generated by the infrastructure bill.

- Freeport-McMoRan (FCX): UP 7.8% YTD

- With 43% of all copper mined being used in building construction, with another 20% used in transportation equipment, the Infrastructure Bill should benefit FCX.

- Martin Marietta Materials (MLM): UP 6.5% YTD

- As a producer of crushed sand and gravel products, ready-mixed concrete and asphalt, paving products and services, dolomitic lime for the steel and mining industries, and chemical products for use in flame retardants, wastewater treatment, and assorted environmental applications should be of major benefit to MLM.

- Vulcan Materials (VMC): UP 3.4% YTD

- Being America's largest producer of construction aggregates, asphalt and cement should benefit VMC going forward.

- Oshkosh Corp. (OSK): UP 1.1% YTD

- As the manufacturer of specialty trucks used in heavy construction projects as well as cement mixers, truck-mounted cranes, "cherry pickers" and other hydraulic lifting systems OSK is well placed to meet the demand for the electrification of the federal vehicle fleet.

- Caterpillar (CAT): No Change YTD

- As the manufacturer of asphalt pavers, compactors, excavators, pipe layers, backhoes, etc., CAT will benefit from future major infrastructure projects

- Deere & Company (DE): DOWN 2.2% YTD

-

- As a major producer of earth-moving and road-building and forestry equipment, DE should see an increased demand for its machinery.

-

- Crown Castle International (CCI): DOWN 3.6% YTD

- As one of America's leading wireless tower real estate investment trusts, CCI should benefit from the expansion of mobile data usage.

In summary, the munKNEE Infrastructure Bill Beneficiaries Index is UP 30.6% YTD. To put that in perspective, the S&P 500 is only UP 3.4% YTD.

More By This Author:

Update: SciSparc To Spin Off Pharmaceutical Activities Into New Subsidiary

February Momentum Report For The 5 Major Canadian Cannabis LP Stocks

Green Thumb's Q4 Financials Were Absolutely Dismal

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more