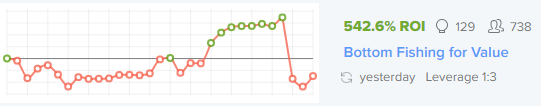

In Bottom Fishing For Value, Ambarella And AMD Are Tops

A favorable reversal for momentum stocks helped the Bottom Fishing for Value continue its positive ROI. Ambarella (AMBA) may move and hold above the $40 level, as markets rewarded the stock for its value through multi-year contracts and a moat in automotive safety solutions.

In the semiconductor space, Intel (INTC) said it would slow the pace of chip releases. Why not? AMD (AMD) is a big threat, with its Zen release for later this year, but not big enough in company size to scare Intel. Qualcomm's (QCOM) stock made most of its gains alongside the market moving higher.

Here is a direct link to the strategy.

The bearish calls on optical equipment maker Ciena (CIEN), ailing search engine firm Yahoo (YHOO), and solar supplier SolarCity (SCTY) all closed. These companies took a direction unfavorable to the strategy.

For the micro-cap for value strategy, Glu Mobile (GLUU) finally sold off. The absence of any new game releases, positive user growth for existing games, and profit taking all helped move the stock lower. Similarly, MeetMe's (MEET) over 50% ROI and Stratasys (SSYS) are falling due to profit taking. They had a nice run.

Disclosure: None.

Ambarella is a tiny company with much larger competitors. It had income of only a shade under $90 million last year, has only about 600 employees and a market cap of just over $1.3 billion. Texas Instruments a competitor in the similar semiconductor field has 30,000 employees and a market cap of $57 billion! Perhaps Ambarella's tiny size is an advantage? Currently out of 10 analyst opinions this month, 3 are a strong buy, 4 a buy a, 5 a hold.

Thanks for the AMBA quick take. Is there a risk TXN buys out AMBA? Stock dropped but is still expensive.