Inflation Data Alters Fed Expectations; Tech Sector Reacts

The market has seemingly reached a verdict: July's subdued inflation report has led to an anticipation of the Federal Reserve refraining from further interest rate hikes.

However, the accuracy of this assumption is contingent upon a broader spectrum of data points to emerge between now and the Fed's forthcoming meeting on 19 and 20 September.

Most of these indicators align with the central bank's direction and its endeavors to curtail inflation to its long-term goal of 2% presently. The critical factor lies in the Federal Reserve's patience level as they inch closer to their goal.

With the unveiling of the Consumer Price Index (CPI) on Thursday, revealing a 12-month inflation rate of 3.2%, the market has elevated its conviction that the Fed will maintain its current stance. This sentiment prevails despite the headline CPI figure's first upward tick in over a year.

Calculation from CME Group demonstrates that the likelihood of a September rate hike has plummeted to 9.5% from a prior 14%, marking a significant shift in a mere week. Furthermore, the chances of additional rate hikes have also dwindled, decreasing to 27.3% for November and 24.1% for December.

Nvidia: Retracement Perspective

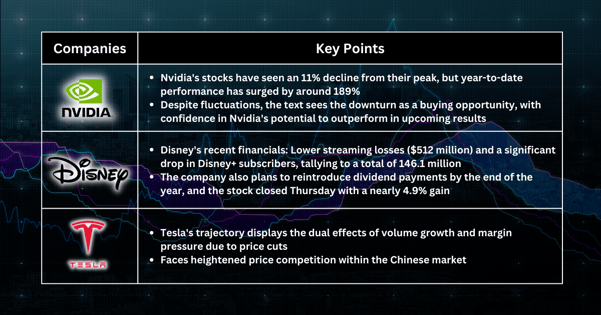

Nvidia's (NVDA) stocks have experienced an approximately 11% decline from their peak. While the year-to-date performance showcases an impressive surge of around 189%, a 9% contraction since the start of August has stirred concerns. Despite these fluctuations, we recommend viewing this downturn as a buying opportunity. Our conviction remains high, positioning the stock as our favored choice within the semiconductor sector.

Contrary to these concerns, we anticipate Nvidia to exceed market expectations in its upcoming quarterly results, predicting a significant boost. Extrapolating October quarter Nvidia figures from the intricate supply chain landscape can be an intricate puzzle. Any short-term limitations in the supply chain are likely to bolster optimism for substantial gains in the future. The matter at hand is whether this upward trajectory materializes sooner or later.

Disney: Progress on the Horizon

Disney's (DIS) recent financials presented a mixed picture following the Wednesday market close, concurrently with an announcement of price hikes for its ad-free streaming services.

The latest quarter saw a reduction in operating losses for the streaming service, amounting to $512 million. However, Disney+ subscribers faced a record decline of 11.7 million, tallying the total to 146.1 million.

Despite this subscriber downturn, CEO Bob Iger remains optimistic about the impact of higher prices on Disney+. An earlier price increase in late 2022 did not yield a substantial loss of subscribers. Additionally, Disney revealed plans to reintroduce dividend payments by the year's end. The stock concluded Thursday with a nearly 4.9% gain.

Tesla: Volatile Landscape Ahead

Tesla's (TSLA) trajectory displays the dual effects of volume growth and margin pressure due to price cuts, resembling traditional original equipment manufacturers (OEM) margins. Moreover, the company faces heightened price competition within the Chinese market.

More By This Author:

Exercising Caution Amidst Positive Headlines: Unveiling Deeper LayersUpcoming US CPI Data Looms As Pivotal In Deciding Hiking Cycle's Fate

Powerful Support For Stock Bulls: US Job Report And Tech Earnings Point To A Promising Future

Disclaimer: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more