IDEXX Labs - Money In Pet Healthcare?

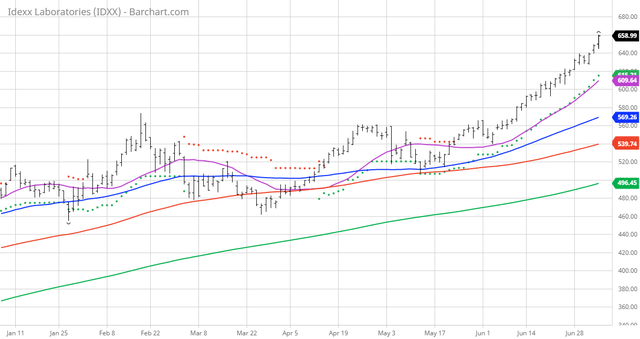

The Barchart Chart of the Day belongs to the pet healthcare company IDEXX Laboratories (NASDAQ: IDXX). The last time I featured IDEXX was May 28, 2016, when it traded at 90.07. Today it closed at 658.99. I sorted Barchart's All-Time High list first by the highest number of new highs in the last month, then used the Flipchart function to review the charts for consistent price appreciation. Since the Trend Spotter signaled a buy on 5/21 the stock gained 19.88%.

IDEXX Laboratories, Inc. develops, manufactures, and distributes products and services primarily for the companion animal veterinary, livestock and poultry, dairy, and water testing markets worldwide. The company operates through CAG; Water Quality Products; Livestock, Poultry, and Dairy; and Other segments. It provides point-of-care veterinary diagnostic products, including instruments, consumables, and rapid assay test kits; veterinary reference laboratory diagnostic and consulting services; practice management and diagnostic imaging systems and services for veterinarians; and health monitoring, biological materials testing, and laboratory animal diagnostic instruments and services for the biomedical research community. The company also offers diagnostic and health-monitoring products for livestock, poultry, and dairy; products that test water for various microbiological contaminants; and point-of-care electrolytes and blood gas analyzers and SARS-CoV-2 RT-PCR that are used in the human point-of-care medical diagnostics market; in-clinic chemistry, blood and urine chemistry, hematology, and SediVue Dx analyzers; SNAP rapid assays test kits. In addition, it provides Colilert, Colilert-18, and Colisure tests, which detect the presence of total coliforms and E. coli in water; Enterolert, Pseudalert, Filta-Max, and Filta-Max xpress, Legiolert, and Quanti-Tray products; veterinary software and services for independent veterinary clinics and corporate groups. The company markets its products through marketing, customer service, sales, and technical service groups, as well as through independent distributors and other resellers. IDEXX Laboratories, Inc. was incorporated in 1983 and is headquartered in Westbrook, Maine.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers are shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart technical indicators:

- 100% technical buy signals

- 96.62+ Weighted Alpha

- 94.12% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50, and 100 day moving averages

- 18 new highs and up 18.02% in the last month

- Relative Strength Index 84.79%

- Technical support level at 649.01

- Recently traded at 658.99 with a 50 day moving average of 569.26

Fundamental factors:

- Market Cap $55.28 billion

- P/E 82.23

- Revenue expected to grow 16.00% this year and another 10.20% next year

- Earnings estimated to increase 20.70% this year, an additional 12.30% next year and continue to compound at an annual rate of 16.74% for the next 5 years

- Wall Street analysts issued 4 strong buy, 3 buy, 3 hold, and 1 sell recommendations on the stock

- The individual investors following the stock on Motley Fool voted 639 to 11 that the stock will beat the market

- 16,690 investors are monitoring the stock on Seeking Alpha

The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop-loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Disclosure: I/we have no stock, option, or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more