Inflation Is Back… And The Fed Won’t Be Cutting Rates Any Time Soon

Inflation is going in the wrong direction again… and that is BAD news for stocks.

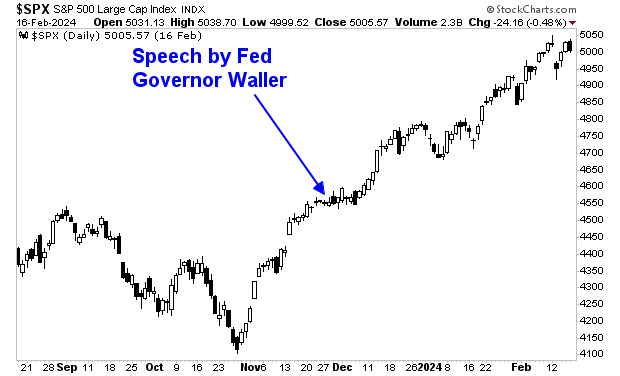

If you’ll recall, the primary driver of the recent rally in stocks was the Fed suggesting that it would soon begin cutting rates. Indeed, it was a speech by Fed Governor Waller concerning that exact topic in late November 2023 that ignited the move from4,550 to new all time highs for the S&P 500.

However, with the economy still growing at an annualized rate of 3%, stocks at new all-time highs, and financial conditions looser today than they were before the Fed starting raising rates in March 2022, the ONLY way the Fed could cut rates without looking like a group of political activists is if inflation is at or close to target.

It’s not. In fact, the latest inflation data is going the WRONG way for the Fed.

The Consumer Price Index (CPI) for Januarywas supposed to show a month over month (MoM)increase of just 0.2% and a year over year (YoY) increase of 2.9%. Instead it showed a MoM of 0.3% and a YoY of 2.9%).

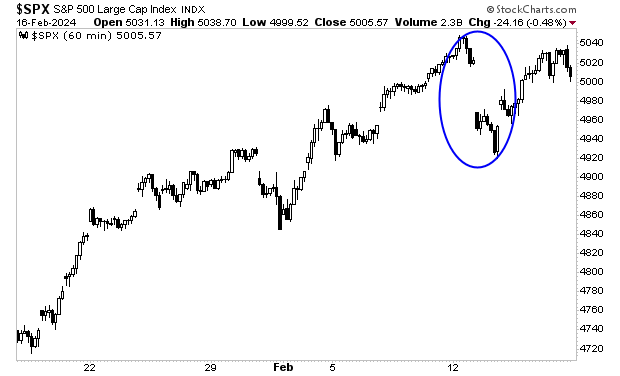

That 0.1% difference in MoM and 0.2% difference in YoY don’t sound like a big deal, but this was the reason the market dropped like a brick last week on Tuesday.

Then, on Friday, January’s Core Producer Price Index (PPI) came in at 0.5% MoM vs. expectations of 0.1%. Now that is a legitimately big deal as the Core PPI is the Fed’s PREFERRED inflation measure.

This means there will be NO rate cuts in March. And investors will be lucky if they get a rate cut in April/ May.

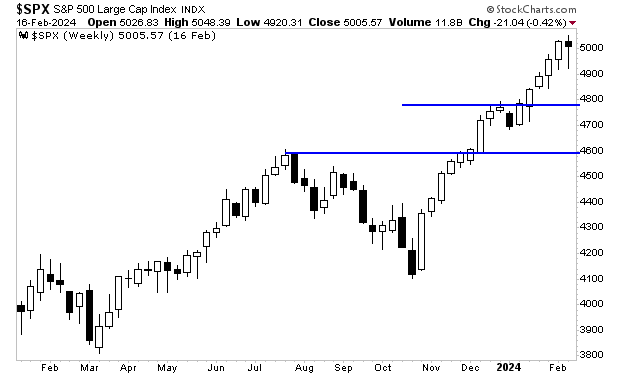

This sets the stage for a significant stock market correction. I’ve warned repeatedly that stocks are quite stretched above their primary trend. I believe the S&P 500 will be working its way down to 4,800 and then eventually 4,600 in the coming weeks. I’ve illustrated those levels on the chart below.

More By This Author:

Four Charts Every Trader Needs To See TodayI Have A Serious Question For You

Market Forecast Based On Earnings So Far