Identiv Inc. (INVE) Situation Analysis – Rubicon Capital Group

Rubicon Capital Group’s situation analysis of Identiv Inc (Nasdaq: INVE).

Seth Klarman Tells His Investors: Central Banks Are Treating Investors Like “Foolish Children”

"Surreal doesn't even begin to describe this moment," Seth Klarman noted in his second-quarter letter to The Baupost Group investors. Commenting on the market developments over the past six months, the value investor stated that events, which would typically occur over an extended time frame, had been compressed into just a few months. He noted Read More

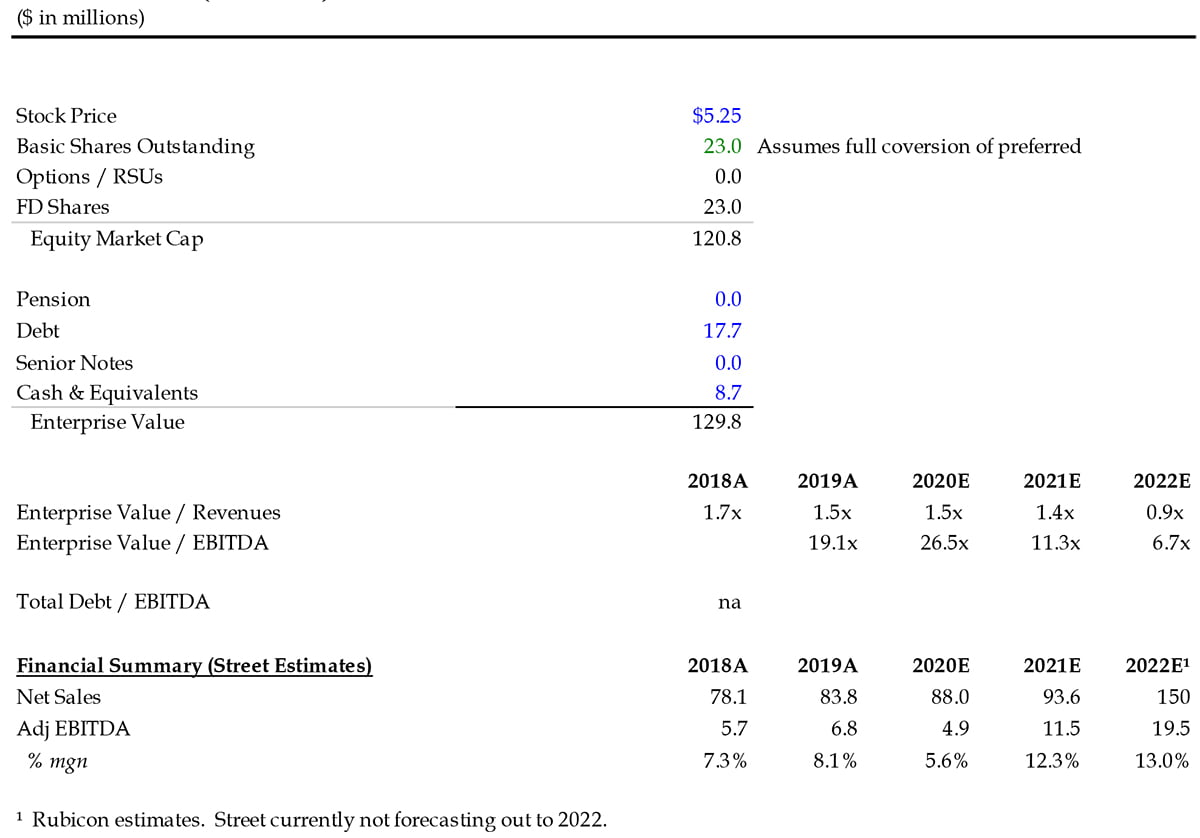

- Mkt Cap: $ 120 MM

- Ent Val: $ 130 MM

- EV / Rev: 1.5x LTM, 1.4x fwd.

- EV / EBITDA: 19.1x LTM, 11.3x fwd.

- Price Target: $10 + (trading), $20+ (transaction)

Situation Analysis

- Identiv (“INVE” or the “Company”) is a global provider of physical security and secure identification consisting of products, software and systems that address the markets for physical and logical access control as well as a wide range of Radio Frequency Identification (“RFID”) enabled applications (chips, transponders and inlays).

- Key products include premise security solutions, work from home access products, identification tools, smart cards, readers, premise security controllers and consoles, RFID inlays, tags and readers.

- INVE is a technological leader in physical access control, security, surveillance and analytics with decades of relationships and a strong reputation in the government and private sector.

- Identiv has been a storied stock over the years and has not been a great performer. Management (led by one of the original founders of the Company who rejoined in 2015) has methodically taken steps to position the Company to be the best in several key security segments that feature compelling future growth prospects.

- The investment case to own INVE at first is hard to fully ascertain as it manages multiple products in niche segments, sell side coverage is anemic and there is not a true public comp in the market.

- While INVE operates a generally economically resilient baseline access and security business (over-indexed to the gov’t sector with some COVID-19 tailwinds), our excitement for INVE is based on their opportunity in the RFID sector– a market with enormous growth potential which is not sufficiently addressed by the sell side.

- While RFID technology has been used for years (retail tags, logistics, tracking), INVE excels in two niche technologies therein (High Frequency “HF” and Near-field Communication “NFC”) where adoption has reached a watershed moment driven by contactless transactions and the Internet of Things (“IoT”).

- Currently Identiv backlogs for RFID products are up significantly (60%+) and are poised to double near term.

- The impressive near term growth excludes a pending major project where INVE will be a sole supplier for an undisclosed large consumer electronics maker (we suspect it is the “Fruit” company) which could lead to a much larger follow on supply agreement that would be a gamechanger for the Company.

- While the use cases for RFID are virtually endless (some will be highlighted in the report), it is our view that increasing demand for such applications has the potential to at least double INVE revenues ($100MM+) over time with EBITDA growing from a current run rate of ~$5MM to closer to $25-40MM.

- In terms of valuation, it is easy to pencil out a $10 stock (~100% upside) based upon modest end-market growth but we see potential for a much higher value ($20+) should the RFID market really take off.

- It is also likely that longer-term Identiv ’s business represents an attractive acquisition target for its technological superiority, market reputation and deep supplier and customer relationships.

Company Overview

- Premises Segment (50% of LTM sales / 63% of GM) – Includes physical location security, identity management, video analytics, mobility solutions, the well-known Hirsch brand & Cisco premises control platforms and video business intelligence solutions (3VR video and analytics).

- Leading supplier of physical access control solutions (ID card readers, chips, card firmware) to both federal and state government customers including agencies within the DOJ, Treasury, FBI, U.S. Marshall, courthouses etc.

- One of ~30 approved vendors to provide security and access under the Federal Identity, Credential & Access Management (FICAM) framework. INVE believes they have the most cost-effective framework and that expansion opportunities from its installed base exist.

- 85% of this segment sold to the Federal, State and Local Governments where budgets remain strong. Q3 is a seasonally strong quarter (end of federal government fiscal year).

- In response to COVID-19 workplace demands, Identiv is actively working on platforms with its existing tech to track, trace, pre-vet and analyze credentialed individuals entering facilities, attending meetings as well as mobile employees needing workspace.

- Recurring software is ~LDD% percent of total revenue and is growing (47% y/y last quarter). INVE recently introduced to the market a security as a service platform (through 3VR) that requires no upfront hardware costs from the customer.

- Fragmented competitive landscape includes a division of Honeywell, HID, a division of Assa Abloy, Lenel, Genetec, Gallagher Group Ltd. and Milestone Systems.

- Leading supplier of physical access control solutions (ID card readers, chips, card firmware) to both federal and state government customers including agencies within the DOJ, Treasury, FBI, U.S. Marshall, courthouses etc.

- Identity Segment (50% of LTM sales / 37% of GM) – Broad range of access cards, smart card readers, RFID and Near-field Communication (“NFC”) products, tags, transponders and inlays.

- Includes Thursby Software, a provider of high-end mobile security devices to gov’t and enterprise clients which is experiencing strong demand due to recent work from home mandates.

- The new app-based direction for Identiv addresses the needs of those who often work remotely and need real-time access to their security systems. Currently, due to work from home mandates, sales for such solutions have been robust and broad based.

- INVE is a differentiated player in advanced RFID applications (50 patents) which support the Internet of Things (IoT) with a low-cost method to apply identity and state to physical objects.

- RFID solutions address a wide range of IoT applications from access control to asset tracking, product authenticity, customer engagement, tamper detection and transportation access.

- INVE works with chip manufacturers (including a strategic relationship NXP Semiconductor) to form advanced RFID inlays. Through its facility in Singapore, INVE electrically fuses rolls of NXP chips with in-house designed antennae to create tags efficiently. INVE has a strong reputation as a high quality, high volume manufacturer and has engendered trust among its chip partners and customers.

- Competitors on the smart card reader side include Gemalto (subsidiary of Thales) and HID Global (a subsidiary of ASSA Abloy). In RFID, the market is fragmented with the top competitor being SMARTRAC NV, which was acquired by Avery Dennison for €225MM in March of 2020.

- Includes Thursby Software, a provider of high-end mobile security devices to gov’t and enterprise clients which is experiencing strong demand due to recent work from home mandates.

The RFID / NFC Opportunity

- There are numerous subsets of RFID technology that correspond to range, frequency, power and security. Our analysis is principally focused on the High Frequency (“HF”) and Near-field Communication (“NFC”) subsets of the market where Identiv is a leader.

- https://lowrysolutions.com/blog/what-are-the-different-types-of-rfid-technology/

- NFC has been made popular by Android Pay and Apple Pay. It is a communication and protocol technology that utilizes HF chips allowing two electronic devices to exchange information in a secure manner. These devices can be NFC-enabled smartphones, NFC-enabled devices, or any item with an NFC tag.

- An NFC tag is an antenna with storage – High Frequency (HF) tags have lower range but more security than Ultra High Frequency (UHF) tags which are used in retail, asset tracking / logistics, etc.

- When an NFC-enabled device is placed within four centimeters of another NFC-enabled device, the chip emits a radio frequency that allows information to display on the device’s screen.

- Radio Frequencies produced by chips do not require a power source to transmit information (vs. Bluetooth which drains battery power) allowing chips to serve as a small, durable and energy efficient alternative.

- In many cases, the tags function like more advanced and more versatile versions of the bar code scanning system and do not require any additional hardware as NFC-equipped phones serve that function.

- NFC chips can be placed on virtually anything and are incredibly cost effective. ~1.4 billion smartphones shipped per year have NFC chips providing numerous opportunities for individuals to effectively interact with NFC-enabled content. Market forecasts for NFC-related chips are well into the billions.

- Currently, INVE can produce ~200MM units per year with an ability to double capacity within 6-8 months at a de minimus capital cost as expansion requires more stamping machines and not physical space. The key in INVE’s competitive advantage their technological know-how, automated processes and market reputation.

- ASPs for HF chips inlays range from $.20 on the low end to $1+ on the high end. At an average price of ~$.60 per unit the revenue opportunity for INVE is quite meaningful ($100MM+) with the ability for INVE capacity to exponentially grow from here should use cases and demand materially increase, which we expect.

What has Changed? Why Now?

- Mobile identity applications have been in development for years but have yet to achieve widespread adoption largely a function of: A) Use cases and applications for NFC were nascent (with payments as the majority) and B) A surge in contactless transactions due to COVID-19 have opened up prospects for incremental use cases.

- After multiple refinements of use cases involving NFC technology over the years, the market has seemed to reach a point where widespread adoption beyond payments as highly likely.

- With the launch of the iPhone 11 and iOS13, Apple has opened a large array of new NFC capabilities to developers beyond just payments – identity and access being one of them (digital keys, A/R, V/R, etc).

- On the iPhone XS (Max), XR as well as the iPhone 11, NFC tags can be scanned without having to start the NFC reader app first. This “Background Tag Reading” feature opens the ability to utilize NFC chips beyond payments where a mobile device can serve as a proxy for one’s identity. Apple has also fully enabled ultra-wideband (UWB) for the iPhone 11, a radio technology that uses low energy levels (battery conservation) for short-range, high-bandwidth communications.

- INVE has become a thought leader with this protocol and views this move as Apple eventually looking to replace some functionality now offered via Bluetooth over time. https://www.howtogeek.com/441183/what-is-ultra-wideband-and-why-is-it-in-the-iphone-11/

Overview of RFID / NFC Use Cases

- Augmented / Virtual Reality: NFC chips in augmented / virtual reality hardware that can serve a wide range of virtual gaming, entertainment, communication and medical applications (3D viewing capabilities).

- Example: New NFC framework allows devices to interact with tappable objects:

- https://www.engadget.com/2020-02-16-chrome-81-beta-ar-nfc.html

- Example: New NFC framework allows devices to interact with tappable objects:

- Access Control: Replacing physical access cards where NFC technology provides verified credentials to gain contactless access into campuses, buildings, hotel rooms, stadiums, transit stations, etc.

- Example: A hotel chain offering contactless check in and room entrance just with the tap of a phone while it is still in lock mode. This is an attractive alternative to current Bluetooth-based app native applications that improve the overall customer experience while minimizing front of house expenses.

- Example: Digital car keys for the new BMW 5 Series:

- https://www.theverge.com/2020/6/22/21299182/apple-carkey-ios-14-13-digital-key-unlock-car-iphone-wwdc-2020

- Intelligent Packaging / Promotion:

- A customer walking down an aisle with their phone out receives an automatic trigger from an NFC antenna that gives them more information on the product, provides a discount, etc. Serves as a cost-effective way to increase engagement with the customer.

- Example: Identiv has already collaborated with Kraft Heinz to create NFC-enabled tags:

- https://www.youtube.com/watch?v=XzsTQanuPgs&list=PLJL7I5KIqVWxsejinJ1_mCyDmBHt6zabW&index=17

o Example: Chips embedded in toys (Mattel) and sports gear (Nike) to give them a virtual identity.

- https://www.youtube.com/watch?v=XzsTQanuPgs&list=PLJL7I5KIqVWxsejinJ1_mCyDmBHt6zabW&index=17

- Mobile Phones: NFC (widely used for payments and in ~1.4BN phones shipped annually) serves as a natural sensor platform for a huge array of instrument and things around the home or anywhere someone may go.

- Tamper Resistance: Tamper-proof RFID labels for protection from counterfeit medicine. Labels can be personalized with different sizes and various chip configurations depending to provide security and secure authenticity for products that may include cannabis, COVID-19 tests, pharmaceuticals, luxury goods, etc.

- Example: Canadian cannabis market (legal) – government is interested in better tracking the authenticity, dosage and provenance of cannabis products. According to our research, the opportunity in Canadian cannabis could be upwards of 4BN units annually.

- https://www.youtube.com/watch?v=5ulzsO5MJU0&list=PLJL7I5KIqVWxsejinJ1_mCyDmBHt6zabW&index=17&t=0s

- Example: Canadian cannabis market (legal) – government is interested in better tracking the authenticity, dosage and provenance of cannabis products. According to our research, the opportunity in Canadian cannabis could be upwards of 4BN units annually.

- Tracking and Tracing: Disposable temperature sensing RFID device (wristband or stuck on the skin) can be checked regularly, discretely and remotely. Identiv is working with major theme parks on such products. There are ~500MM annual theme park visitors globally.

What is of Value? / Investment Case

- Strong market reputation in technology forward applications (integrated access, video, mobility, RFID)

o Identiv has been a leading global supplier of smart card readers for 20+ years and has supplied millions of readers and RFID-enabled products for numerous federal agencies and enterprise customers.

o Tracking, tracing and mobility applications are currently experiencing a COVID-19 related tailwind. - Substantial and wide-open market opportunity ahead in IoT with RFID / NFC

- NFC is a low cost and energy-efficient way to add connectively in the most secure way possible.

- Consumer adoption of NFC technology beyond payments is starting to take off beyond just payments with an addressable market opportunity in the billions of units.

- Our research suggests that the NFC / HF subset of the RFID market is growing somewhere between 20-40% annually with lead times for products expanding.

- INVE RFID backlogs are rapidly growing (up 66% in Q1 and over 120% over plan in Q2) which excludes a major pending order for delivery 2H20/1H21. This order could be just the beginning for follow on business from this customer for INVE.

- Immediate share gain opportunity in RFID:

- Following the acquisition of SMARTRAC by Avery (€225MM), Avery has deemphasized their presence in the HF space and has instead decided to focus on higher volume, less engineered products.

- This has created an immediate $15-20MM (baseline) revenue share gain opportunity for INVE (total company rev currently of ~$85MM). In Q120, numerous customers were dropped by SMARTRAC which came scrambling to INVE to fill their orders.

- Long standing supplier, government and enterprise relationships

- Strategic relationship with NXP Semiconductor (which owns 80%+ of the NFC market) makes INVE its go to partner for NFC applications that use IoT-ready chips for contactless transactions.

- Entrenched relationships with U.S. federal, state and local government as well as blue chip enterprise customers (undisclosed consumer electronics maker, Mattel, McDonalds, Nike, Kraft Heinz).

- Management team committed to creating shareholder value

- Founder Steve Humphries returned to the Company in 2015 after previous management nearly ran the Company into the ground. Since then he has been methodically rebuilding INVE with an emphasis on developing distinct core competencies in niche segments. Mr. Humphries owns a meaningful portion of equity (5%+) and participated in a secondary stock offering at $15 in 2014.

- The board is conducting an ongoing review of strategic alternatives and while nothing seems imminent, it is our view that a number of key assets (if not the entire business) that would be very attractive to a range of strategic buyers.

Risks / Catalysts

- Inability to execute.

- Slowdown of demand for security applications (gov’t budget cuts, etc.). On the other hand, increased fraud, hacking etc. could serve as a catalyst for demand for enhanced security products.

- Market for NFC technology does not open beyond payments as expected.

- Large order for customer does not lead to follow on business.

- New competition entering the RFID the market as it rapidly expands.

- At present, INVE has the best reputation in the space, known for product quality, reliability and, most importantly, security. Given the fact that ASPs are low relative to the overall bill-of-materials, our view is that this is less of a risk than it would be in a higher value space.

- Upside surprise on top line with better than expected RFID performance over the next 6 quarters.

Valuation Considerations

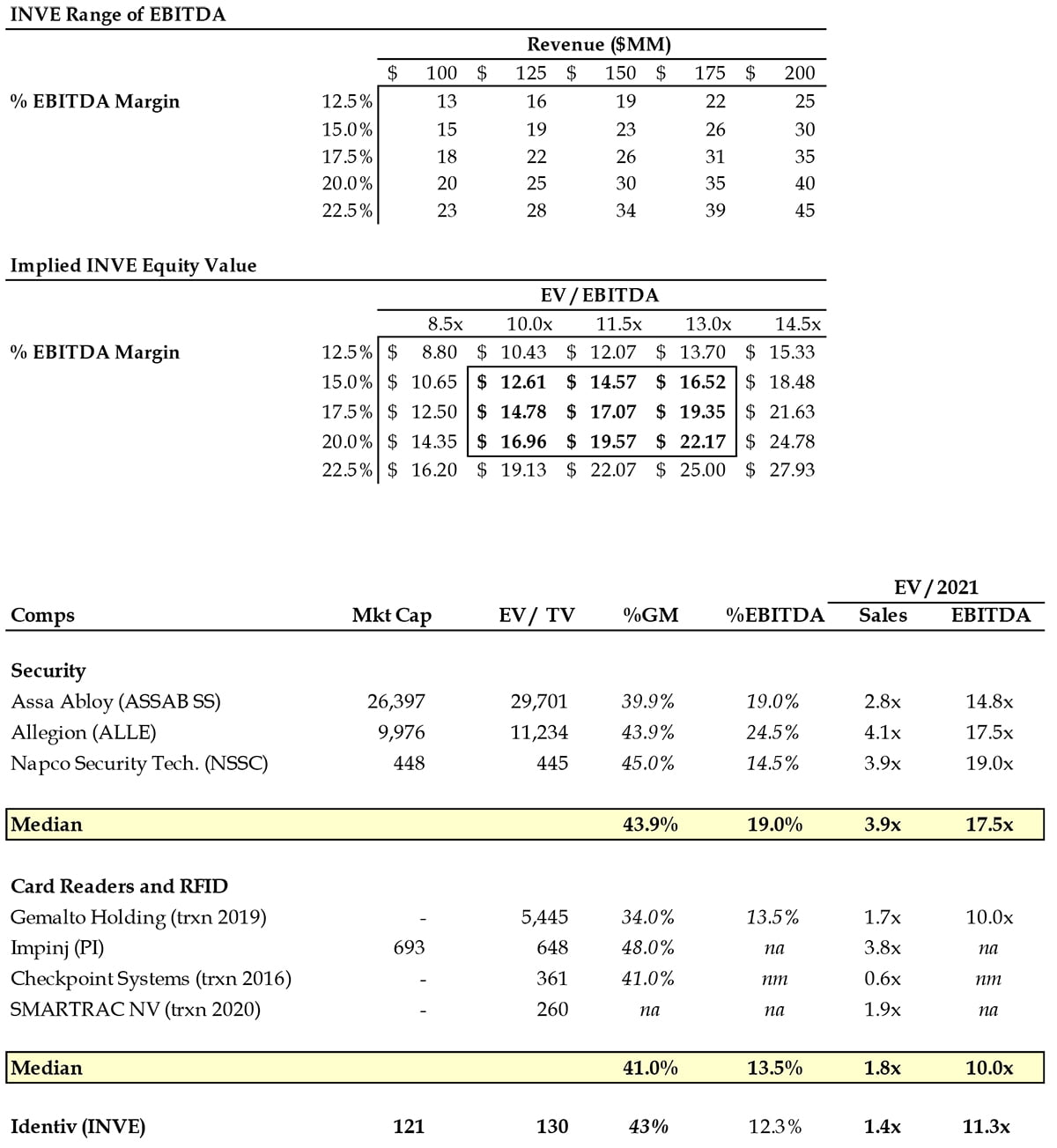

- INVE is currently trading at 1.4x fwd revenue and 11.3x EV / fwd EBITDA. These metrics largely do not reflect a ramp in RFID revenue which we anticipate will occur over the next 18 months.

- Last quarter, management kept revenue guidance flat at $86-90MM had it not been for disruptions related to COVID-19 - we think that range would have been increased principally due to strength in the RFID business.

- Management admits that INVE is currently operating as a subscale business. With scale (which we think is closer to $200MM of revenue), INVE will begin to create significant operating margin leverage.

- At scale, management anticipates LDD% top line growth, 44-48% gross margin (currently there) and 15-20% EBITDA margins.

- While RFID segment margins are overall GM dilutive, on an operating margin basis, they are in line with the overall company.

- Capital intensity for this business is quite low so most of EBITDA will flow to FCF.

- At scale, management anticipates LDD% top line growth, 44-48% gross margin (currently there) and 15-20% EBITDA margins.

- Comps are a bit tricky:

- Pure play premise-related security companies (NSSC, ALLE, ASSAB) trade in a range of mid to high teens EBITDA with some transaction comps for specific products done as high as 20x EBITDA.

- With regards to RFID, comps (PI trading, SMARTRAC trxn, Gemalto trxn, CKP trxn) range from 1x to 3.5x sales or 8-10x EBITDA.

- On a blended basis we view a 10-14x EV / EBITDA trading range as an appropriate multiple for INVE.

- Based upon a variety of scenarios, our base case value for the equity is $10 and if the NFC thesis takes shape, we can envision a $15-$20+ price for the equity.

Capitalization and Valuation

Key Assumptions

- We anticipate a material ramp of revenue to occur in a 2H21 - 2022 context which would get us to roughly $150+ run rate of revs by the end 2022.

- For 2022, we are assuming a 13% EBITDA margin, however, the midpoint of longer-term margin guidance of (15-20%) equates to approx. $25MM+ of EBITDA which could translate to stock worth $15-20 per share or even higher at our contemplated multiples.

- As previously mentioned, comparables are tricky for INVE, however public company security businesses trade in the mid to high teens with some transactions for key assets in excess of 20x.

- RFID is a bit more complex as there is not one exact direct comp to Identiv ’s capabilities in HF RFID / NFC.

- Utilizing sales transaction comparables for SMARTRAC (which principally manufactures more commoditized ultra-high frequency products) and Gemalto and assuming that the RFID business could generate $100MM of revenue it is not inconceivable for INVE’s RFID segment to be worth in excess of $200MM or$8.70 a share (155% of the entire enterprise value for INVE).

This article first appeared on ValuewalkPremium.

Disclaimer: The opinions in this article are for ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!