In The Flesh

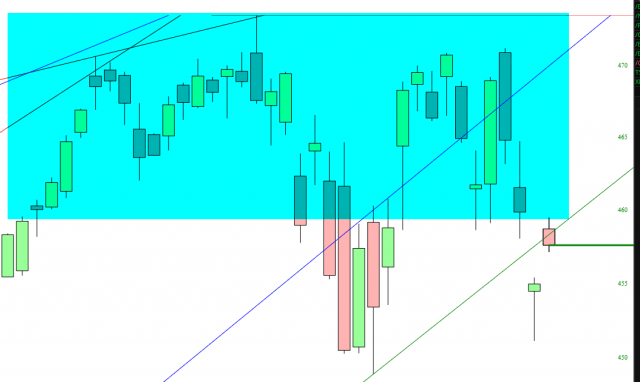

Well, the bulls are clearly trying to Build Back Better, but I would say there is a meaningful wall of overhead supply keeping them at bay. Todays’ bounce was oh-so-obvious this in BTFD world we live in. I’m glad I took some profits yesterday, but I wish I took even more.

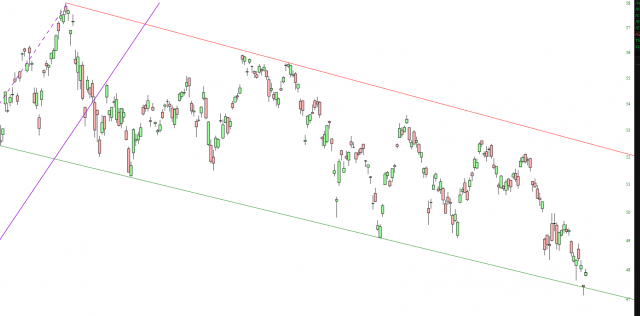

The most compelling “buy” in ETF land is the emerging markets EEM, but I said the same thing Friday, and it slumped on Monday. In other words, sometimes weakness merely begets more weakness, irrespective of present price position relative to pattern. Still, we can all agree it is grinding along the support line of its channel.

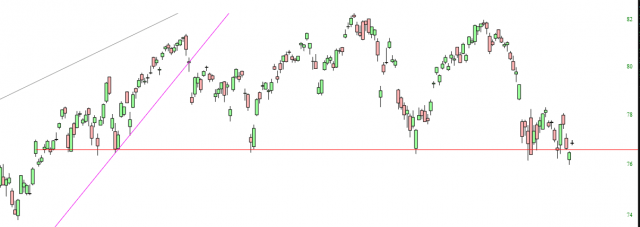

In sharp contrast to this, although it, too, is “foreign” to the U.S., is the EFA, which is worldwide equities sans North America. This is a glorious, glorious topping pattern.

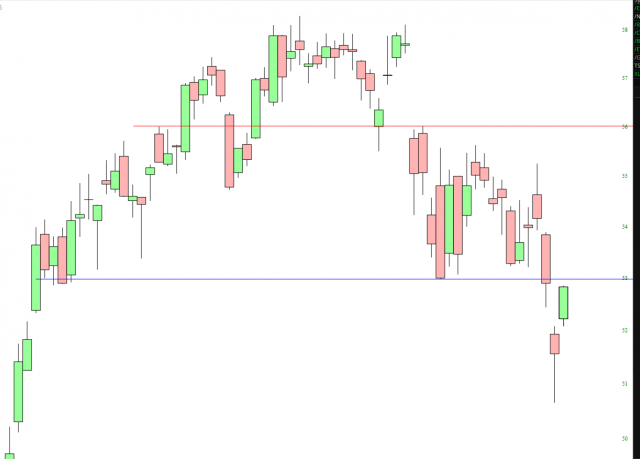

If I may also offer one more ray of hope to my briefly-beleaguered bearish brethren, I present the KBE, which is the regional banks, which also seems to have accomplished nothing today except to return to major resistance.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more