Inflation Is Under Control And The Fed Is Done Hiking; What Now?

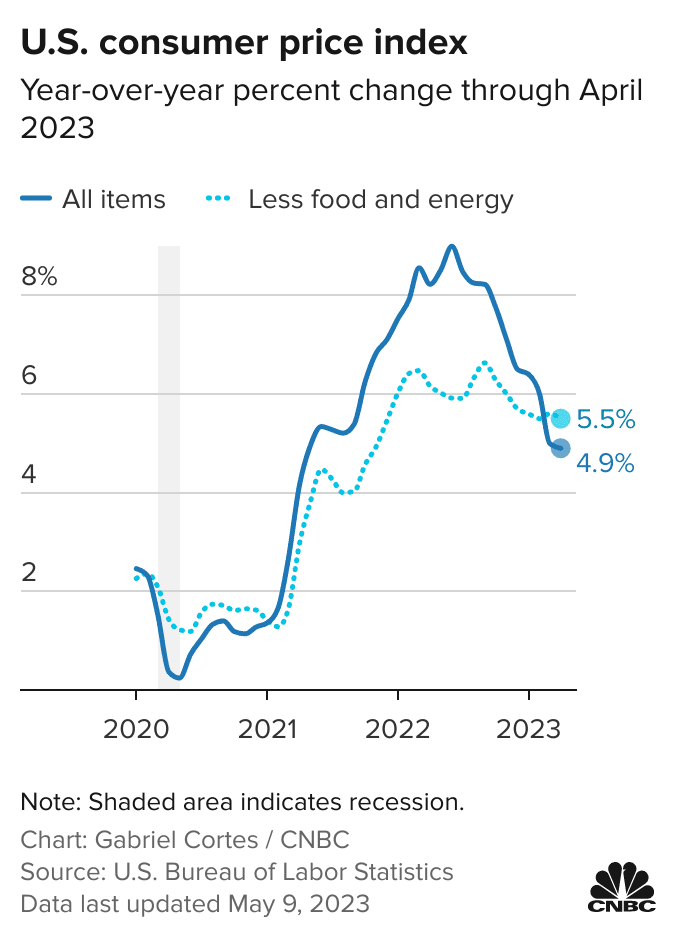

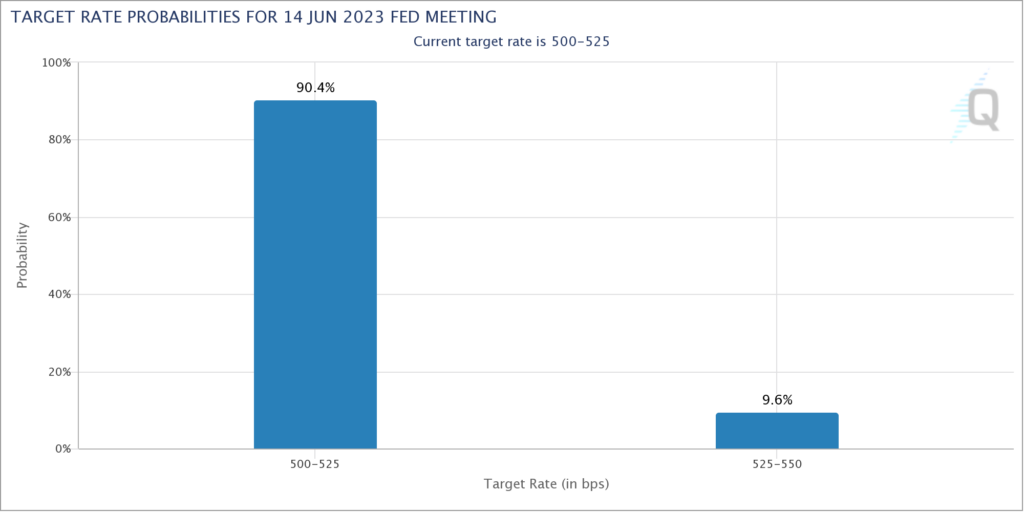

Any way you slice it, inflation is clearly coming down and seemingly under control. Wednesday’s April CPI Report was just the latest data point to confirm that. And that means that the Fed’s hiking cycle is likely over. Fed Futures are pricing in a 90% probability of a pause at the June meeting. What now?

(Click on image to enlarge)

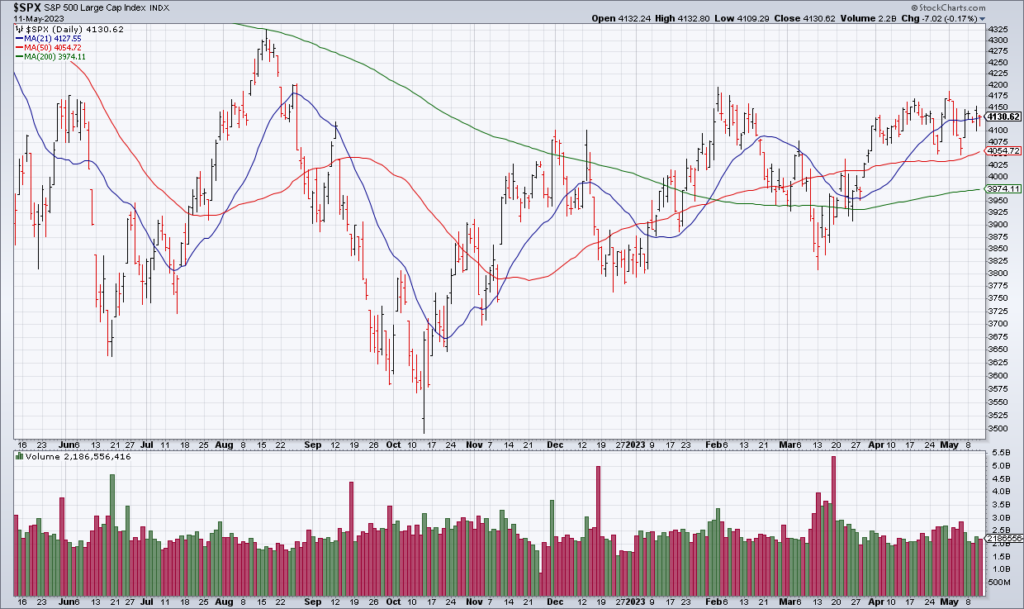

The S&P hasn’t made much progress over the last three months, frustrating both bulls and bears. There are two narratives that you can have at the moment. The bullish narrative believes that the bear market is over because the Fed is done hiking. The bearish narrative believes that monetary policy acts with a lag and all the Fed’s previous hikes are still working their way through the economic system. My bias is the latter but it’s a waiting game for now.

More By This Author:

PYPL: Tremendous Value

LYFT Is A Second Rate Company – And The Investment Lesson You Must Learn

AAPL Is Past Its Prime