Immunome - Oncology Is Hot

MicroMarvel is a series of articles highlighting undercovered stock with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

Image Source: Unsplash

Today's MicroMarvel is the oncology biomedical company Immunome (IMNM). I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 12 /22 the stock gained 27.48%.

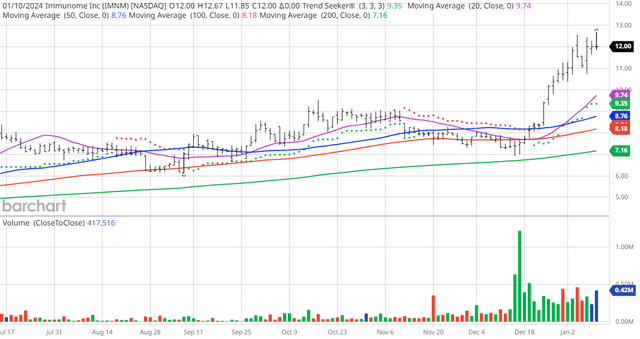

IMNM Price vs Daily Moving Averages (Barchart)

Immunome, Inc., a biopharmaceutical company, discovers and develops antibody therapeutics for oncology and infectious disease. The company's lead oncology program includes IMM-ONC-01 that targets IL-38 tumor-derived immune checkpoint capable of promoting evasion of the immune system. It also develops IMM-BCP-01, an antibody cocktail product candidate for the treatment of SARS-CoV-2 infections and COVID-19. The company was incorporated in 2006 and is headquartered in Exton, Pennsylvania.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 113.50+ Weighted Alpha

- 203.02% loss in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 12 new highs and up 55.63% in the last month

- Relative Strength Index 78.34%

- Technical support level at $11.66

- Recently traded at $12.00 with a 50-day moving average of $8.76

Fundamental Factors:

- Market Cap 513 million

- Revenue estimates were not given by Wall Street analysts

- Earnings are projected to increase 63.80% this year and an additional 3.60% next year

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying, but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts have 2 strong buy recommendations in place on the stock

- Analysts price target consensus is at $12 which is today's price

- Value Line gives the stock its highest rating of 1

- CFRAs MarketScope rates the stock a strong buy

- 1,020 investors are following the stock on Seeking Alpha

More By This Author:

Chart Of The Day: Elanco Animal Health- Big Money In Animal Pharma

MicroMarvel - GigaCloud Technologies

Chart Of The Day: Dell Technologies - Hardware Is Trending

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

On the ...

more