Indicators Suggest Weakness Should Be Bought

It's been a hectic travel weekend and I'm still on the road. And with all the news flying around at the moment, I feel it is important to spend the appropriate amount of time analyzing the situation and the market action. As such, I'm going to let the indicators do the talking.

Weekly Market Model Review

Now let's turn to the weekly review of my favorite indicators and market models...

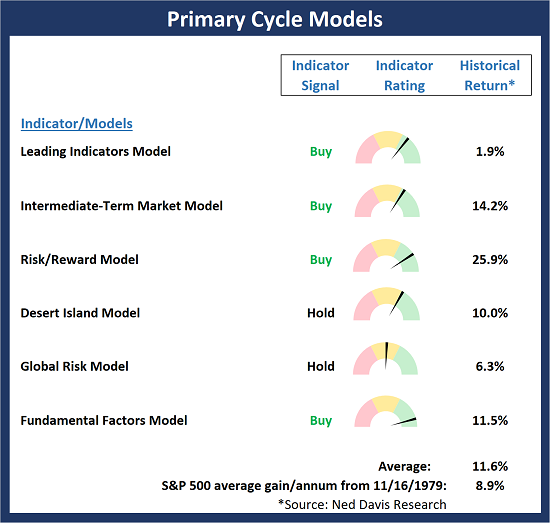

The State of My Favorite Big-Picture Market Models

Two-component models signals within the Primary Cycle board (my "Desert Island" and the Global Risk Model) moved from buy to hold this week. However, the Primary Cycle board remains in pretty good shape which suggests investors should treat pullbacks as buying opportunities and to continue to lean bullish.

This week's mean percentage score of my 6 favorite models slipped to 70.3% from 84.1% last week (Prior readings: 79%, 83.9%, 81.1%, 73.5%, 62.9%, 65.4%) while the median also fell to 68.4% versus 86.5% last week (Prior readings: 80%, 86.7%, 82.5%, 68.5%, 66.3%, 71.3%, 68.8%).

(Click on image to enlarge)

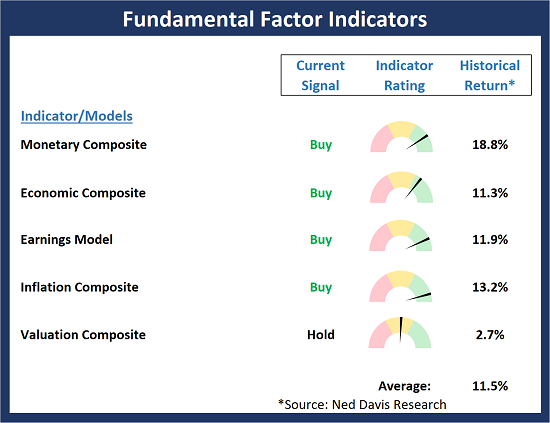

The State of the Fundamental Backdrop

With monetary conditions improving a bit and our economic composite pulling back a similar amount, the Fundamental board is pretty much unchanged. However, the overall backdrop remains largely positive.

(Click on image to enlarge)

The State of the Trend

As one would expect with the S&P 500 having its worst week of the calendar year 2019, some of our trend indicators took a hit last week. The news from President Trump regarding additional tariffs on China surprised the market and caused traders to move to "risk-off" positions. The obvious fear is the economic outlook will worsen as the trade war looks to be taking a turn for the worse.

(Click on image to enlarge)

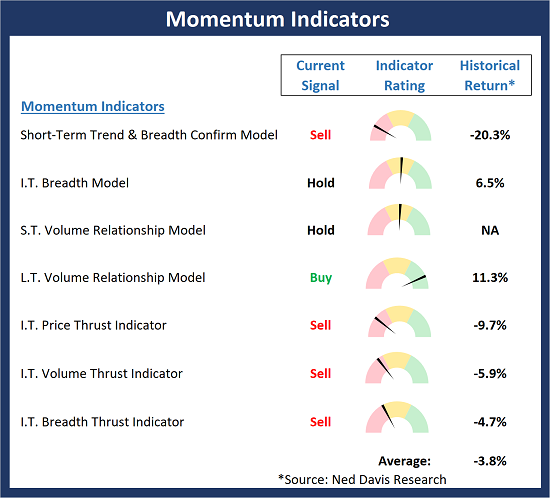

The State of Internal Momentum

As I mentioned last week, not everything is rosy in the indicator world. Exhibit A in the argument continues to be the Momentum board. While the major indices are only a few days removed from all-time highs, the Momentum indicators have weakened noticeably.

(Click on image to enlarge)

The State of the "Trade"

While the "setup" was a little choppy and there was definitely a false start or two, the bears finally got to take advantage of the shorter-term bearish positioning. This week, the setup is much more neutral. This suggests that the bears could certainly continue to run with the ball for a spell.

(Click on image to enlarge)

Disclosure: At the time of publication, Mr. Moenning held long positions in the following securities mentioned: none - Note that positions may change at any time.

The opinions and forecasts ...

more